Shares of Shopify Inc. (NYSE:SHOP) have gained 8.6% following the robust first-quarter earnings results. The company delivered first-quarter 2019 adjusted earnings of 9 cents per share against the Zacks Consensus Estimate of a loss of 5 cents. Moreover, the figure soared 125% year over year.

Total revenues surged 49.5% from the year-ago quarter to $320.5 million, surpassing the Zacks Consensus Estimate of $310 million. The figure also fared better than management’s guided range of $305 million to $310 million.

The top line benefited from a diversified expanding merchant base and rapidly growing penetration in international markets. The company continues to launch a number of merchant-friendly applications to meet the requirements of a dynamic retail environment, in turn bolstering merchant base.

Notably, shares of Shopify have gained 85.2% year to date, substantially outperforming industry’s rally of 19.9%.

Quarter in Detail

Subscription Solutions revenues (43.8% of total revenues) surged 40.2% to $140.5 million driven by persistent growth in Monthly Recurring Revenue (MRR) aided by the addition of several new merchants.

As of Mar 31, 2019, MRR was $44.2 million, up 36% from the year-ago quarter figure of $32.5 million. Shopify Plus accounted for $11.3 million, representing 26% of MRR compared with 22% in the quarter ended Mar 31, 2018.

Merchant Solutions revenues (56.2%) advanced 57.7% to $180 million, primarily driven by growth in GMV which gained 50% from the year-ago quarter to $11.9 billion.

Robust performance of Shopify Payments, Shopify Shipping and Shopify Capital also aided growth.

Shopify Capital advanced $87.8 million cash to merchants in the reported quarter, registering growth of 45% compared with $60.4 million in the year-ago quarter. Notably, since the launch of Shopify Capital, cumulative merchant cash advances have improved to almost $535 million, out of which $107 million was outstanding as on Mar 31, 2019.

Shopify Shipping witnessed robust adoption in the first quarter. The offering is being leveraged by approximately 40% of total eligible merchants across the United States and Canada.

Gross Payments Volume (GPV) came in at $4.9 billion, accounting for 41% of GMV processed in the first quarter, up from $3.0 billion (38%) in the prior-year quarter.

Purchases from merchants’ stores from mobile devices witnessed 79% of traffic and garnered 69% of orders for the quarter ended Mar 31, 2019, up from 75% and 64%, respectively, reported in the year-ago quarter.

Operating Details

Non-GAAP gross profit surged 45.7% year over year to $181.1 million. This can be attributed to robust performance of Shopify Shipping and Shopify Capital.

Non-GAAP gross margin contracted 100 bps from the year-ago quarter to 57%. The margins were impacted by higher mix of merchant solutions, which carry comparatively lower margin returns.

Non-GAAP operating expenses surged 46.5% year over year to $182.5 million. Non-GAAP operating expenses as a percentage of revenues contracted 100 bps to 57%.

Shopify reported a wider adjusted operating loss of $1.4 million compared with the year-ago quarter’s loss of $0.2 million.

Balance Sheet & Cash Flow

Shopify ended the reported quarter with cash, cash equivalents and marketable securities balance of $1.997 billion compared with $1.97 billion recorded at the end of the fourth quarter.

The company generated cash from operations of $24.3 million in the quarter, compared with $1.9 million used in the year-ago quarter.

Latest Developments to Aid Financial Performance

In a bid to make the platform more merchant friendly, Shopify is working on extending language capabilities beyond English. The focus on local languages is helping in bolstering international presence. We believe this inclusive move will boost engagement and consequently increase adoption going forward.

Recently, the company announced availability of local language capabilities in Simplified Chinese and Dutch on its platform in “a limited beta” version, taking total languages accessible to nine. Notably, Shopify platform already includes English, Brazilian Portuguese, Japanese, German, Spanish, French, and Italian language capabilities.

Management claims more than 0.1 million merchants utilize the platform in languages other than English, which is major driver in this regard.

With an aim to bolster Shopify Plus merchant base utilizing Shopify Payments, the company rolled out “a multi-currency feature” by which merchants can sell in several currencies and receive payments in their respective local currency.

Shopify is also benefiting from adoption of Dynamic Checkout, Centralized Marketing Dashboard and Fraud Protect.

Moreover, management remains positive about the company’s expanding partner ecosystem that aids it to identify and reach merchants who are otherwise inaccessible. The total number of apps registered in the App store amounts to more than 2,700, out of which 200 apps were added in the first quarter. More than 19,000 partners referred merchants to Shopify in the past 12 months.

The company introduced Shopify Studios, in the quarter. It is a production house with film content development and full-service TV capabilities aimed at inspiring entrepreneurship among merchants.

Shopify recently introduced new retail hardware offerings which include Dock and Stand, and, Tap & Chip Reader, to enable merchants provide enhanced retail experience to customers.

The company also announced new integration with Snap (NYSE:SNAP) , by which merchants on Shopify platform can utilize Snapchat’s Story ad campaigns for effective marketing.

We believe these latest merchant friendly initiatives will drive top-line growth in subsequent quarters.

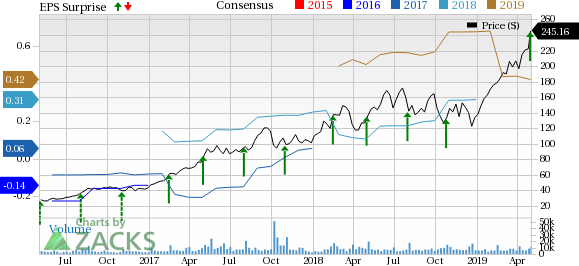

Shopify Inc. Revenue (Quarterly)

Guidance

For second-quarter 2019, Shopify projects revenues in the range of $345-$350 million, whose mid-point of $347.5 million, is marginally above the current Zacks Consensus Estimate of $347.02 million.

In the second quarter, the company intends to introduce Shopify Payments in the Netherlands.

For full-year 2019, Shopify raised outlook. Management now projects revenues in the range of $1.48-$1.50 billion (mid-point at $1.49 billion) better than the previous guided range of $1.46-$1.48 billion. The Zacks Consensus Estimate is currently pegged at $1.47 billion.

Management now envisions adjusted operating income for fiscal 2019 to be in the range of $20-$30 million, better than the previous guided range of $10-$20 million.

Zacks Rank & Other Key Picks

Currently, Shopify carries a Zacks Rank #2 (Buy).

A couple of other top-ranked stocks in the broader technology sector are Cadence Design Systems, Inc. (NASDAQ:CDNS) and Synopsys, Inc. (NASDAQ:SNPS) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Cadence Design and Synopsys is pegged at 12% and 10%, respectively.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

Shopify Inc. (SHOP): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Synopsys, Inc. (SNPS): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

Original post

Zacks Investment Research