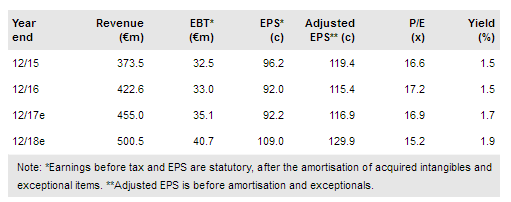

GFT Technologies AG (DE:GFTG) remains on target and thematic trends are broadly the same. Underlying Q1 revenue growth was solid at 13.3%, helped by 3% more days in the period, and management guidance was maintained. GFT’s retail banking activities remain buoyant, benefiting from digital banking projects in continental Europe and the group’s first retail banking project in the US, while the investment banking backdrop remains challenging, not helped by Brexit and the political changes in the US. With the sustained healthy outlook in digitalisation across the retail banking sector and the prospect of a recovery for the investment banking market (since these businesses need to invest in IT to sustain growth), we believe the shares are looking increasingly appealing on c 13x our FY19e earnings.

Q1 results: Total revenue growth was 14%

Q1 revenue grew by 14% to €111.1m, which includes 13.3% organic growth, a 2.2% currency headwind and €2.9m from Habber Tec Brazil, which was acquired in April 2016. Employee numbers grew 16% over the year to 4,833, but were down 1% over the quarter. EBITDA (GFT definition) slipped by 2% to €9.9m, but rose 10% after adding back €1m restructuring costs and a €250k earnout payment for Habber Tec. Net debt rose by €19.2m over the quarter to €61.2m, while outstanding acquisition liabilities and the pension deficit take the adjusted net debt to €102.1m. We note that most cash flow is generated in H2, as some of GFT’s largest customers utilise their budgets at the end of the financial year.

To read the entire report Please click on the pdf File Below