Dental products maker SmileDirectClub (NASDAQ:SDC) stock continues to underperform as shares still trade below pre-COVID levels. This leaves plenty of “meat on the bones” upside just to get even as the pandemic recovery takes shape. Shares were recently smacked down due to a cybersecurity attack in May that will have a $10 million to $15 million material impact on Q2 2021 earnings.

The maker of invisible teeth aligners competes with industry leader and top competitor Align Technologies (NASDAQ:ALGN) makers of Invisalign. SmileDirectClub has embarked on an aggressive marketing and awareness campaign that takes direct aim at Align and comparing the cost savings against its product. The Company is a direct-to-consumer (DTC) play on providing invisible teeth alignment services safely and economically without the 3X markup that traditional orthodontists charge. This is a reopening play that has yet to hit all engines as 75% of the addressable market is outside the U.S. and Canada where COVID restrictions are still effect. Prudent investors looking to get a jump on the potential surge in business with the acceleration of COVID vaccinations. Prudent investors can play the rebound and recovery by monitoring shares of SmileDirectClub for opportunistic pullback levels.

Q1 FY 2021 Earnings Release

On May 10, 2021, SmileDirectClub released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported an earnings-per-share (EPS) loss of (-$0.12) excluding non-recurring items missing consensus analyst estimates for a loss of (-$0.08) by (-$0.04). Revenues rose 1.4% year-over-year (YoY) to $199.5 million beating the consensus analyst estimates for $196.18 million.

SmileDirectClub CEO David Katzman stated:

“The first quarter represents continued traction against our long-term targets as we execute against our controlled growth plan. We are especially pleased to see consumer sentiment gaining positive momentum as we remain laser focused on the delivery of a world class Club Member experience.”

He continued,

“The improvements we have made, and continue to make, on customer service and enhancing our leading telehealth platform for orthodontia are working. We remain the low-cost provider, with brand presence, no pricing pressure, and no real competitor that provides an end-to-end vertically integrated platform for the consumer.”

He noted that without the cyberattack, he expected revenues to grow 5% to 7% over Q1 2021. As of the end of Q1, the Company had 126 permanent SmileShops as primary fulfillment centers. The Company also held over 156 pop-up events during the quarter for a total of 282 location sites. The strategy of pop-up shops help to fulfill

Conference Call Takeaways

SmileDirectClub CEO, David Katzman, set the tone:

“Over the past five quarters, we have continued to lay infrastructure to execute against this long-term strategy, which position s us to generate average revenue growth of 20% to 30% per year for the next five years and adjusted EBITDA margins of 25% to 30% by the end of that time period.”

He went on to highlight their missions to democratize access to a smile affordably as a telehealth business. He notes that 75% of the total market opportunity lies internationally, outside the U.S. and Canada. The Company has expanded to 13 countries internationally including the launch in Mexico. The Company grew its dental partners to 1,500 in the last Q as well as open the door for a strong pipeline of potential partners. The Company’s award winning SmileDirectClub brand oral care products are available in over 400 Walmart (NYSE: NYSE:WMT) locations and over 1,000 Shorts Drug mart locations.

In the U.S. and Canada, they are available in over 12,500 retail stores. The Company also unveiled Lifetime Smile Guarantee for customers who order 2 retainers per year which allows for 1 free touch up treatment annually as needed. He concluded by underscoring the value proposition, “For too long, straightened teeth by orthodontist with invisible aligners or braces has meant paying a huge markup. Orthodontists have traditionally purchased invisible aligners from a wholesaler manufacturer, market up cost by 3 times and then sold them to consumers for $5,000 to $8,000. Our proprietary technology and platform offer consumers the ability to get the clinically safe and effective treatment but without the 3-time markup.”

SDC Opportunistic Pullback Levels

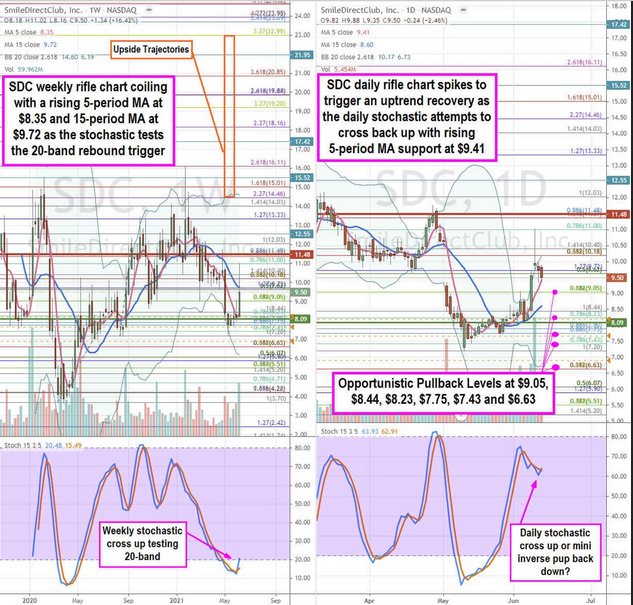

Using the rifle charts on the weekly and daily frames provides a clearer view of the landscape for SDC stock. The weekly rifle chart completed its full stochastic oscillation down and coiled to test the 20-band oversold rebound level. The weekly 5-period moving average (MA) support is rising near the $8.44 Fibonacci (fib) level. The weekly 15-period MA sits near the $9.72 fib area. The recent spike to the $11 fib and reversion back under the weekly 15-period MA completes a quick channel tightening bounce. The weekly has a market structure high (MSH) sell trigger that formed on the breakdown under $11.48. If the weekly stochastic can cross the 20-band, then watch for reversions on pullbacks to the weekly 5-period MA.

The daily rifle chart formed an uptrend that peaked at the $11 fib and is testing a reversion to the daily 5-period MA at $9.41. If it breaks that, then look for reversions back towards the daily 15-period MA near the $8.44 fib. The daily market structure low (MSL) triggered on a breakout through $8.09, making it a key spot to watch on pullbacks. Prudent investors can watch for opportunistic pullback levels at the $9.05 fib, $8.44 fib, $8.23 fib, $7.75 fib, $7.43 fib, and the $6.63 fib if you’re lucky. Upside trajectories range from the $14.46 fib up towards the $22.99 fib.