Inflows into short Bitcoin investment vehicles reach a record four-week run of $88 million.

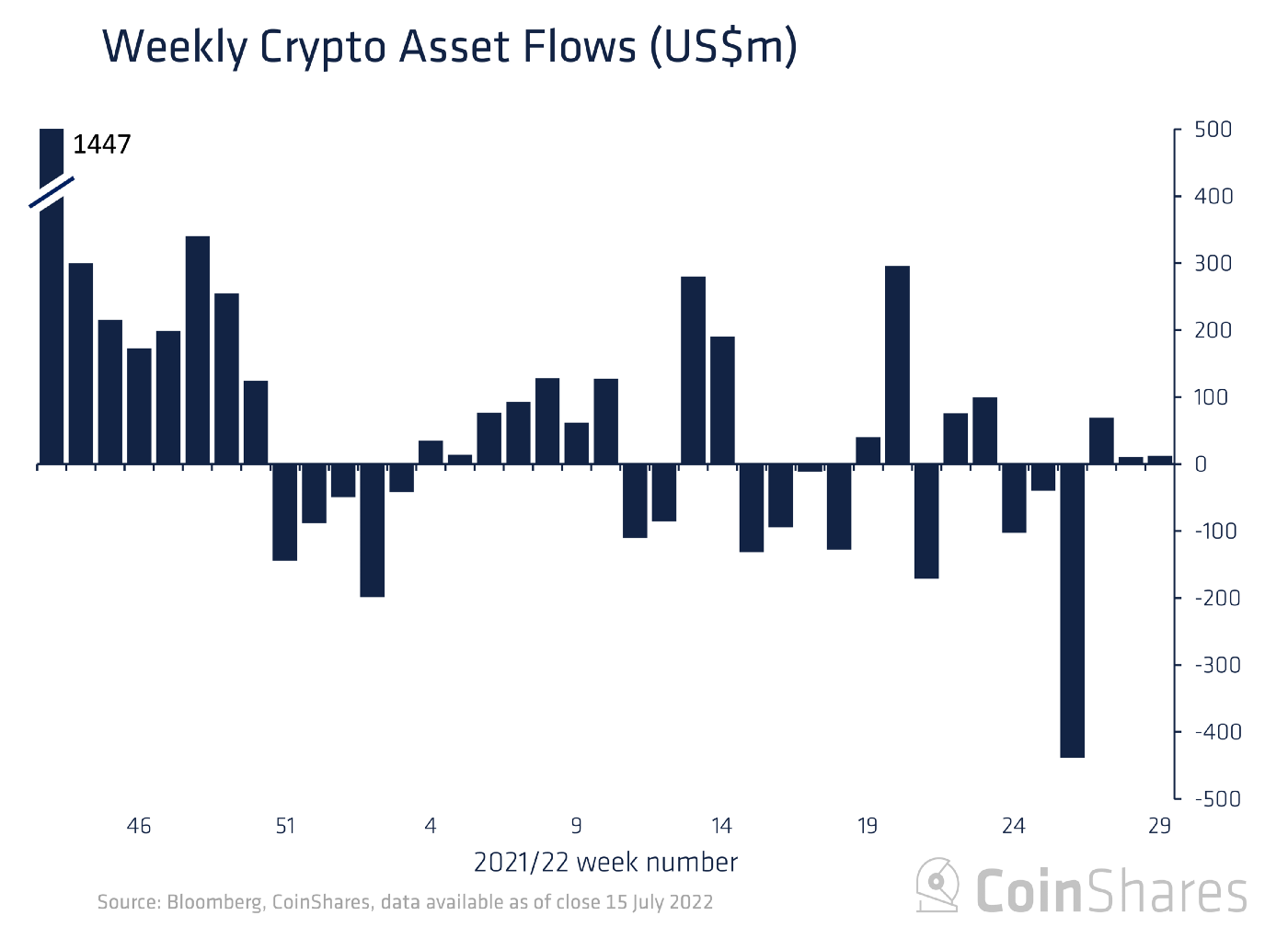

Data released by CoinShares reveal that short Bitcoin Exchange-traded funds (ETFs) continue to dominate inflows into digital asset investment products. These products saw $15 million in inflows last week, bringing the total investments in the asset class to a record $88 million (61% of AUM) over the past four weeks.

Investors Continue to Favor Short Positions

Amidst the current crypto market winter, investors increasingly favor short-Bitcoin positions. Following an increase in demand for a short investment product and its subsequent launch, investors have continued to pour in their money.

Recently, the first short Bitcoin exchange-traded product (BITI) in the US was launched by Proshares. The fund allows investors to bet against the price of the most popular cryptocurrency, a venture that can be difficult and expensive. This is due to the stringent regulations imposed by cryptocurrency exchanges, making it difficult to short spot Bitcoin.

Furthermore, the financing charges linked to conventional means of gaining short exposure can range from 5% to 20%. This makes BITI a more economical strategy as it charges an expense ratio of 0.95%. As a futures-based ETF, BITI aims to track the S&P CME Bitcoin Futures Index’s performance inversely.

Following a lackluster debut on the New York Stock exchange, the fund saw a staggering 380% volume increase the day after. This highlighted a strong demand for the products as investors continued to bet against Bitcoin. Subsequently, it has continued to dominate the total inflows into the Digital Asset Funds every week, even accounting for 79% in the first week of July.

Source: Coinshares

Accordingly, data for last week shows that investments in digital asset products totaled $12 million, of which $15 million went to short investment products. Meanwhile, net outflows for long ETFs totaled $2.6 million, with assets under management (AUM) increasing by 11.4% from $17.8 billion in June.

Despite the increase in AUM, investors continue to increase their short positions in Bitcoin. This has brought inflows into short Bitcoin products to a record four-week run totaling $88 million and 61% of total AUM.

Short Bitcoin Inflows Could Decline in A Bull Run

With the entire crypto market in a bear run, short Bitcoin ETFs help investors profit from the falling prices of Bitcoin. However, in a bull run, the inflows into them would drop significantly as investors turn to long investment products as they bet on Bitcoin.

The inverse nature of short Bitcoin products makes them suitable for bear markets and untenable in bull markets. They are appropriate for investors who intend to profit from a downturn in price. For example, when the price of Bitcoin drops by 20%, the value of a short Bitcoin product would rise by 20% and vice versa.

Therefore, investors would turn to long ETF products in a bull run, which directly relates to the base index. However, investors looking to hedge their long positions against a downturn can also use short ETFs in a bull market.

While short Bitcoin ETFs saw significant inflows, Multi-asset investment products continued their strong bear market performance. With inflows of $2 million, the total for the year surged to $219 million, far above any other asset class.

Meanwhile, altcoins were relatively quiet, with Solana accounting for the only significant inflow, which amounted to $0.5 million. Also, a three-week streak of inflows into Ethereum was broken by small outflows totaling $2.5m. Overall, Investment product volumes were only $1 billion last week, much lower than the $2.4 billion weekly average over the past year.