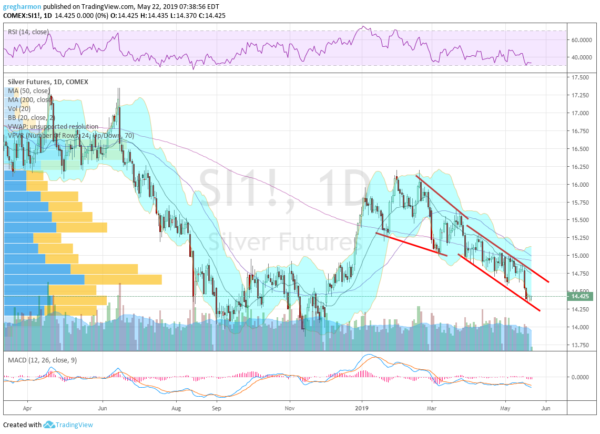

Silver started moving higher in November. And by the end of the year it had crossed above its 200 day SMA. It had not been above that marker since June, when it began a 3 month plunge from a double top. It came back to retest the 200 day SMA and held into January. The situation looked good for shiny metal #2.

A reversal to a higher high at the end of January and digestive pullback to a higher low reconfirmed the uptrend. It reversed higher again but stalled at the previous high, hmmm. It could not make a higher high this time and fell back. In fact the pullback made a lower low and undercut the 200 day SMA.

This was a change of character. And in the wider scope a top at a much lower high. The path through March started to look like a falling wedge. This often resolves with a reversal higher and as it moved back over the 200 day SMA at the end of the month got bulls excited. But instead it petered out and morphed into a falling channel.

Now it has moved under the high volume node below 14.60 and sits at the bottom of the channel. What is next? It would appear a retest at the November lows is in order. With relatively less prior volume to work through it is an easier path than a reversal. Should it get under 14 the prior volume starts to get really light.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.