2023 wasn’t quite good for Simon Property Group (NYSE:SPG) shareholders until about two months ago. The stock had started the year above $118 a share, but the bears then dragged it down to the support at $100 in March, May and October. Then, all of a sudden the market awakened to the idea that the Fed is likely done with raising interest rates. This simple change of mind catapulted SPG to over $130, up 28% from the early-October low at $102.11.

Simon Property is the blue chip of mall REITs. It owns the best properties in the best locations in the US and its 2020 acquisition of Taubman Centers (NYSE:TCO) gave it a significant presence in Asia, as well. The company also has a foothold in Europe through its 22% interest in French peer Klepierre. This global industry dominance produces the A-rated balance sheet and ample free cash flows, which attracted us to Simon stock in the first place.

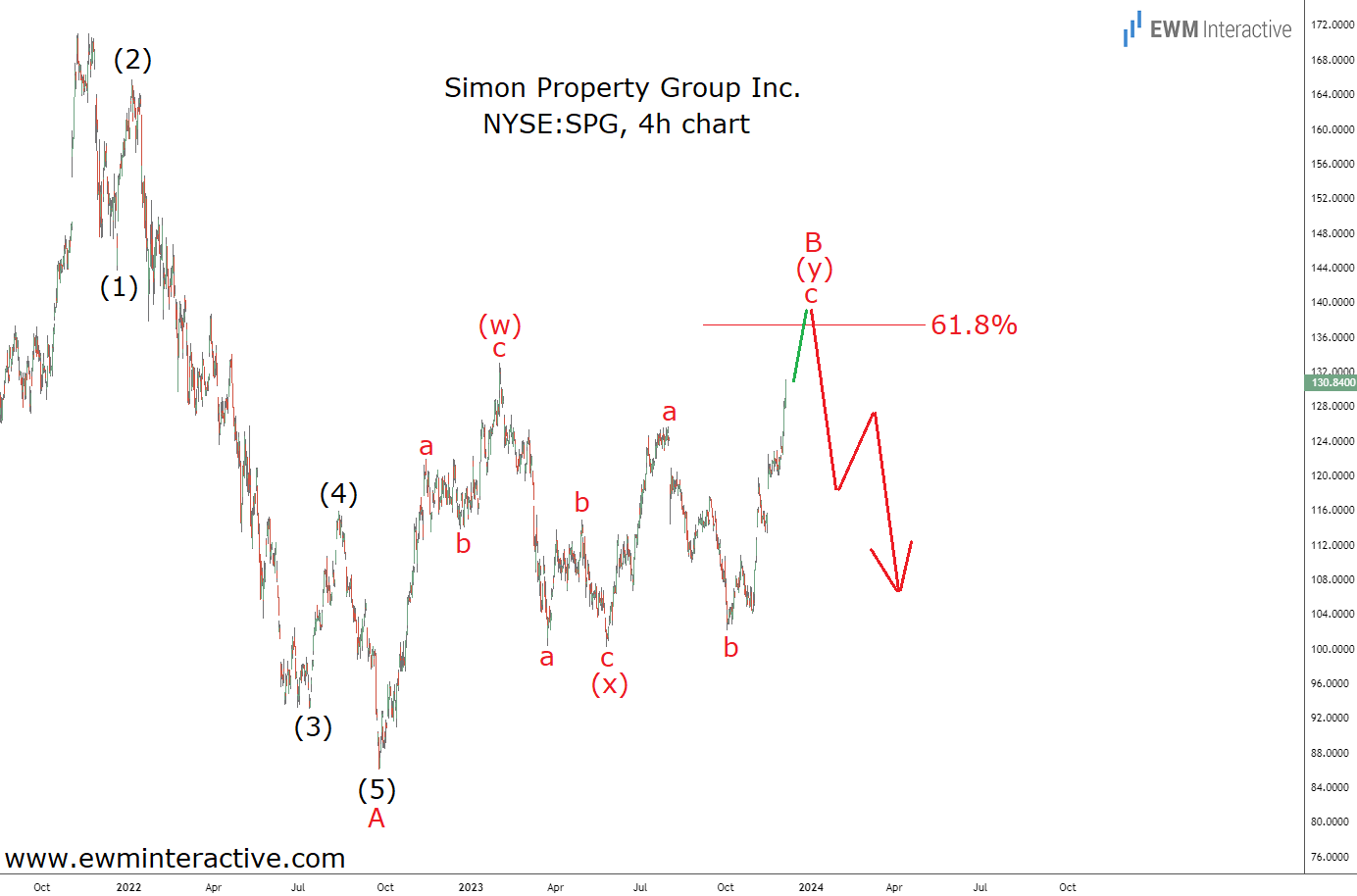

The problem is that at a price of over $130 a share, SPG is likely approaching fair value. It is no longer the obvious bargain it was when we first bought it at $75 during the Covid-19 panic of March, 2020. Another thing tilting the odds back in the bears’ favor going forward is the 4-hour chart below. It reveals an Elliott Wave setup, which every experienced analyst will recognize.

The chart shows that the ~50% decline that occurred between November 2021, and September 2022, is a five-wave impulse. It is labeled (1)-(2)-(3)-(4)-(5) in wave A, where wave (3) is almost exactly 2.618 times longer than wave (1). The theory states that a three-wave correction follows every impulse. That’s exactly what we think has been in progress since the bottom of wave (5) of A at $86.02.

Wave B looks like a (w)-(x)-(y) double zigzag retracement, where all three waves have the structure of simple a-b-c zigzags. Wave ‘c’ of (y) is now unfolding and likely to exceed the top of wave (w). We wouldn’t see this breakout as a buy signal, however, since the 61.8% Fibonacci resistance lurks nearby. This level is where corrections often end. When they do, the preceding trend resumes.

If this count is correct, a bearish reversal near $140 a share for the start of wave C down can be expected. Once the bears have returned, downside targets below $80 a share would make sense. This can easily turn into another 50% selloff for Simon Property, especially if we do get the widely-predicted 2024 recession. So instead of joining the bulls after their impressive two-month gain, we think investors should probably start taking profits here. At least that’s what we’re doing already, which still leaves us with 14 positions in The EWM Interactive Stock Portfolio.