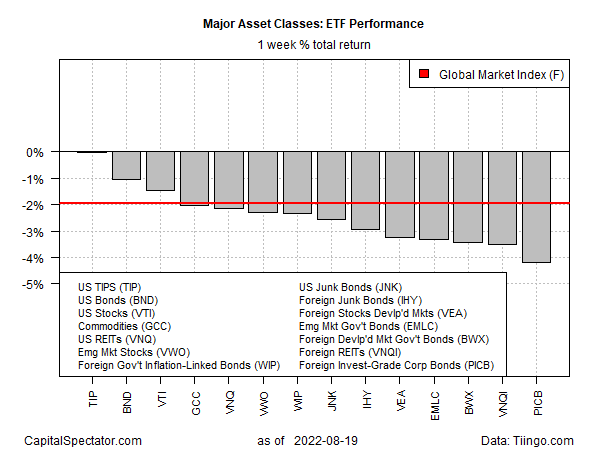

A clean sweep of red ink washed over all the major asset classes for the trading week through Friday, August 19, based on a set of ETFs.

US inflation-indexed Treasuries were relatively stable, inching down fractionally for the week. Despite the essentially flat performance, iShares TIPS Bond ETF (TIP) continues to reflect a downside bias.

The rest of the field posted clear-cut losses, ranging from a 1.1% weekly decline for investment-grade US bonds (BND) to a 4.2% haircut for foreign corporate bonds (PICB), the deepest shade of red.

The bond market will be increasingly focused on the Federal Reserve’s upcoming Jackson Hole symposium (Aug. 25-27). A key focus is reading the tea leaves from the speeches and comments and deciding how or if the central bank will adjust monetary policy.

“Powell will reiterate that the Fed’s commitment to bringing down inflation will require an extended period of restrictive policy and thus below-potential growth and higher unemployment,” predicts Tom Kenny, a senior economist at ANZ Banking Group in a note sent to clients. “Chair Powell’s speech will be very different to last year’s when he got the inflation story very wrong. He put forward a case for why elevated inflation would prove transitory.”

Fed funds futures this morning are estimating a modestly higher probability (~55%) for a 75-basis-points rate hike vs. a 50-basis-points increase (~45%) at the next FOMC meeting on Sep. 21.

The Global Market Index (GMI.F) also fell last week, dropping 2.0%. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive index for portfolio strategy analytics.

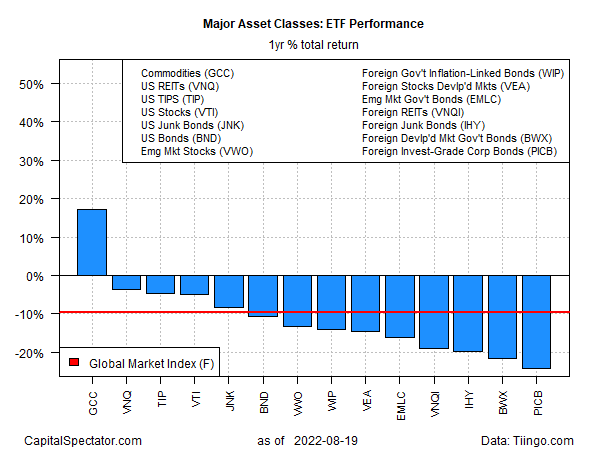

For the one-year performance window, broadly defined commodities are holding on to the only gain for the major asset classes. WisdomTree Commodity (GCC) is up 17.2% over the past year.

The rest of the field is underwater. The deepest one-year loss for the major asset classes: a 24.2% tumble for foreign corporate bonds (PICB).

GMI.F has shed 9.6% over the past year.

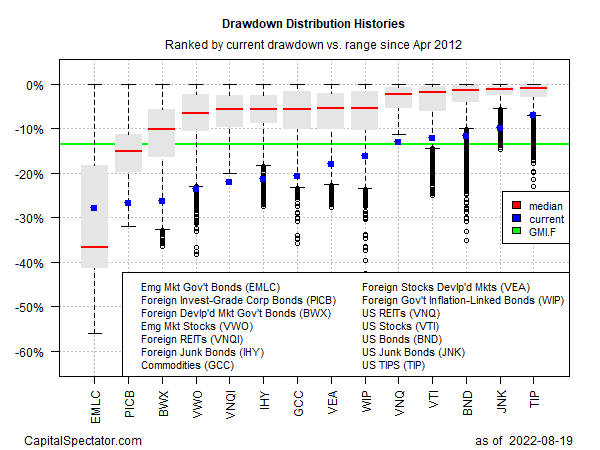

Using a drawdown lens to review the major asset classes indicates that most of the ETF proxies are currently posting relatively steep peak-to-trough declines (deeper than -10%). The outlier: inflation-indexed Treasuries (TIP), which closed on Friday with a relatively light peak-to-trough decline of -6.9%.

GMI.F’s drawdown: -13.6% (green line in chart below).