Fed-Ex (NYSE:FDX) reports their fiscal 2nd quarter, 2021, Thursday afternoon, December 17th, 2020, after the closing bell.

Since FDX is an industrial stock and has had a monster rally from near $125 when it last reported in June ’20 to the $289 close tonight, December 11th, and is also expected to benefit from the vaccine distribution logistics, there is no doubt actual Q2 ’21 earnings and more importantly guidance will be closely watched.

A longer article will be forthcoming this week as a FedEx earnings preview.

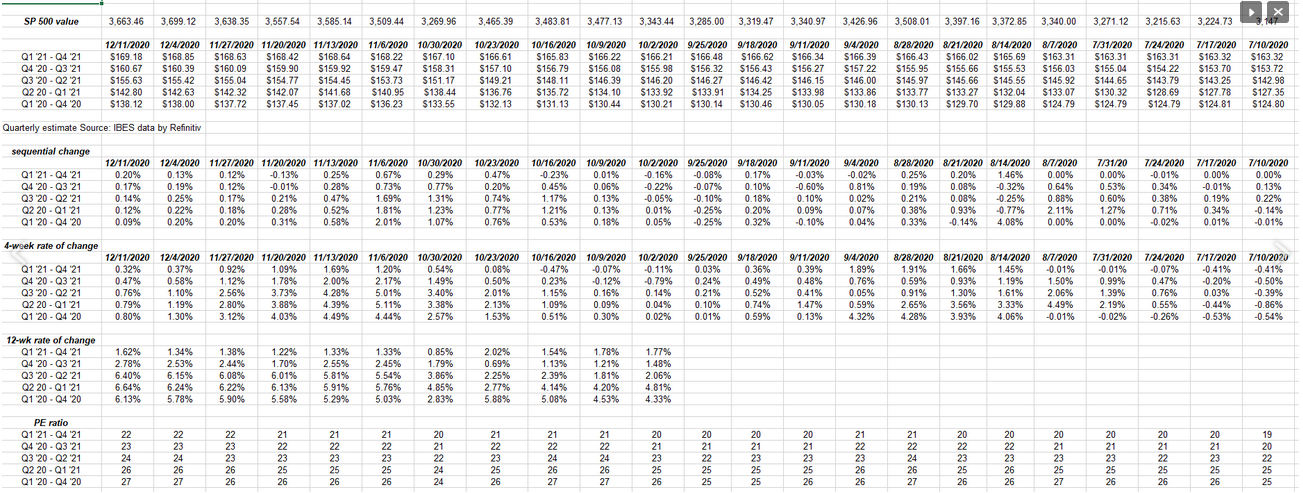

S&P 500 data:

- The forward 4-quarter estimate rose again this week to $160.66 versus last week’s $160.40.

- The PE ratio on the forward estimate fell to 22.8x, still salty given the expected “average” S&P 500 EPS growth rate for calendar 2020 and 2021 is 4%.

- The S&P 500 earnings yield using the forward estimate is 4.39% this week, versus 4.34% last week. This was the first sequential increase in the S&P 500 earnings yield since the month of October, and probably due to the fact that the S&P 500 fell 1% on the week. The NASDAQ Composite fell roughly 69 bp’s on the week, while the QQQ’s fell 1.2% the last five days.

S&P 500 Forward Earnings Curve:

Click on the forward earnings analysis and you’ll see the sequential and 4-week rate of change are a little softer in terms of their percentage increases but the 12-week remains Ok.

Starting next Friday, December 18th, through the first week of January ’21, the revision activity will likely slow to a crawl. It happens every quarter, but with the seasonality around the holidays and the New Year, the sell-side analysts and revision activity gets particularly slow.

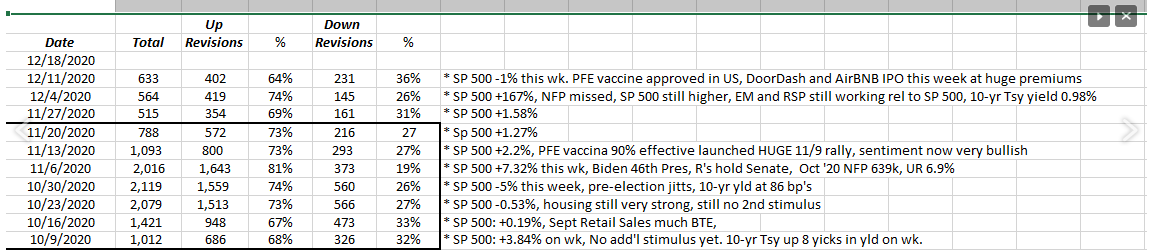

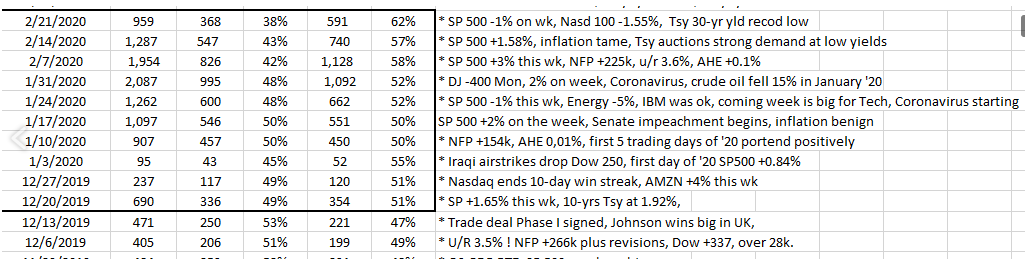

This above chart, if enlarged, will show week-to-week positive and negative revisions for the S&P 500 from early Oct ’20 through December 11 ’20.

Now lets look at the same period in 2019:

Starting with early December ’19, the first mention of the coronavirus was January 21, 2020. But note how the estimate revisions slowed materially in the last weeks of December and early Jan ’20. With New Year’s Week ’20, there were (only) a whopping 95 revisions for S&P 500 companies, and the week before that was pretty low too.

(Data compliments of IBES data by Refinitiv. Refinitiv shows a rolling 4-week period within “This Week in Earnings” every week, but this blog tracks the data on a spreadsheet with S&P 500 weekly return data. The weekly revision data goes back to October, 2009. Yes, I’m a data geek.)

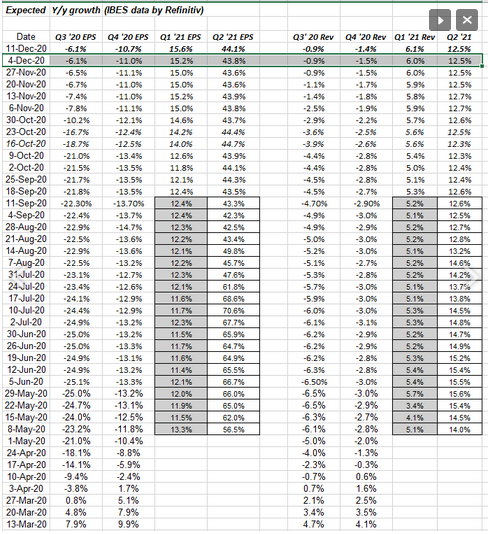

Q3 ’20 – Q2 ’21 expected S&P 500 EPS and revenue growth

Look at the sharp recovery in Q3 ’20 EPS and revenue growth once the reporting started.

Note how Q4 ’20 has lagged in terms of the same revisions.

The conclusion is that either analysts remain cowed and tentative about Q4 ’20 numbers, perhaps due to the lack of stimulus, or Q4 ’20 is going to see similar upward revisions starting in early January ’21 once companies start reporting.

My own opinion is Q4 ’20 EPS estimates are still too low. The analyst pattern has been clear all during Covid i.e. missing a big upside number is not nearly as fatal to an analyst’s career as missing a big downside surprise.

Summary / conclusion: Bottom-up quarterly estimates for calendar 2022 don’t start being published by Refinitiv until April 1, 2021. The only reason that is brought up is that for calendar 2022, the estimate started out at $200 on April 1, 2020 didn’t get revised lower too much from March through July, hitting a low of $186 and change, and it’s back to $197 already.

Ironically, the same is for 2021: I was worried the estimate would fall below the 2019 print of $162.93 and in fact it never did bottoming at $163.31 and now back above $169. (What’s more interesting is that the $163.31 low 2021 EPS estimate didn’t bottom until mid-August ’20, or 5 months after the S&P 500 bottomed. )

FedEx and Micron (NASDAQ:MU) will report over the next two weeks and those companies – given their operating leverage – have volatile EPS. That being said the rest of 2020 the first week of January ’21 will likely see minimal revision activity. That could change with the Georgia Senate runoff races since – if the Republicans lose both Senate seats – tax hikes will quickly be back on the table in 2021.

Take everything here with skepticism. Invest in a way that is comfortable for you. The data and the markets change daily and weekly and often sharply.

Thanks for reading.