Yesterday was a good day for bulls and I wish it was banked today rather than yesterday so that weekly candlesticks had a good finish.

Instead, today will be a bit of a nail-biter to ensure that by close of business, markets finish as good as, if not better, than they did yesterday.

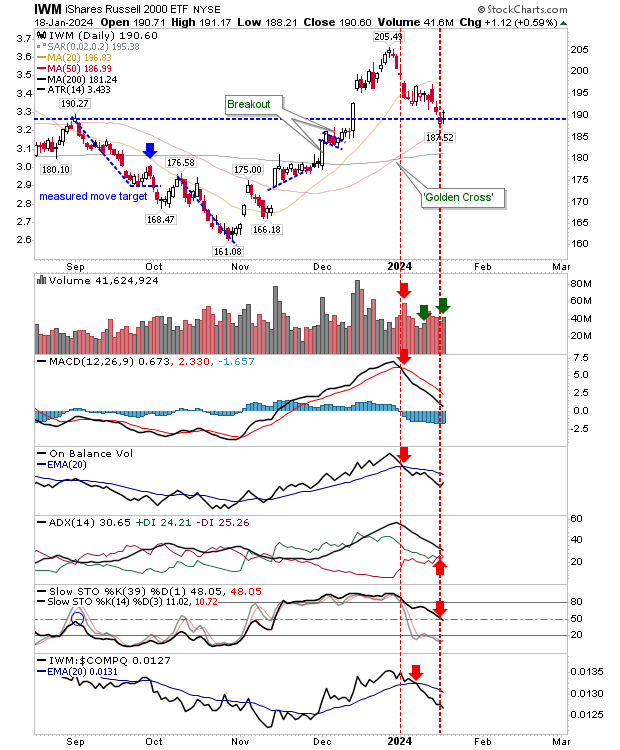

The Russell 2000 (IWM) might offer the best chance for bulls. Yesterday delivered a positive test of the 50-day MA, but yesterday's rally closed with an indecisive doji.

It was a bit disappointing to see this kind of doji so soon in a bounce.

Volume climbed to register as bullish accumulation but the trend indicator ADX, has switched to a new 'sell' trigger as had intermediate-term stochastics, following earlier 'sell' triggers in the MACD and On-Balance-Volume to leave technicals net bearish.

The relative underperformance of the index to the Nasdaq accelerated. What I do like is that the index found support defined by the September swing high.

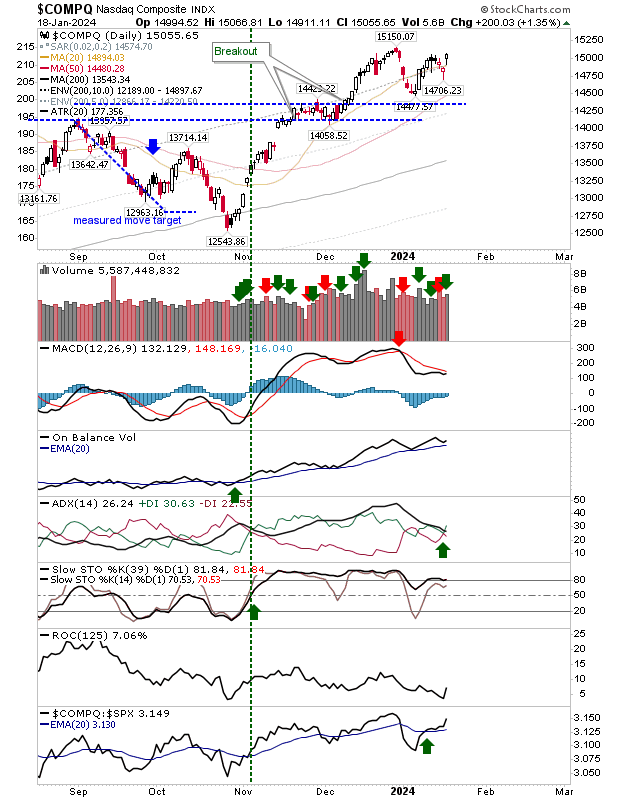

The Nasdaq had an unusual candlestick. The bounce off the swing low finished as a "hammer", not one you typically see following a swing low as a candlestick like this is usually the swing low.

As with the Russell 2000, yesterday's volume ranked as accumulation, and technically, there is still a working MACD trigger 'sell'. The index is outperforming the S&P 500.

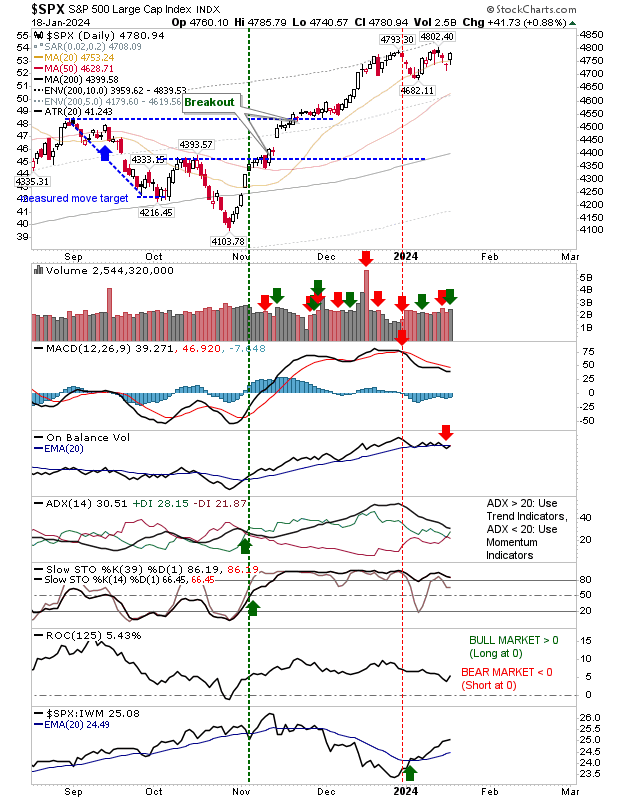

The S&P 500 has shaped a more traditional consolidation and yesterday's action did conform to a more traditional candlestick commonly seen in "bullish morning star" reversal.

The index did enjoy a day of confirmed accumulation, but there was a new 'sell' trigger in On-Balance-Volume. Of the three indexes I track, this is the one most likely to break out today.

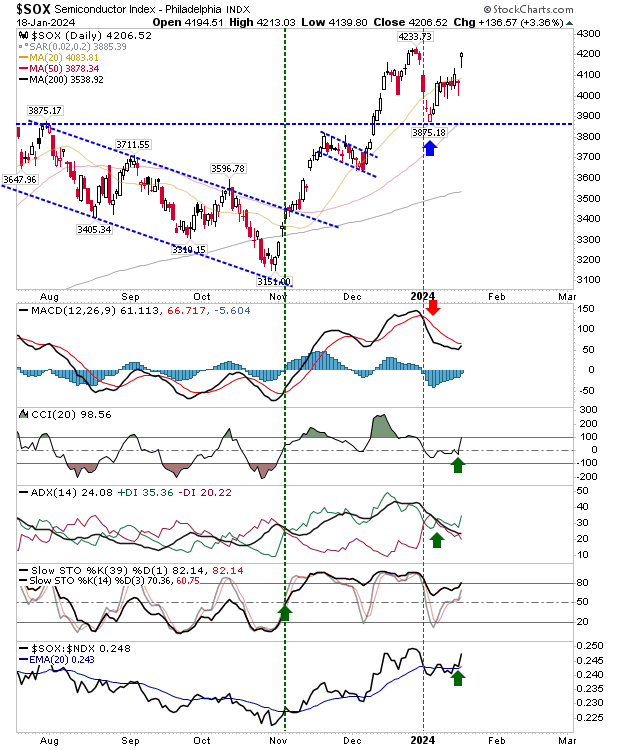

I haven't mentioned the Semiconductor Index in a while. It gapped higher in what could be said to be an "island reversal" - a generally bullish pattern - except it occurred near the end of the rally rather than the start.

The trend has been strongly bullish and is once again outperforming the Nasdaq 100. There is a good chance for a test of the December high today which may see a pause in the advance.

For today, I will be looking for the S&P 500 to be the main performer, although the Russell 2000 ($IWM) has good potential to continue its recovery.