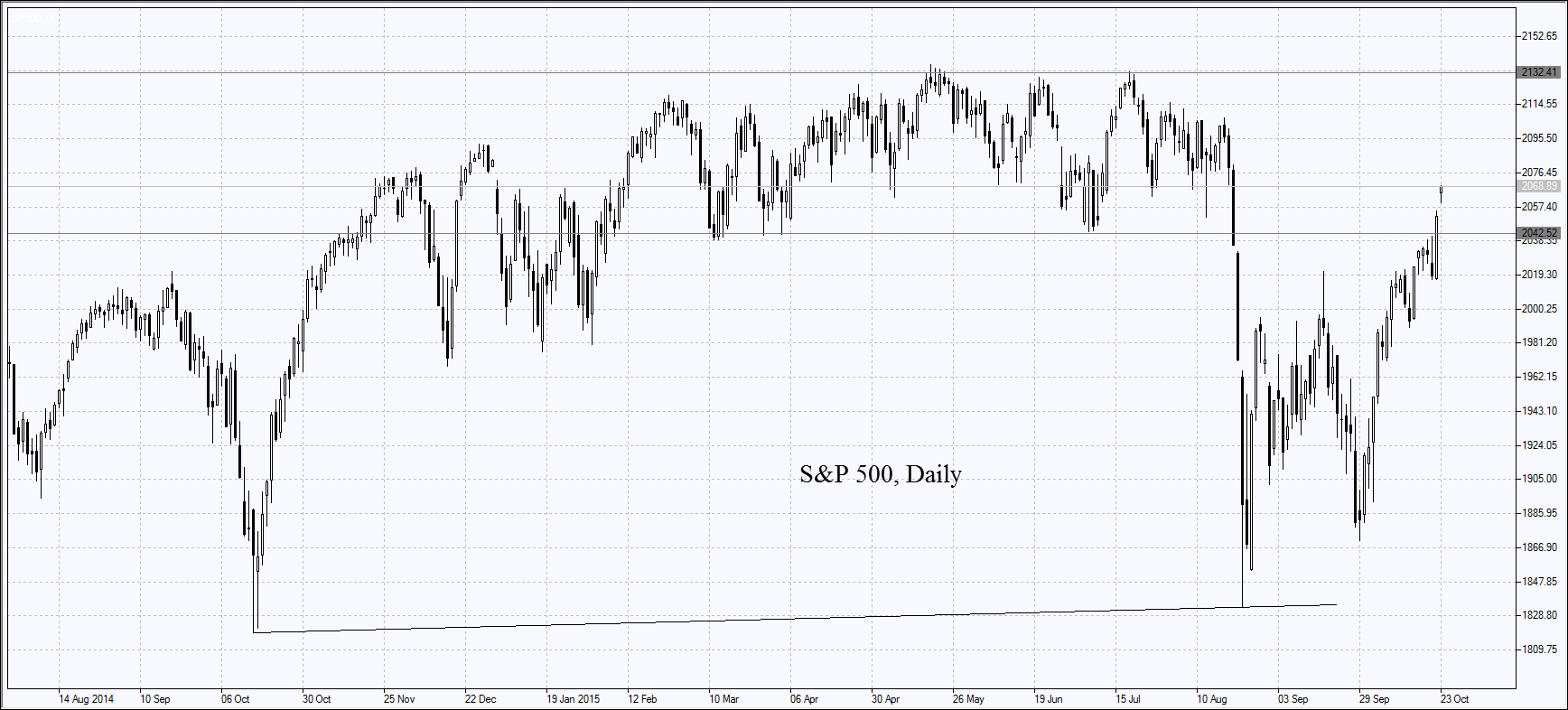

On Thursday, US stocks quotes rose. The S&P 500 index closed at 2-month high. This was mainly due to the publication of McDonald's (N:MCD) good quarterly corporate report (shares climbed 8,1%), eBay (O:EBAY) (+13,9%) and Dow Chemical (N:DOW) (+5,1%). After the market closure, more positive news appeared. Alphabet shares (former Google (O:GOOGL)) price increased 9,6%, Microsoft (O:MSFT) - 7.2%, and Amazon (O:AMZN) - by 10.6%. Macroeconomic data were also positive. The number of unemployed in the US increased less than expected last week. Home sales in the secondary housing market in September exceeded forecasts and reached 5.55 million, which is close to the maximum since 2007. This has contributed to a significant strengthening of the US dollar. US stock market turnover was 11% higher than the average for the 20 sessions and has reached 8 billion shares. Manufacturing PMI index for October calculated by Markit will be published today at 15:45 in the US.

European stock indices also increased yesterday. Besides the positive dynamics in the United States, the ECB meeting contributed to this as well. The ECB president Mario Draghi noted that the ECB may revise its monetary policy in order to fight against low inflation in December. The emission will be proceeded in the amount of 60 billion Euros per month in order to purchase the assets and may be extended after the planned completion in September 2016. The European Central Bank inflation targeting level is 2%, while it was 0.1% in September. European stock markets are still increasing today as positive PMI data published. No significant EU statistics is expected. The euro quote decreased due to a possible increase in the emission of the ECB.

Nikkei increased for the third day in a row, along with other world stock indices. Shares of food producer Snack food company Calbee (T:2229) climbed 9.6% and soft drinks producer Megmilk Snow Brand (T:2270) - by 10.5% due to the forecast of their positive financial April-September reports published in the Nikkei business daily. Regular Japan macroeconomic data will be released next Wednesday morning.

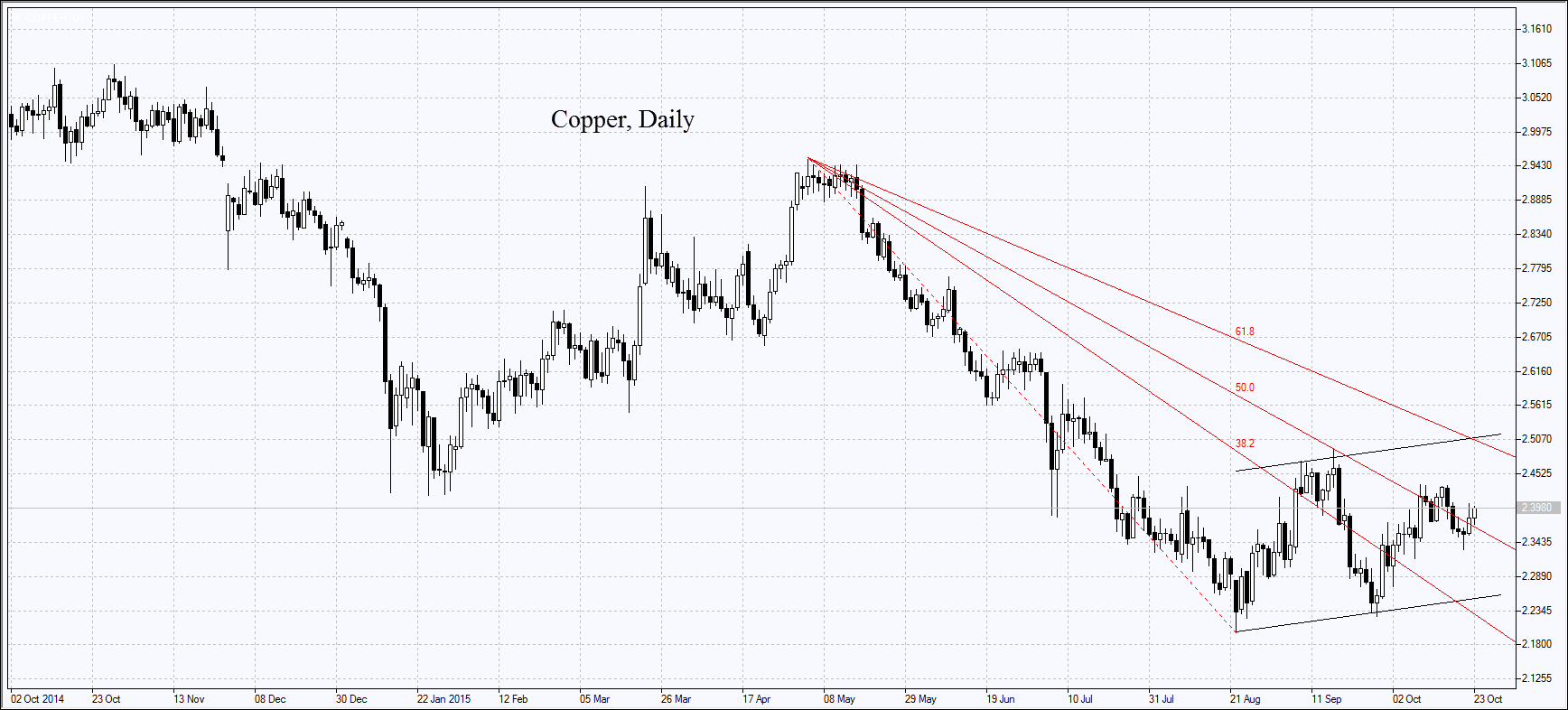

Copper quotes rose after the announcement of further 100 million pounds reducing its production by US company Freeport-McMoran (N:FCX). It was reduced by 150 million pounds earlier and now the company intends to realize 4.1 million pounds of copper in 2015 and 5.2 million pounds of copper in 2016. Company’s copper sales amounted to 4.2 million pounds last year. There is another factor that influences its growth: copper import to China reached 351 thousand tons in September. This is the highest record since January 2014. Copper delivery to China amounted 2.55 million tons for the last 9 months, which is only 3.6% below last year's level. Market participants do not exclude that the slowdown of the Chinese economy may not reduce the demand for copper, though it was expected by many of them. Investment company Antaike published a forecast concerning demand increasing for the metal in China about 4-4.5% next year, and about 5.3% increasing this year. Gold is increasing in price today, despite the strengthening of the US dollar. This is due to the demand increase in India: Dussehra, the festival which starts in November, raises the demand for gold jewelry, which is a custom gift during the festival. Jewelry products provide two-thirds of gold demand in India.

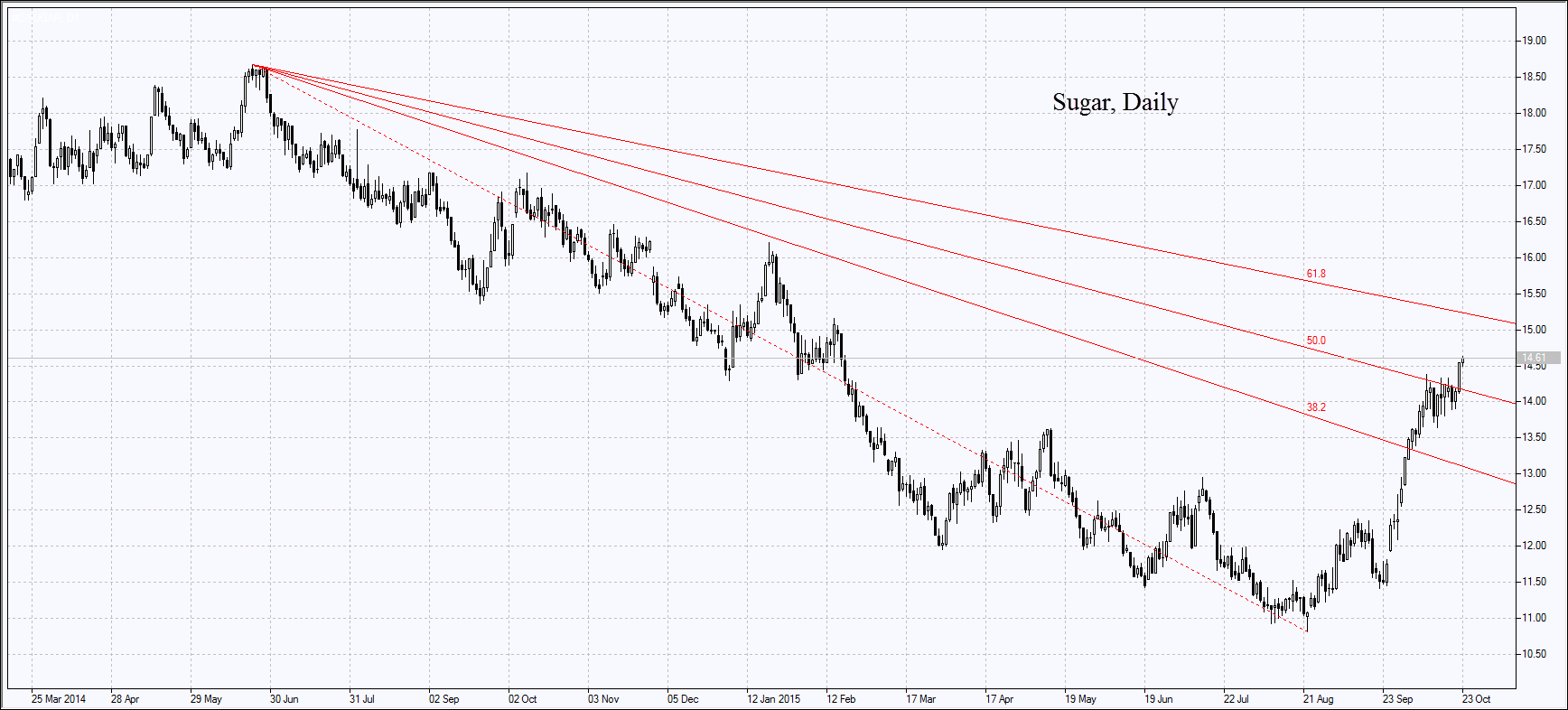

Sugar quotes are increasing third day in a row due to the strong demand in Syria. Previously closed ports have started work due to Russia’s support. This caused a sharp increase in sugar imports. Its September - October volume is estimated at 465 thousand tons, but it could be more