In this section of this multi-part research article related to the potential economic destruction of the Covid-19 virus event across the global markets (Part I, Part II).

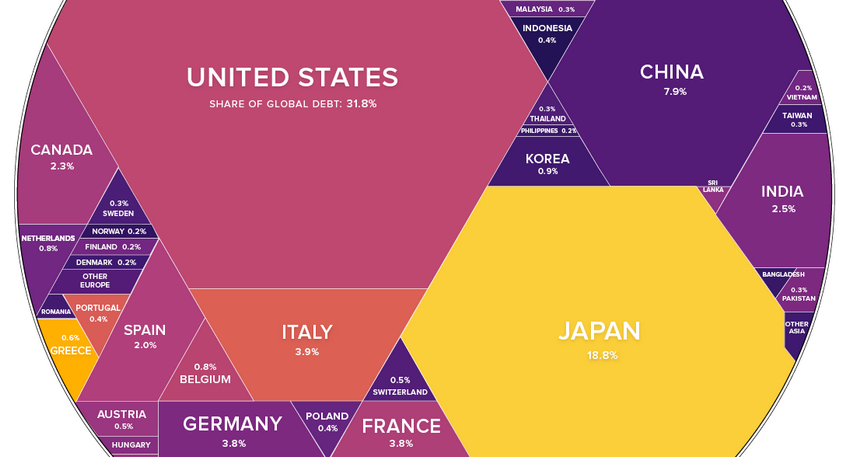

We’re going to peer into data related to the GDP and other factors of the US economy. Remember, the US economy is the largest single economy and consumption component in the world. As we suggested in our earlier research, the US and China (combined) account for about 30% of the total global GDP each year. The top 12+ GDP nations on the planet account for just under 80% of the total annual GDP for the globe. What happens if economic activity and global GDP collapse for the next 24+ months because of the Covid-19 virus?

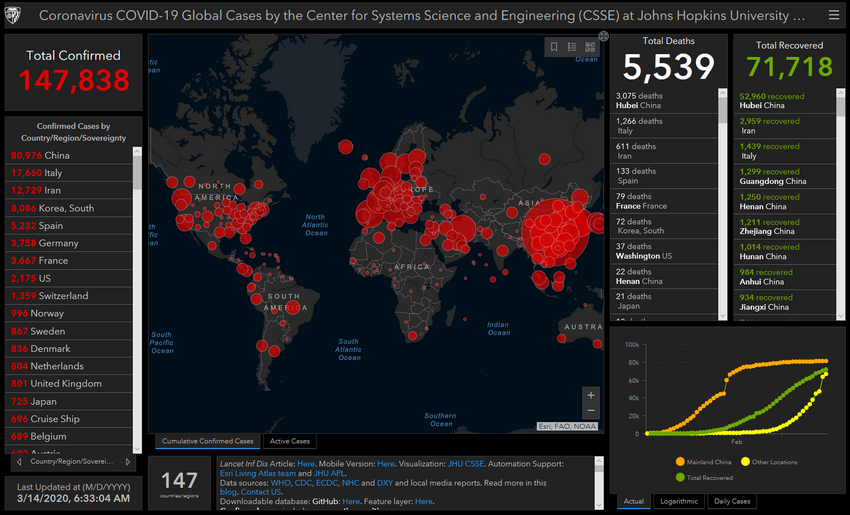

The second thing we want to discuss is the real potential for economic interruption within the global markets. As of today, the US has declared an emergency status and many states and cities have already started to shut down schools, sporting events, entertainment venues and many other aspects of the US economy. Additionally, a travel ban has been set up in an attempt to prevent the spread of the Covid-19 virus and the potential of an uncontrolled global contagion. We believe these travel restrictions will stay in place for at least 60+ days and we believe the spread of this virus will continue for at least another 45+ days before potentially “leveling off”.

The third thing we want to discuss is the economic fallout that is resulting from this Covid-19 event. It has clearly become evident that exporting a large portion of our manufacturing capabilities to China and other nations puts the USA in a very dangerous situation. China has threatened to withhold vital medical supplies and other items from the USA over the past few weeks as China attempts to blame the USA for initiating this virus event. Simply put, America will not be held hostage by China under any circumstances.

Additionally, we believe other mature economies and nations are also starting to reconsider many policies and manufacturing processes related to this event. Although we don’t have any real proof that this Covid-19 virus event originated in a Chinese lab in China, the very first instance of this virus was documented in China in November 2019 and didn’t really spread to any other country until well into 2020. It makes perfect sense this Virus originated in China and spread throughout the Chinese New Year to other nations.

Debt and Banking capabilities become a real issue at times when consumers shift spending and economic habits. Large sectors of the economy become “at-risk” very quickly. The way our researchers put it is “isolated economic events may cause certain economic events to unfold, but extended economic events put greater pressure on even mostly healthy corporations and enterprises as lack of revenues and a shift in consumer activity can result in a broad market collapse”.

So, here we have the setup of the economic event and now we can speculate about the consequences. Our researchers believe the immediate needs of all nations is to attempt to contain this virus event and to reconsider policies and manufacturing processes/locations to eliminate risks related to hostile countries. Is it worth it to save a few pennies to manufacture something while putting your entire nation at risk when an event like this happens?

The funny thing about all major events, like this, is that usually cause people and nations to “shift gears”. Remember after 9/11 how America shifted away from certain policies and came together to support our military against terrorists around the world? Remember after the 2008-09 credit crisis how the US took immediate steps to attempt to prevent this type of financial event from happening again and how consumers were “shell-shocked” to re-enter the marketplace after the fallout? This same type of social constriction happens all over the world as consumers/people act in a flock-mentality.

What do our researchers believe is the most likely outcome for Q1 and Q2 of 2020?

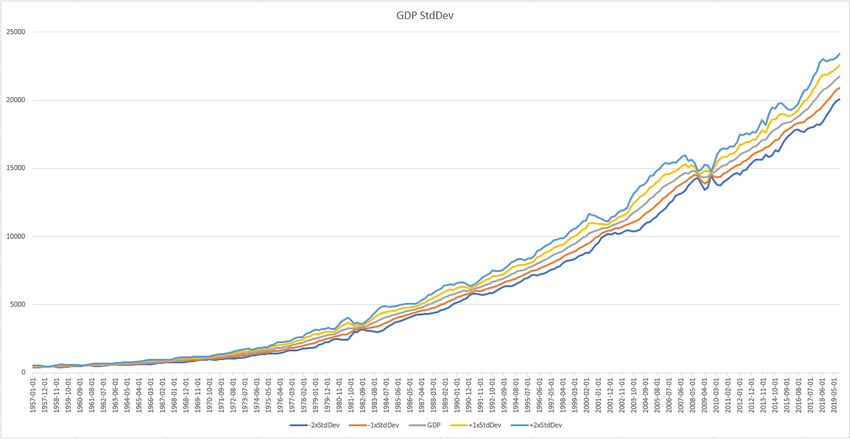

We took the past 73 years of quarterly US GDP data and attempted to run two rolling Standard Deviations on them. The first, a 12 quarter (roughly three years) rolling Standard Deviation. The second, a full 10-year rolling Standard Deviation. The purpose of this was to determine how volatile past economic events have been related to these standard deviation ranges.

There have only been a few economic events that meet any of the criteria similar to the Covid-19 virus event. The closest was the 2008-09 Credit Crisis. All other events were isolated US types of events related to bubble events and Federal Reserve functions.

1957-1958: a collapse in GDP growth (below the 12 QTR StdDev) took place where GDP contracted by nearly 10 billion (-2%), then almost immediately rebounded back to 2x StdDev growth by 1959.

Mid 1960 to mid-1961: GDP growth collapsed to below 1x StdDev range, at one point almost stalling in Q1 1961, then immediately rebounded back to 2x StdDev growth by the end of 1961.

Q1 1982 to Q1 1983: GDP growth stalled to levels near 0.5 StdDev range for a period of 12 months before slowly rebounding back to 1x+ levels by late 1983 into 1984.

Q3 1990 to Q4 1991: GDP growth stalled to nearly 0.6 of the StdDev range, then rebounded back to 1.5x StdDev range by Q2 1992

Q4 2000 to Q3 2002: The Dot Com bubble and the 9/11 terrorist attacks resulted in an extended contraction in GDP expansion throughout this time. By Q4 2001, GDP growth was only 0.53x the StdDev range. Growth finally rebounded in late 2002.

Q1 2008 to Q1 2010: The Credit Crisis really took a toll on GDP. Throughout most of 2008, GDP levels were still positive and above 0.5x the StdDev range. Yet in Q3 2008, everything turned negative and GDP reached an extreme (-2.088x) StdDev range in Q3 2009. Gdp rebounded back to 2x StdDev range in Q1 2010.

Q3 2015 to Q3 2016: This was an election year GDP contraction. GDP continued to grow, but fell below the 1x StdDev range that seems to be very consistent. Q4 2016 returned to levels above 1x StdDev.

What this shows us is that a -2x StdDev range is not uncommon and that a bigger move could take place with the right global economic setup. A 3x or 4x GDP reversion (downside collapse) is also not out of the question if certain circumstances setup to present such an event.

In conclusion

This lengthy article and extensive research, our researchers do believe a 2x to 3x GDP reversion event is on the immediate horizon. Given current data points and the fact that we’ve had little “transition” from previous growth phases to this potential new contraction phase, we believe the GDP contraction for Q1 2020 is likely going to be -10% or more from previous levels. We believe Q2 GDP contraction may actually be higher (-12% or more). This will be the result of China’s contracting and quarantining economy as well as the fallout from the continued spread of the Covid-19 virus throughout the rest of the world.

We believe Q4 2020 may result in a positive GDP quarter before further GDP contraction takes place in early 2021. We believe this will likely be the result of extended global economic malaise, global banking issues, global credit, and corporate earnings issues and the possibility that a global asset revaluation event may be taking place (similar to the 2008-09 Credit Crisis event). This time, though, we believe it will be foreign markets engaging in a Credit Crisis and asset revaluation process that will drag the US economy into a 2021~2023 slump.

A 2x StdDev GDP event right now would be a collapse of $1.65T. A 3x StdDev GDP event right now would be a collapse of $2.486T. A 4x StdDev GDP event (God forbid), right now would be a collapse of $3.316T. Remember, it is not really the size that matters – it is the length of time this contraction takes place.

Be prepared for some really ugly earnings data in Q1 an Q2 of this year, then we’ll figure out if our expectations were accurate or not and what we should be doing to plan going forward.

The type of market condition I think we have entered could be here for a long time, and it’s going to be a traders’ market, which means you must have a trading strategy, plan your trades, and trade your plan. It’s amazing how simple a few trading rules that are written down on paper can save you thousands of dollars a week or month from locking in gains or cutting losses.