Speculators seem to be driving XRP's price action, which may lead to a long squeeze.

Key Takeaways

- XRP is up by more than 40% this week, recently reaching a high of $0.75.

- Most of the buying pressure appears to be coming from retail investors, while whales have been exiting their positions.

- While prices could rise to $0.95, investors must be prepared for a bull trap.

On-chain data suggests that the recent price action for Ripple’s XRP token may not last as whales have been exiting their positions at every upswing.

XRP Targets Higher Highs

XRP has had a bullish week.

Ripple’s XRP token has enjoyed a strong tailwind after trading at a low of $0.52 on July 21. The sixth-largest cryptocurrency by market cap has surged by more than 40% since then to reach a high of $0.75.

The sudden spike in buying pressure has allowed prices to overcome the resistance given by the 50-day moving average at $0.68 and turn it into support. Now, XRP must slice through the 200-day moving average at $0.77 to advance further.

The 100-day moving average at $0.95 could serve as a target for the recent upward price action if XRP breaks through the 200-day moving average.

Despite the optimistic outlook seen from a technical perspective, on-chain activity paints a different scenario. Behavior analytics platform Santiment reveals that whales have been cashing out while prices have been rising.

The number of addresses holding more than 1 million XRP has decreased by nearly 21% since Jul. 19. Roughly 18 whales have left the network or redistributed their token within a short period, which is a negative sign for a sustainable uptrend.

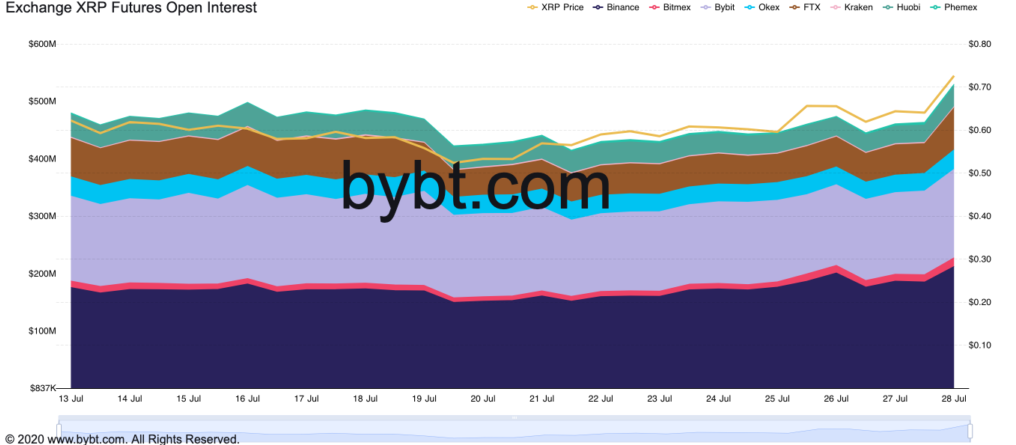

Data analytics provider Bybt shows that the recent uptrend has mostly been driven by open interest in cryptocurrency derivatives exchanges. The total number of outstanding XRP derivative contracts has skyrocketed by $100 million since Jul. 21.

Although an increase in open interest along with a price increase is said to confirm an upward trend, most of the participants entering the market are retail investors. Until whales start accumulating again, investors must take the recent price increase with a grain of salt.

If the number of addresses holding more than 1 million XRP continues to decline, the uptrend would likely be capped by the 200 or 100-day moving average. A rejection from any of these resistance levels could lead to correction towards the 50-day moving average or the $0.52 support zone.

It is worth noting that a breach of the $0.52 support could generate further losses. XRP could then target $0.40 or as low as $0.30.