Silver Non-Commercial Speculator Positions:

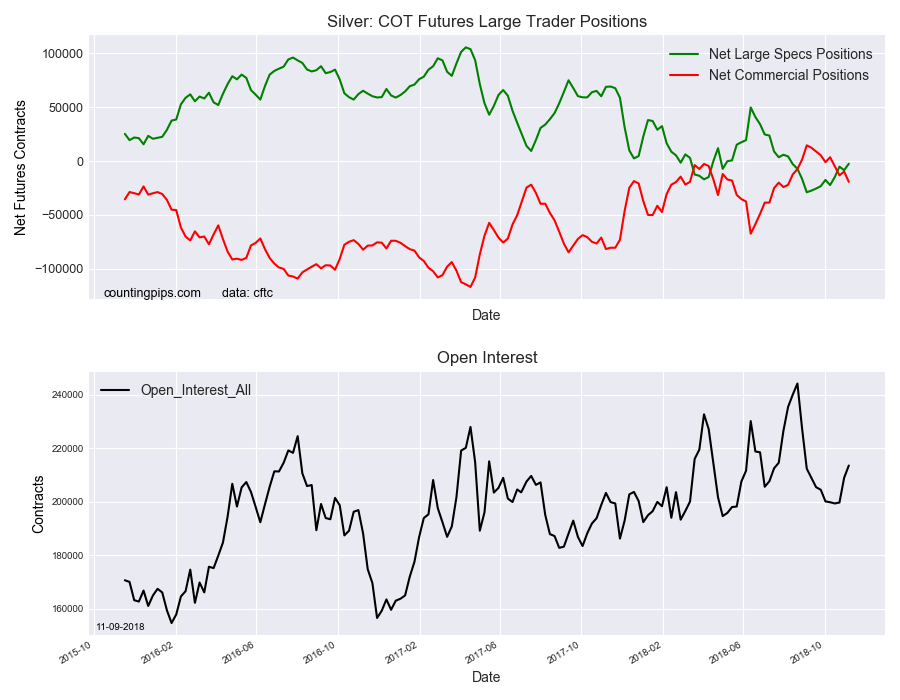

Large precious metals speculators decreased their bearish net positions in the Silver futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Silver futures, traded by large speculators and hedge funds, totaled a net position of -2,470 contracts in the data reported through Tuesday November 6th. This was a weekly lift of 6,000 net contracts from the previous week which had a total of -8,470 net contracts.

This week’s net position was the result of the gross bullish position falling by -2,936 contracts (to a weekly total of 73,117 contracts) compared to the gross bearish position total of 75,587 contracts which dropped by a larger amount of -8,936 contracts for the week.

The speculative net position has now improved (declining bearish bets) for three out of the last four weeks and for seven out of the past nine weeks. The current standing is the smallest bearish position since silver bets went bearish thirteen weeks ago.

Silver Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -19,291 contracts on the week. This was a weekly loss of -9,531 contracts from the total net of -9,760 contracts reported the previous week.

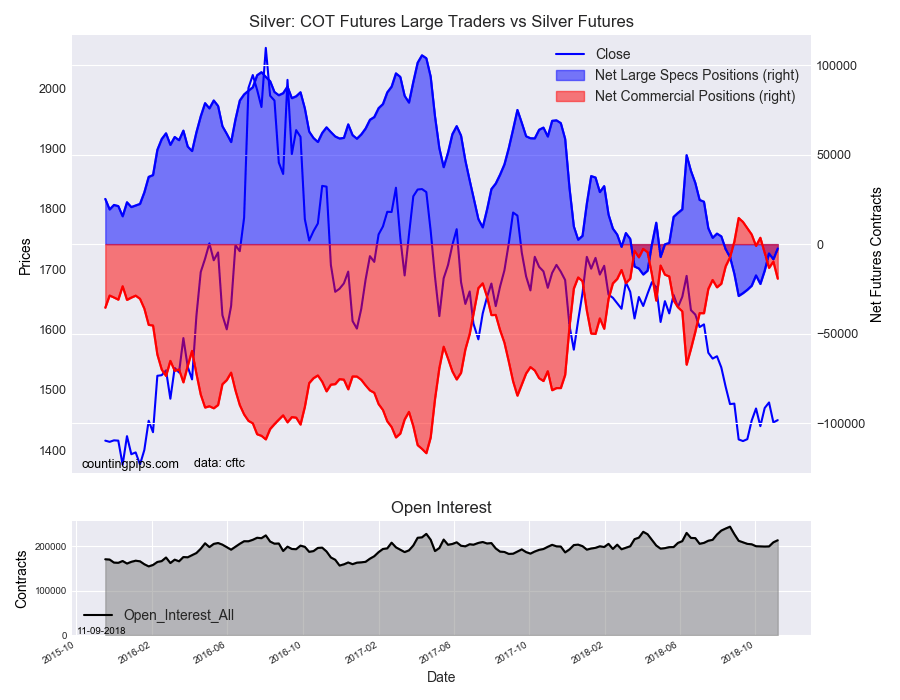

Silver Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Silver Futures (Front Month) closed at approximately $1450.00 which was an uptick of $3.80 from the previous close of $1446.20, according to unofficial market data.