Stock market today: S&P 500 climbs as ongoing AI-led rebound pushes tech higher

Proofpoint, Inc., (NASDAQ:PFPT) recently completed the acquisition of insider threat management company, ObserveIT, for $225 million.

The acquisition is expected to strengthen Proofpoint’s email and cloud access security broker data loss prevention (DLP) capabilities.

Reportedly, the combination of ObserveIT’s endpoint agent technology and data risk analytics, and Proofpoint’s threat detection capabilities will enable enterprises to monitor and look into user activity with their sensitive data. It will also help them identify the location of the activity and efficiently rectify the risk.

Proofpoint intends to convert ObserveIT’s licensing revenue model to a subscription-based one.

The ObserveIT buyout is expected to be slightly accretive for Proofpoint’s revenues and billings in fourth-quarter 2019. However, the planned shift of business model is expected to limit ObserveIT’s revenue generating capability till it has fully transformed into a subscription-based model.

Also, the acquisition is expected to marginally affect Proofpoint’s non-GAAP earnings per share.

Why Proofpoint Stands to Gain From DLP Capabilities

Proofpoint’s management noted that more than 30% of all data breaches take place due to insider threats, which underscores the importance of strong DLP capabilities.

Per a study by Cybersecurity Insiders, 53% of surveyed companies experienced insider attacks. Further, per the Verizon (NYSE:VZ) 2019 Data Breach Investigations report, 34% of all breaches in 2018 were caused by insiders.

Moreover, per a 2018 report by SecurityIntelligence, the average cost of a cybersecurity breach caused by insider attack was $8.7 million.

As a result, there is an increase in the number of organizations that are becoming more cautious and aware about insider threats. This positions Proofpoint well for growth.

Acquisitions Bode Well

Proofpoint has been making strategic acquisitions to expedite growth. It had a debt free balance sheet with cash and cash equivalents and short-term investments of approximately $1.05 billion as of Sep 30, 2019. This enhances liquidity and can be used for funding product development and to pursue growth strategies like acquisitions.

Management is optimistic about the latest acquisition of Wombat Security Technologies (February 2019), which enhanced the company’s Nexus platform.

With the buyout of Cloudmark in 2017, the company earned the opportunity to continue growing its footprint within the carrier community. Moreover, as a result of its Weblife acquisition in the same year, the company brought to market a new personal email defense, which is its new browser isolation solution.

The buyout of FireLayers in 2016 helped Proofpoint in extending its Targeted Attack Protection solution to SaaS applications and protect these from advanced malware. In the same year, it acquired the Email Fraud Protection business unit from Return Path, which further enhanced its Business Email Compromise capabilities.

Apart from these, the company made various other acquisitions that have not only expanded its product portfolio but also its customer and revenue base.

Zacks Rank and Stocks to Consider

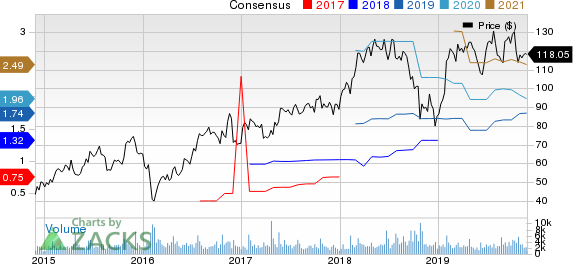

Proofpoint currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector are Alteryx, Inc. (NYSE:AYX) , Cirrus Logic, Inc. (NASDAQ:CRUS) and Fortinet, Inc. (NASDAQ:FTNT) , each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Alteryx, Cirrus Logic and Fortinet is currently pegged at 39.85%, 15% and 14%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Fortinet, Inc. (FTNT): Free Stock Analysis Report

Proofpoint, Inc. (PFPT): Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS): Free Stock Analysis Report

Alteryx, Inc. (AYX): Free Stock Analysis Report

Original post

Zacks Investment Research