Bitcoin price today: rises to $91.5k as Fed cut bets remain firm

The price of a bushel of soybean came close to an all-time high on June 9th, 2022. But instead of finally reaching the $18 mark, it started plunging the following week and hasn’t been able to recover since. At the time of writing, soybean futures trade below $12.50 per bushel, down 30% in just over a year and a half.

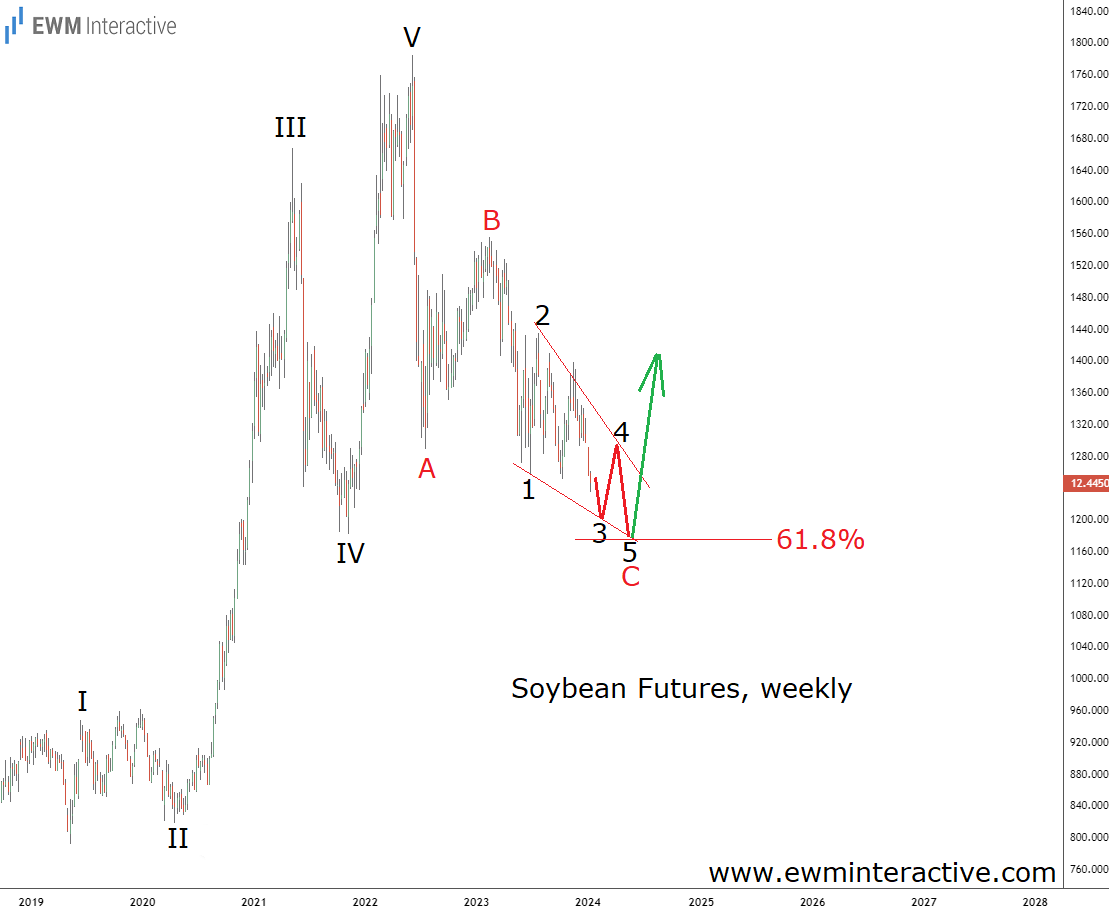

Soybean is the second most traded food commodity in the world, which makes its price quite important, to say the least. As with any other commodity, rising prices are good for producers, while consumers hope that they fall. So, who’s more likely to benefit going forward? The weekly chart below seems to be giving us a hint already.

It reveals that between May 2019, and June 2022, the price of soybeans rose in an impulsive fashion. According to the Elliott Wave theory, impulse patterns develop in the direction of the larger trend. An impulsive rally is followed by a corrective decline, but it implies more upside once the correction is over. Here, the rally from $7.91 to $17.84 is labeled I-II-III-IV-V.

The decline from $17.84 looks like a simple A-B-C zigzag correction, whose wave C is still in progress as an ending diagonal. If this count is correct, we can expect some more weakness towards the support cluster formed by the 61.8% Fibonacci level and the bottom of wave IV.

We might even see a slight dip below the $12 mark. It has previously served as an important support-resistance level in 2009, 2011, 2013, 2016, and 2021. Once there, however, a bullish reversal can be expected to trigger another notable surge. The bulls should be able to exceed $18 a bushel this time.