Two names, one that reported Tuesday after the close, Green Mountain Coffee (GMCR) and one before the open today, American Eagle Outfitters (AEO). The season is slower and some names coming up have less liquidity. Take note of volume before you bid for 50 contracts.

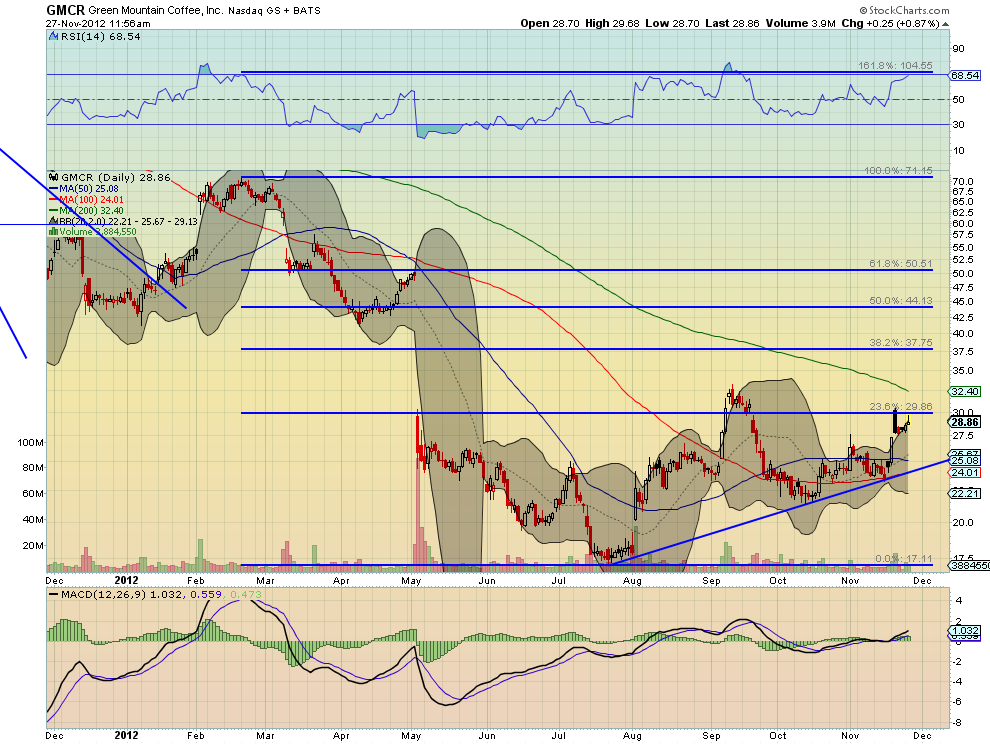

Green Mountain Coffee (GMCR)

Green Mountain Coffee (GMCR) has been making higher lows after bottoming in July at 17. It is now hanging around the 23.6% retracement of the down move as it heads into earnings. The Relative Strength Index (RSI) has run higher into bullish territory and the Moving Average Convergence Divergence (MACD) indicator is positive, both supporting more upside. A short-term upside bias that would be stronger over the 200-day Simple Moving Average (SMA).

A move over resistance at 30 sees further resistance at 33.15 before 41 and a gap fill higher at 48.62. Support lower comes at 27.65 and 25.25 before 23.65, 21.50, 20 and 17.11. Short interest is very high at 38%. The reaction to the last 6 earnings reports has been a move of about 28.68% on average or $8.40 making for an expected range of 20.80 to 37.60. The at-the money weekly November Straddles suggest a mere $5.40 move by Expiry Friday with Implied Volatility at 230% above the December at 100%.

Trade Idea 1: Buy the November 29.5 Calls for $2.46.

Trade Idea 2: Buy the November 29.5/33 Call Spreads for $1.40.

Trade Idea 3: Sell the December 22 Puts for a $0.72 credit.

Trade Idea 4: Buy the December 30/33 Call Spreads selling the December 22 Puts for $0.43.

Trade Idea 5: Buy the December 29 Straddle and sell the November 24/34 Strangle for $5.00.

This is a bet that options are fairly pricing the move this week and that it will continue beyond into December expiry

Trade Idea 6: Buy the December 27/31 Strangle and sell the November 24/34 Strangle for $3.00.

This is also a bet that options are fairly pricing the move this week and that it will continue beyond into December expiry, but less outlay and less reward.

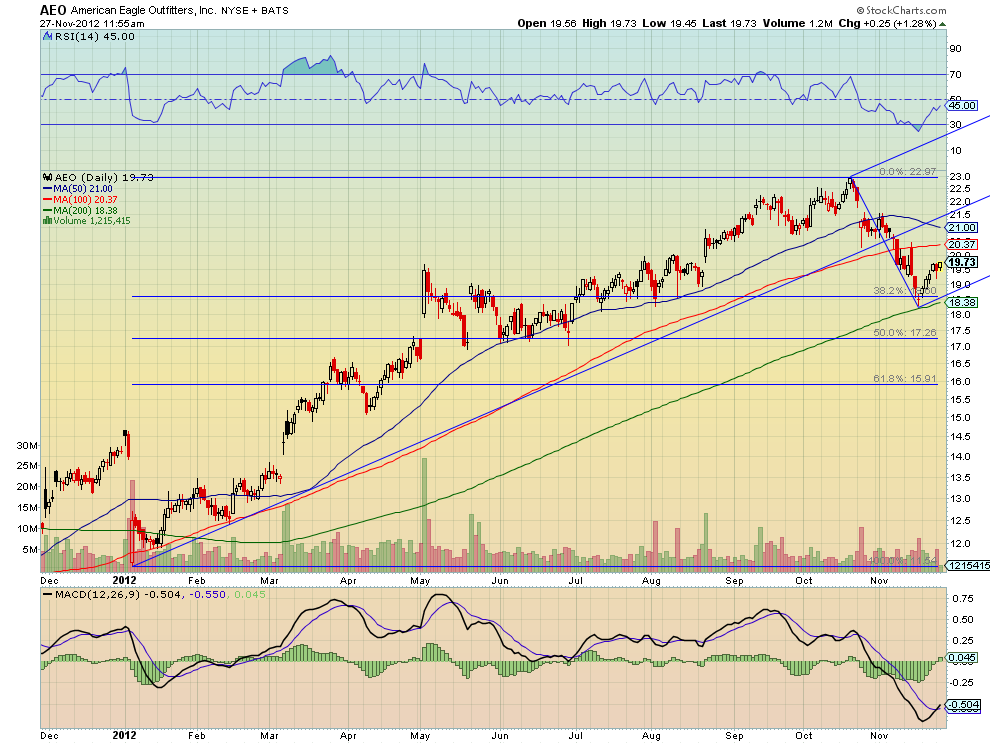

American Eagle Outfitters (AEO)

American Eagle Outfitters (AEO) had a long run higher form a low to start 2012 before pulling back in mid October. The doji at the 200 day Simple Moving Average (SMA) seems to have signaled a reversal and it has been moving higher since, Now in consolidation it has a RSI that is moving higher and a MACD that has crossed to positive supporting further upside. But it is also showing signs of trouble escaping the attraction of the Lower Median Line of the Andrew’s Pitchfork. The Measured Move higher out of the consolidation takes it to 21.20.

Resistance is found at 20.35 and 20.80 followed by 21.60 before a gap to 21.67 and the former high at 22.97. Support lower comes at 18.28 and 17.25 before 15.10. The reaction to the last 6 earnings reports has been a move of about 5.30% on average or $1.04 making for an expected range of 18.55 to 20.65. The at-the money December Straddles suggest a roughly $1.85 move by Expiry with Implied Volatility at 43% near the January at 37%.

Trade Idea 1: Buy the December 20 Calls for $0.75.

Trade Idea 2: Buy the December 20/21 Call Spreads for $0.40.

Trade Idea 3: Sell the December 18 Puts for a $0.30 credit.

Trade Idea 4: Buy the December 20/21 Call Spreads and sell the December 18 Puts for $0.10.

I like #4 best with #2 a second best choice

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Premium Earnings Unlocked From November 26, 2012

Published 11/28/2012, 12:10 AM

Updated 05/14/2017, 06:45 AM

Premium Earnings Unlocked From November 26, 2012

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.