A weekly excerpt from the Macro Review analysis on 10 markets and two timeframes.

Last week’s review of the macro market indicators suggested that with October Options Expiration behind the Equity Markets were looking stronger.

Elsewhere looked for gold (N:GLD) to pullback in the short term in its uptrend, while crude oil (N:USO) rose. The US dollar index (N:UUP) was biased lower in consolidation, while US Treasuries (N:TLT) had a short term bias higher in their consolidation. The Shanghai Composite (N:ASHR) and Emerging Markets (N:EEM) were biased to the upside, with risk of the Emerging Markets hitting long term resistance.

Volatility (N:VXX) was back to the normal range and falling, putting the bias higher for the equity index ETFs N:SPY, N:IWM and O:QQQ. After strong back halves of the week, the SPY and QQQ looked as if they were ready to reverse the downward August trend and resume higher, while the IWM remained in a consolidation zone.

The week played out with gold drifting lower in its bull flag, while crude oil headed lower all week. The US dollar exploded higher late in the week, while Treasuries remained in a tight range. The Shanghai Composite continued to probe around the 3400 level, while Emerging Markets moved sideways around long term resistance.

Volatility continued its move lower making a new two month low. The Equity Index ETFs started the week in consolidation, but by the end of the week they were moving higher, with the QQQ leading the charge out of consolidation and the SPY following, but the IWM stubbornly holding at the top of consolidation. What does this mean for the coming week? Lets look at some charts.

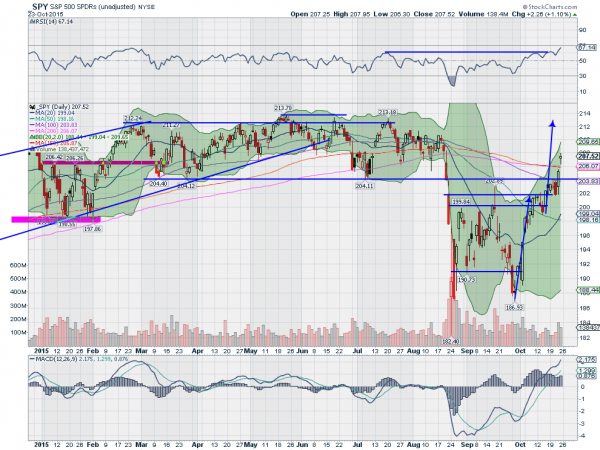

SPY Daily

The SPY started the week moving sideways, consolidating the pop over the recent breakout from last week. Tuesday printed an Evening Star that was confirmed lower Wednesday with a bearish candle, nearly a Marubozu. This finished at support. But when we woke up Thursday, the bounce was underway and continued with a strong day higher over the next hurdle and into the prior consolidation zone over 204.40.

Friday continued higher to end the week up over 2%. This was the first close over the 150 and 200 day SMA’s since August 18th and a two month high. The RSI on the daily chart is rising and in the bullish zone along with the rising and bullish MACD. The Bollinger Bands® are also rising.

On the weekly chart, the SPY printed a near Marubozu to the upside. Back over the 50 week SMA, it has support for more upside from a rising RSI crossing the mid line and with the MACD crossed up and rising. There is resistance at 208.40 and 210.25 followed by 211 and 212.50 before 214. Support lower comes at 206.4 and 204.40 before 201.75 and 200 then 199.50 and 198. Uptrend Continues.

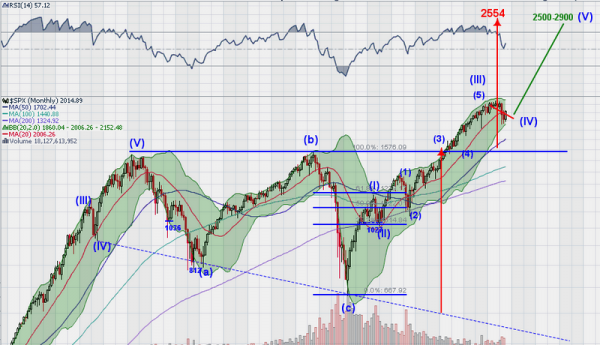

SPY Weekly

Heading into the last week of October, the equity markets are looking strong. Elsewhere look for gold to continue lower in its longer term downtrend, while crude oil heads lower in the short term. The US dollar index is breaking to the upside, while US Treasuries are marking time sideways. The Shanghai Composite and Emerging Markets are biased to the upside, with Emerging Markets at a major resistance level.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. The SPY and QQQ had major moves and look set up to continue higher into next week, with the IWM lagging and at resistance. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.