U.S. Mint Silver Eagle sales surged in the first half of October due to increased turmoil in the political system and economic markets. Silver Eagle sales were strong in the first five months of the year, but weakened in the summer due to several factors.

One factor was the fall-off in demand by the Authorized Dealers (wholesalers) who had continued to purchase record Silver Eagles in the first part of 2016, even though retail investor demand had softened. The other factor was a weakening of investor demand as the contagion from the U.K exit of the European Union subsided in the summer.

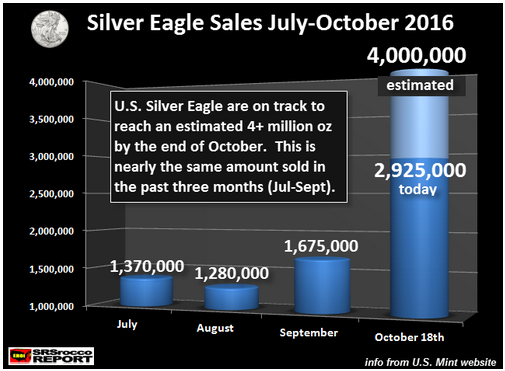

Regardless, U.S. Mint Silver Eagle sales came back with a vengeance in the first half of October, reaching 2,925,000 according to their most recent update today (Oct 18th). If we look at the chart below, we can see how much demand has increased compared the previous three months:

Silver Eagle sales as of October 18th are 75% higher than total sales for September of 1,675,000. Furthermore, they have already surpassed June’s sales of 2,837,000. If Silver Eagle sales continue to remain strong for the remainder of the month, I estimate that at least 4,000,000 will be sold.

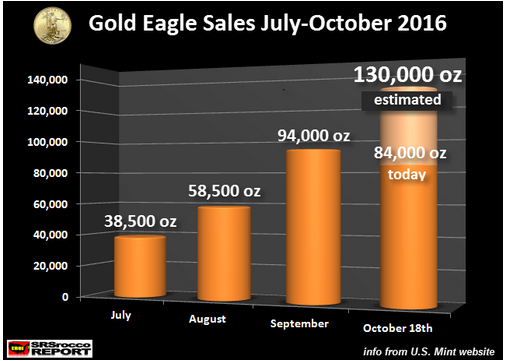

In addition, Gold Eagle sales are also much stronger in October. Even though Gold Eagle sales of 84,000 oz have not yet surpassed the total of 94,000 oz in September, we still have nearly two more weeks remaining in October.

Also, if Gold Eagle sales remain strong for the next two weeks, they could reach 130,000 for the month. Not only is this much higher than September’s sales, it would be the highest monthly sales for the year…. even beating January’s record of 124,000 oz.

I believe investors are buying more Gold and Silver Eagles due to the continued disintegration of the financial and economic markets and the “Political Circus” called the U.S. Presidential Race. There has never been a more bizarre U.S. Presidential Campaign than the one we are witnessing today.

And then we had this headline from Zerohedge today, Saudis, China Dump Treasuries; Foreign Central Banks Liquidate A Record $346 Billion In US Paper. I imagine this is only the beginning, as the situation in the United States continues to unravel after the election… regardless of who is elected.

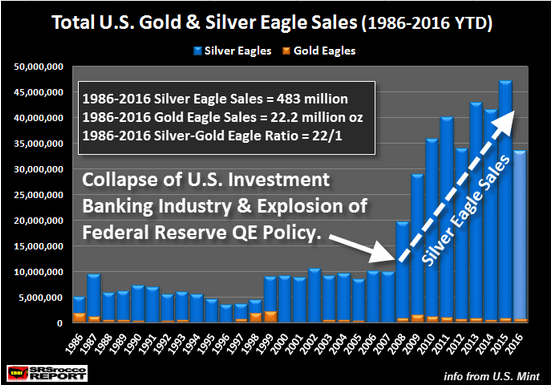

Precious metals investors need to understand just how much Silver Eagle demand increased after the collapse of the U.S. Investment Banking and Housing Market in 2008. As the Fed pumped massive amounts of liquidity via its QE policy (Quantitative Easing = Money Printing) into the U.S. markets, Silver Eagles sales have reached a staggering 325 million since 2008 (2008-2016 ytd):

While total cumulative Silver Eagle sales are 483 million oz (Moz) since the U.S. Mint started the program in 1986, investors purchased a stunning 325 Moz since 2008. Thus, Silver Eagle demand for the past nine years accounts for 67% of total sales since 1986.

Looking at it a different way, investors purchased 325 Moz of Silver Eagles from 2008-2016, versus 158 million oz from 1986-2007.

When the markets finally crack in the future, investors who have purchased physical gold and silver will be holding onto the best quality “Stores of Wealth” providing much better options that those stuck with most Stocks, Bonds and Real Estate.