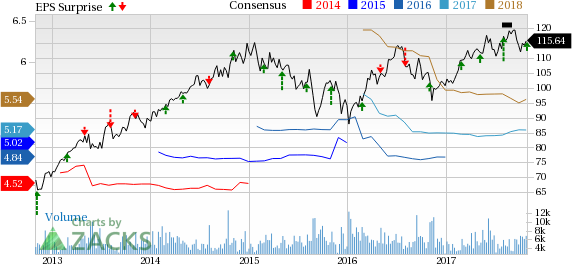

Sempra Energy’s (NYSE:SRE) third-quarter 2017 adjusted earnings per share (EPS) of $1.04 came in line with the Zacks Consensus Estimate. Earnings rose 2% from the prior-year quarter figure of $1.02.

GAAP earnings were 22 cents per share in the quarter, compared with $2.46 a year ago.

Total Revenues

In the quarter under review, total revenues were $2,679 million, up 5.7% year over year on higher contributions from both the energy-related businesses (up 48.3%) and utilities (0.6%). However, total revenues missed the consensus mark of $2,776.1 million by 3.5%.

Segment Update

San DiegoGas & Electric (SDG&E): Quarterly loss for this segment were $28 million as against with the year-ago earnings of $183 million. The downside was driven by an after-tax impairment related to cost recovery for the 2007 San Diego wildfires.

Southern California Gas Company (SoCalGas): The segment registered earnings of $7 million in the third quarter compared with break-even earnings in the year-ago quarter.

Sempra South American Utilities: The segment recorded earnings of $42 million in the third quarter, down from $46 million in the prior-year quarter.

Sempra Mexico: The segment reported earnings of $66 million, compared with earnings of $332 million recorded in the prior-year quarter. This is driven by the absence of the $350 million after-tax re-measurement gain related to the GdC acquisition in last year’s third quarter.

Sempra Renewables: The segment recorded quarterly earnings of $15 million, down from $17 million in the prior-year quarter.

Sempra LNG & Midstream: The segment recorded a loss of $4 million against the year-ago quarter’s earnings of $77 million. This was due to the absence the $78 million after-tax gain from the sale of EnergySouth in the prior-year quarter.

Financial Update

As of Sep 30, 2017, Sempra Energy’s cash and cash equivalents were $189 million, compared with $349 million as of Dec 31, 2016.

Long-term debt was $14,803 million as of Sep 30, 2017 compared with $14,429 million at 2016 end.

Cash flow from operating activities was $2,710 million at the end of third-quarter 2017, up from $1,691 million at the end of the prior-year quarter.

In the third quarter, the company’s capital expenditures, investments and acquisition of businesses worth $1,091 million compared with $2,247 million in the prior-year period.

Guidance

Sempra Energy reiterated its 2017 earnings per share guidance. The company continues to expect to generate earnings in the band of $5.00-$5.30.

Zacks Rank

Sempra Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Peer Release

Entergy Corporation (NYSE:ETR) reported third-quarter 2017 operational earnings of $2.35 per share beating the Zacks Consensus Estimate of $2.24 by 4.9%. However, the reported number improved 1.7% from the year-ago figure.

CMS Energy Corporation (NYSE:CMS) reported third-quarter 2017 adjusted earnings per share of 62 cents, which surpassed the Zacks Consensus Estimate of 55 cents by 12.7%. Quarterly earnings however dropped 11.4% from the year-ago figure of 70 cents.

FirstEnergy Corporation (NYSE:FE) reported third-quarter 2017 operating earnings of 97 cents per share, beating the Zacks Consensus Estimate of 86 cents by 12.8%. Quarterly earnings were also up 7.7% year over year.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

CMS Energy Corporation (CMS): Free Stock Analysis Report

Entergy Corporation (ETR): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

Sempra Energy (SRE): Free Stock Analysis Report

Original post

Zacks Investment Research