Five things to watch in markets in the week ahead

- The week-long selloff gripping risky assets pauses, for now

- Yields also steady, dollar comes off highs after Powell provides some reassurances

- Cryptos bounce back as stablecoins reeling after crash

A calmer end to a torrid week

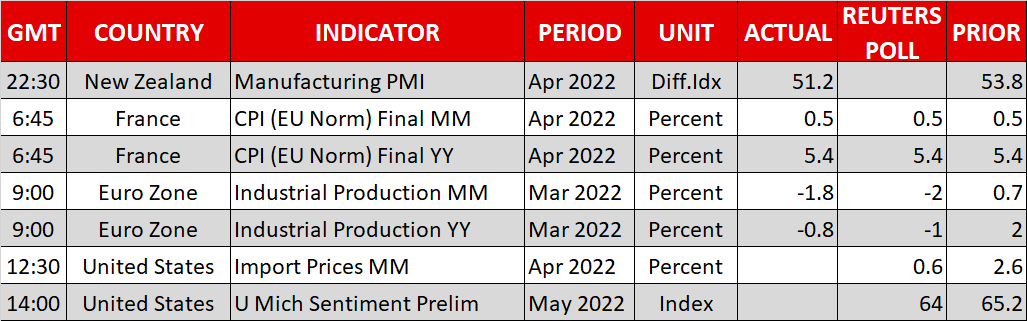

Markets were looking a lot steadier on Friday as the global rout in equities began to subside and demand for safe havens waned slightly. Stocks have been on the backfoot since the end of March. But the selloff accelerated last week after the Fed hiked interest rates by 50 basis points for the first time in 22 years, raising the real prospect of stagflation as there’s yet to be any convincing sign that price pressures are easing.

The S&P 500 and Nasdaq 100 touched one- and one-and-a-half-year lows, respectively, on Thursday before staging a last-minute rally to erase the session’s losses. Their futures are trading more than 1% higher today and European indices have opened with similar gains.

The rebound could just be another pause before traders push the S&P 500 officially into a bear market. But it could also be another case of wishful thinking by traders that the Fed won’t get more aggressive than it already has to combat soaring inflation.

Fresh from his Senate confirmation for a second term as Fed chair, Jerome Powell yesterday gave his clearest indication yet that the central bank is on course to raise rates by 50 bps at each of the next two meetings, adding that policymakers are not “actively considering” a 75-bps hike. However, neither did Powell rule out the need to “do more” should things come in “worse than when we expect”.

Investors seem to be hoping that the pace of tightening will ease after the July meeting. But given that inflation keeps surprising to the upside and Powell has signalled he is willing to get even tougher, stock markets are in danger of further deep losses if the inflationary picture doesn’t improve soon.

Dollar softer, but set for weekly gains

In the world of FX, the brighter mood weighed on the safe havens US dollar and Japanese yen but boosted the riskier currencies. The dollar is broadly softer today, pulling back slightly from yesterday’s 20-year high when its index hit 104.93, although it’s comfortably on track to achieve a sixth straight week of gains.

What is interesting is that the greenback has kept climbing even as Treasury yields have reversed lower this week. The 10-year yield is edging up today but is sharply down from Monday’s 13½-year peak of 3.1090%.

Growing fears that the major economies are slowing and could tip into recession by year-end is behind these latest risk-off moves, as even the ECB has now abandoned all hope that inflation will come down of its own accord and is flagging a July rate hike. Containing inflation is a bigger priority for policymakers right now than supporting growth, and that implies short-term economic pain.

Euro and pound sag amid yen’s safe-haven revival

The euro plunged below $1.04 yesterday for the first time since January 2017 and sterling breached the $1.22 level. Both are a little firmer today, while the aussie has bounced back by about 0.50%.

The Canadian dollar is also heading higher even though oil prices have rebounded only modestly amid doubts about whether the EU will be able to go ahead with plans to ban Russian oil imports as Hungary still opposes such action.

The yen on the other hand managed to end its losing streak, restoring its safe-haven status on the back of the heightened worries about inflation and recession. The dollar is currently trading around 128.75 yen, after popping above 131 yen at the start of the week.

The Swiss franc, though, hasn’t been able to benefit much from the increased risk aversion, weakening to parity against the greenback yesterday.

Mayhem in crypto markets

But the biggest casualties of the past week’s flight to safety have been cryptocurrencies. Bitcoin plunged below $30,000 mid-week and is attempting to reclaim that level on Friday. While cryptos have generally been tracking equities lower, their slide was exacerbated this week from the crash in major stablecoins.

Tether – the largest stablecoin by market cap – broke its 1:1 peg with the US dollar as investors rushed to pull out their funds out of digital assets. Stablecoins are used as medium for buying and selling cryptocurrencies so the loss of confidence at a time when there’s volatility in the broader markets could continue to cause some ripple effects over the coming days.