- Streaming stocks are poised for a rebound in 2023

- Now seems like a good time for investors to consider increasing exposure to the sector

- But, Netflix might not be the best choice to capitalize on this trend

The COVID-19 pandemic gave a significant boost to streaming stocks in 2020 and 2021. Just think about it: Netflix (NASDAQ:NFLX) crossed the impressive 200 million subscribers milestone, and Walt Disney's (NYSE:DIS) Disney+ hit 100 million subscribers during those trying times.

In July 2022, streaming services in the United States overtook cable and broadcasting to capture the largest share of total television viewership for the very first time.

While subscriber growth has slowed down since then, the sector is still moving forward.

Now, the big question is: Which streaming stock should you consider adding to your portfolio in 2023 to make the most of this trend? Using InvestingPro, let's try and delve deep into the sectors' financials to answer this question.

Streaming Sector Set to Grow

Right now, there's an overwhelming number of over 200 streaming services available worldwide, offering a wide range of media entertainment options, from videos to music and games.

As time goes by, the streaming market is becoming more and more saturated, leading to intense competition among companies vying for the top spot. To stand out from the crowd, these companies are constantly embracing new trends and ideas that can give them a competitive edge over others.

One such trend is content localization, where streaming services target specific regional audiences by providing translations and subtitles in their preferred languages for their favorite content. This approach allows them to cater to diverse viewers and create a more personalized experience.

Furthermore, original content plays a pivotal role in these streaming services. They focus not only on localized content but also invest heavily in producing their own exclusive shows and movies. By offering unique and compelling content, they aim to captivate audiences and keep them hooked on their platforms.

Looking ahead, the streaming services sector is expected to continue its remarkable growth. The demand for fresh and revamped content remains high, serving as a driving force for the industry's expansion in the years to come.

In 2021, the global streaming services market size was estimated at $375.1 billion. The market is projected to grow at a CAGR of 18.45% to reach $1,721.4 billion by 2030.

Which Is the Best Streaming Stock to Buy Now?

First, it's important to highlight that Netflix's upcoming earnings report, scheduled for next Wednesday, will provide valuable insights into the industry's overall performance.

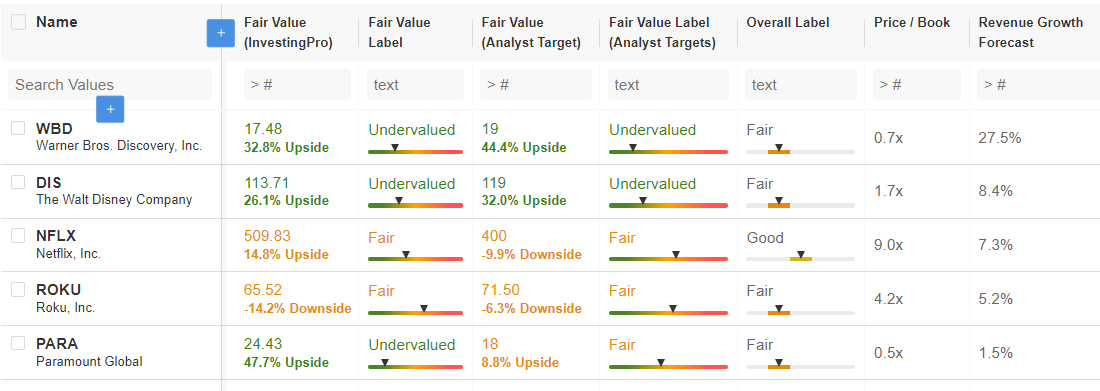

We conducted a thorough examination of the leading streaming stocks focusing on companies specializing in entertainment (excluding giants like Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN)). Our selection includes Netflix, Walt Disney, Paramount Global (NASDAQ:PARA), Roku (NASDAQ:ROKU), and Warner Bros Discovery (NASDAQ:WBD).

To delve deeper into these stocks, we utilized InvestingPro's fundamental analysis tool, creating an Advanced Watchlist that includes these companies.

Source: InvestingPro, Watchlist screen

Source: InvestingPro, Watchlist screen

While Netflix holds undeniable recognition as the most renowned name in the streaming industry, its current valuation is considered "fair" by both analysts and InvestingPro models. Furthermore, it carries the highest Price/Book ratio on the list, which led us to eliminate it as a potential choice, just like Roku.

We also made the decision to exclude Paramount Global from our considerations, despite its strong upside potential as indicated by InvestingPro models. This is due to concerns raised by analysts and underwhelming revenue growth forecasts.

Among the remaining two options, Warner Bros and Walt Disney, we have leaned towards Warner Bros. This decision is not only based on higher upside potential according to both analysts and InvestingPro models but also due to its lower Price/Book ratio, which adds further appeal to the investment.

Warner Bros Discovery: Outlook Improves After a Difficult 2022

Warner Bros Discovery (WBD) has experienced a challenging period following the completion of its $43 billion merger between Warner Bros and Discovery in April 2022. The company faced various obstacles, including leadership changes, declining revenues, company-wide layoffs, and other adverse factors, resulting in a significant decline in its stock price throughout 2022.

However, there is good news on the horizon. WBD, a media giant, has set its sights on achieving $4 billion in cost-saving synergies over the next two years. In a positive turn of events, the company saw its streaming losses reverse in the first quarter, with subscriber growth surpassing consensus estimates.

"We have undertaken significant restructuring efforts and implemented a more focused and precise realignment. We are witnessing several encouraging signs," stated David Zaslav, the CEO of Warner Bros. Discovery.

Notably, the company has revised its previous forecasts and now anticipates its direct-to-consumer business in the United States to become profitable this year. Previously, the company had projected that the profitability threshold for its streaming division would not be reached until 2024.

In the midst of the ongoing streaming war, where competitors like Disney (DIS), Netflix (NFLX), and Apple (AAPL) fiercely vie for subscribers, Warner Bros. Discovery launched its streaming service called "Max" at a critical juncture.

During the platform's launch, Mr. Zaslav emphasized the value of the company's intellectual property, leveraging popular franchises such as "The Lord of the Rings" and "Harry Potter," as well as successful series like "Friends," "The Big Bang Theory," and the more recent "The Last of Us."

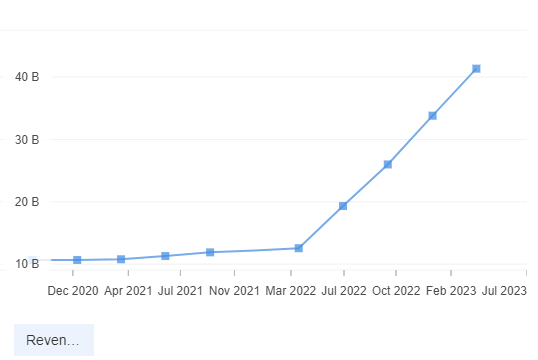

Strong Revenue Growth

Over the past few quarters, the company has experienced a noteworthy upward trend in its revenue figures, indicating a promising trajectory.

Source: InvestingPro, Graphics screen

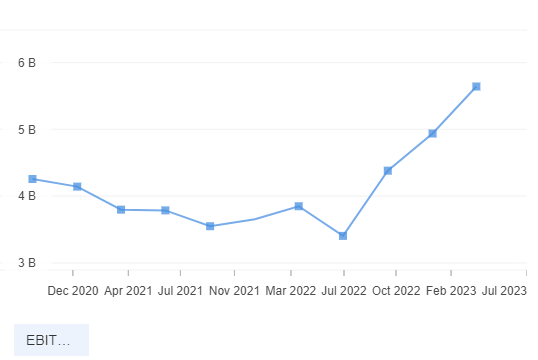

Similarly, the EBITDA (earnings before interest, taxes, depreciation, and amortization) has also shown improvement since the second half of 2022, further underscoring the positive financial momentum of WBD.

Source: InvestingPro, Graphs screen

It's important to highlight that analysts are projecting a loss per share of $0.025 for the upcoming quarterly results, scheduled for August 3. However, even a slight outperformance compared to expectations could propel the company toward profitability.

Such a milestone would not only have a direct impact on the financials but also potentially boost investor confidence, leading to a positive impact on the stock price.

Source: InvestingPro, Results screen

Revenue is expected to remain stable at $10.516 billion compared to the previous quarter, which indicates a consistent performance

Conclusion

The upcoming quarterly results of Netflix will bring significant attention to the sector, which is displaying signs of recovery following a challenging 2022. In this context, Warner Bros Discovery, with its impressive catalog of prestigious yet underutilized licenses, stands out as an appealing choice.

The company's positive revenue growth, improving financial metrics, and potential profitability make it a compelling contender for investors seeking opportunities in the streaming industry.

***

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by subscribing and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. Our exclusive summer discount sale has been extended!

InvestingPro is back on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won't last forever!

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor's own.