Oracle stock jumps 5% on TikTok deal progress, OpenAI fundraise talks

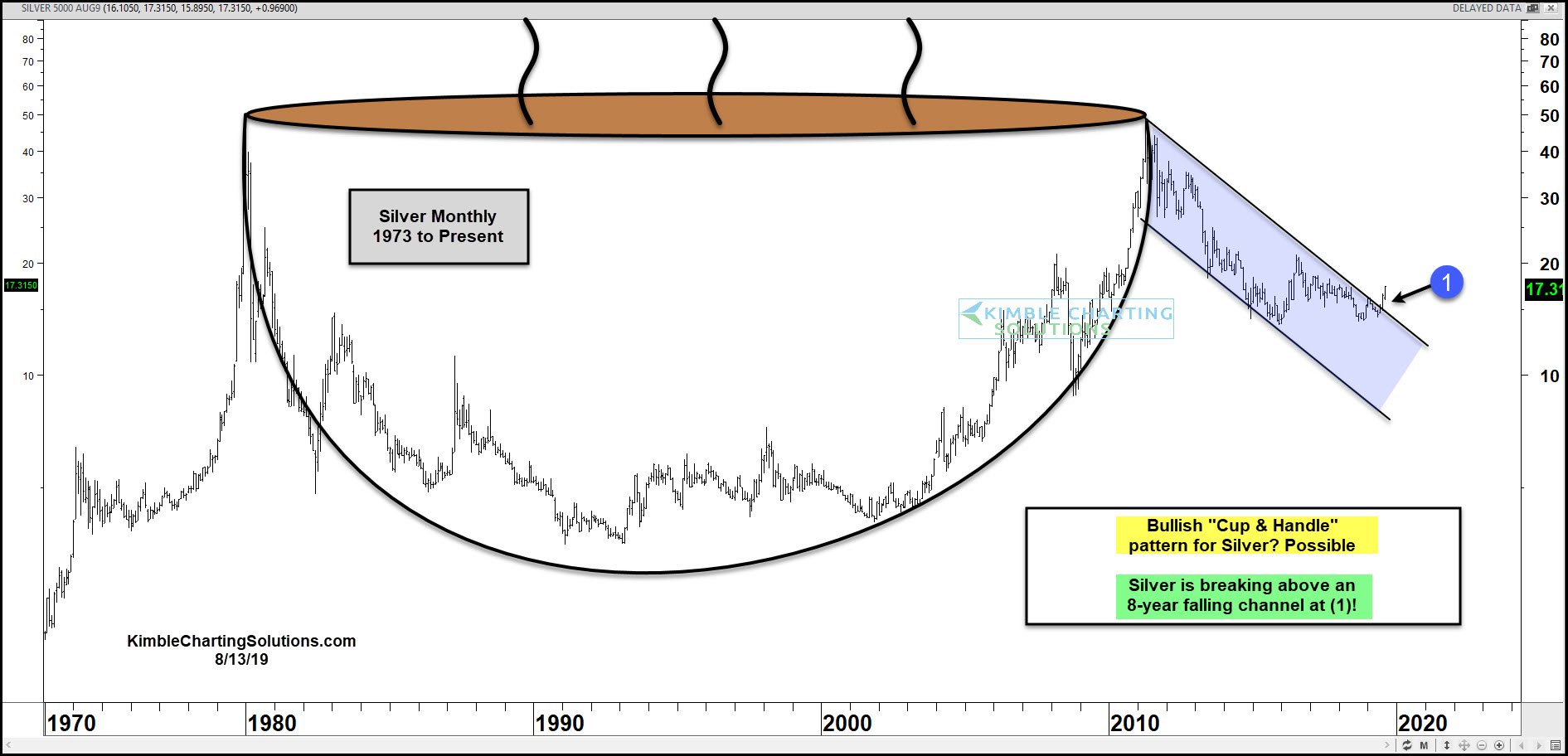

Is Silver creating a multi-decade bullish Cup & Handle pattern? Possible!

Silver peaked at $50 in the early 1980s and then proceeded to fall for years. It peaked again at $50 in 2011 and it has declined for the past 8-years.

The two peaks at the $50 level could be the top of a bullish cup and handle pattern.

One this is for sure, Silver has been very weak over the past 8-years, as it has declined over 65%! The 8-year decline in Silver has created a uniform falling channel.

The move higher in Silver of late does have it breaking above the falling channel at (1). This breakout sends a bullish message to Silver owners.

The next important resistance test for Silver comes into play at the $17.64 level!

What would it take to determine if Silver has created a multi-decade bullish cup and handle pattern? A clean break above the $50 level, which is still a “long, long” way off!