- Oracle stock zoomed to 52-week highs following earnings

- Following the rally, the stock entered overbought territory

- Should you consider buying now? Let's use InvestingPro to try and find out

In its recent earnings, Oracle (NYSE:ORCL) reported quarterly revenue of $13.84 billion, surpassing expectations by 0.7% and marking an 18% YoY increase. The company's robust annual revenue growth can be attributed to the thriving artificial intelligence sector.

As the demand for cloud services continues to rise with the emergence of AI-focused companies, Oracle has achieved record-breaking annual revenue, surpassing $50 billion, as highlighted by Oracle CEO Safra Catz. Furthermore, ORCL's earnings per share for the period stood at $1.67, surpassing InvestingPro expectations by 5.6%.

Oracle's net profit zoomed 24% to $3.3 billion in the last quarter. On an annual basis, the company's net profit rose by 17% to $8.5 billion. Notably, Oracle holds the highest annual net profit in the information technology sector, trailing only Microsoft (NASDAQ:MSFT) and Qualcomm (NASDAQ:QCOM).

Oracle Enters Overbought Territory

Investors reacted positively to the impressive financial results that exceeded expectations as ORCL stock surged by 6.22% to $116.68 on the first day of the week. The upward momentum continued throughout the week, culminating in a new all-time high of $126.55 at the close of trading yesterday.

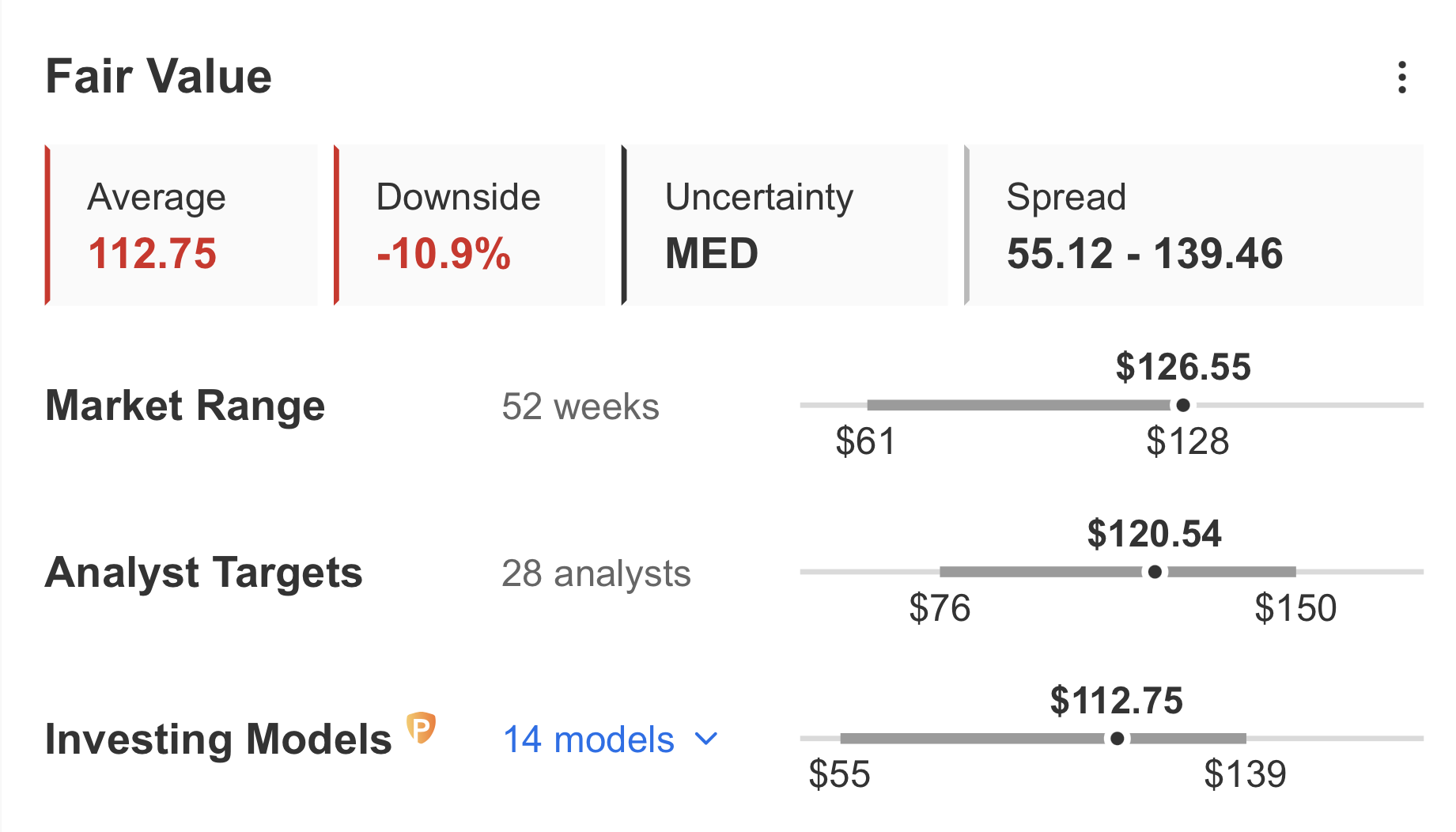

However, it is worth noting that the rapid ascent of ORCL stock has triggered the RSI indicator on the price chart, signaling that the share price is overbought. Additionally, the fair value estimate for ORCL on the InvestingPro platform indicates that the stock is trading at a premium due to these overbought conditions.

Source: InvestingPro

Based on 14 financial models, the InvestingPro fair value estimate for ORCL is $112.75.Consequently, the InvestingPro platform suggests that the stock is currently trading at an 11% premium. Furthermore, the price forecast, compiled from the opinions of 28 analysts, indicates an average target price of $120.54, which is below the current price.

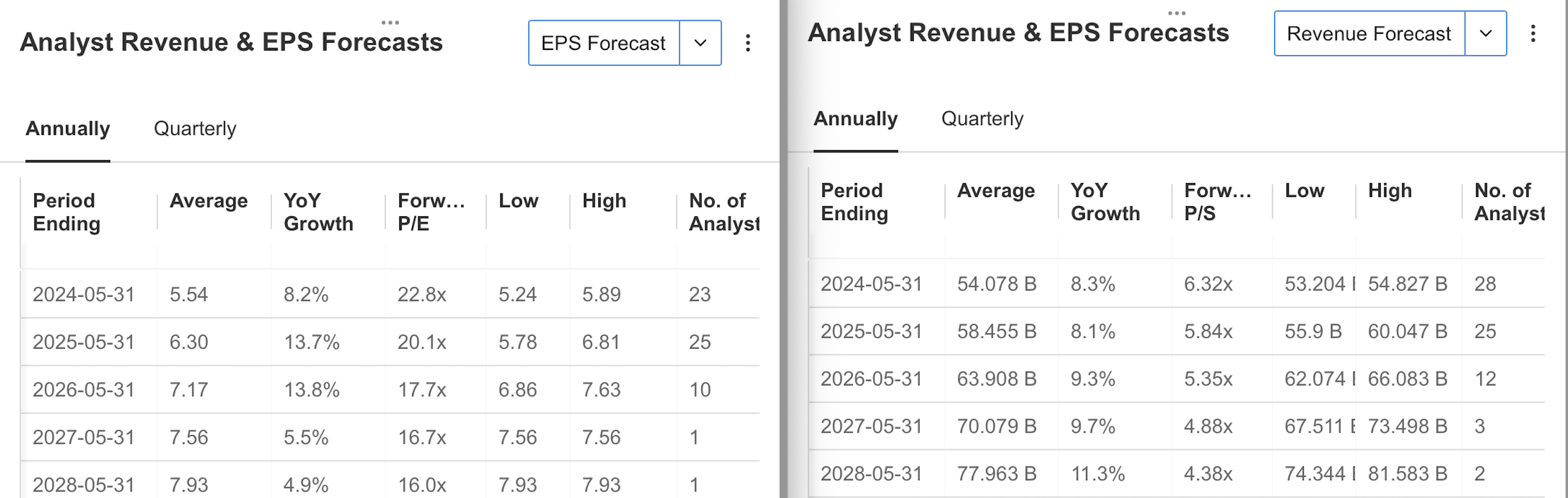

On the other hand, it's important to note that 12 analysts have recently revised their expectations downward for the company's upcoming earnings report.

Source: InvestingPro

According to InvestingPro's projections, ORCL's EPS for the next period is estimated to decline to $1.14. Additionally, the revenue forecast for the next quarter is estimated to be $12.45 billion.

However, looking at the long-term EPS and revenue forecasts, it is anticipated that Oracle will continue to experience steady growth. So, the company's performance and financial results should improve over time.

Source: InvestingPro

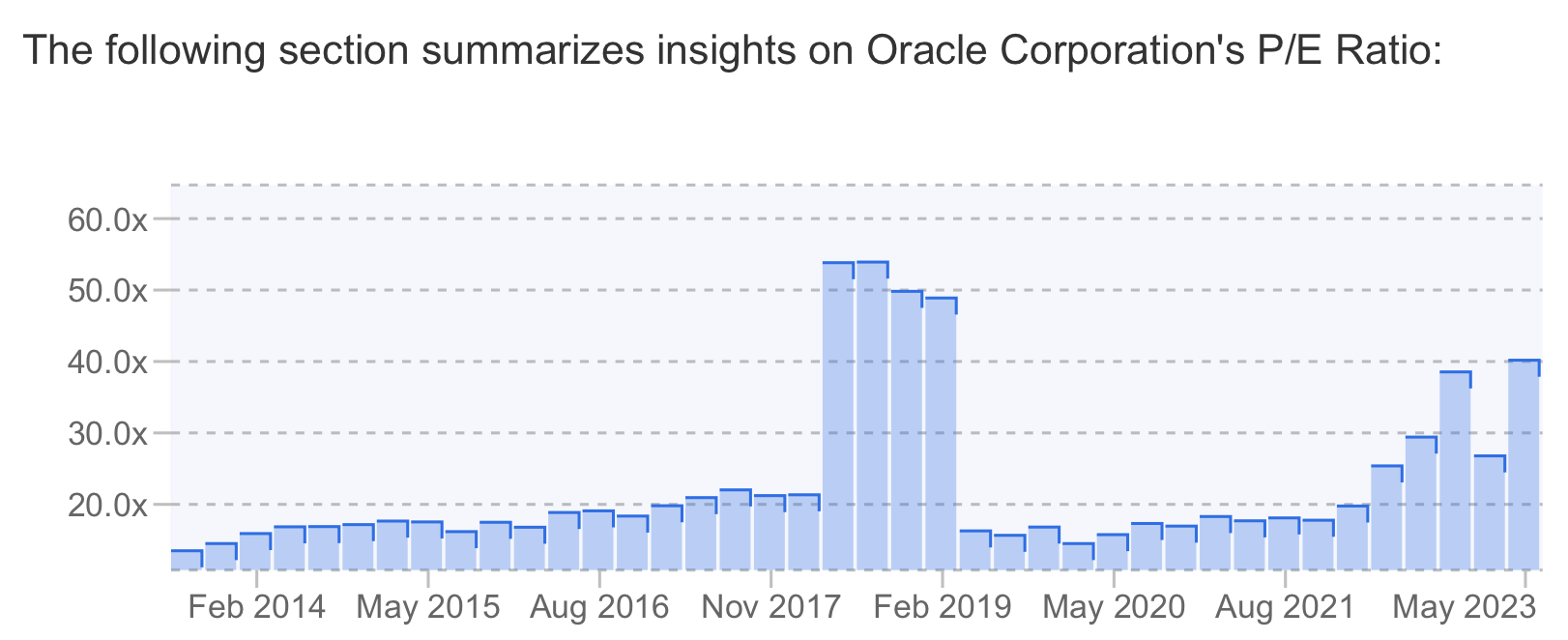

Oracle's High Price/Earnings Ratio Raises Concerns

One of the concerns surrounding Oracle is its high price/earnings (P/E) ratio. Currently, Oracle's P/E ratio on an annual basis stands at 40.2x. Comparatively, the median P/E ratio on an annual basis since 2019 has been 17.7x. This year, Oracle's P/E ratio has reached its highest level in the past five years.

With its current P/E ratio, Oracle is valued above the average of the information technology sector. This indicates that the market has priced Oracle's earnings at a higher multiple compared to its historical average and peers in the sector. Investors may view this high P/E ratio as a potential risk, as it suggests that the stock may be overvalued relative to its earnings.

Source: InvestingPro

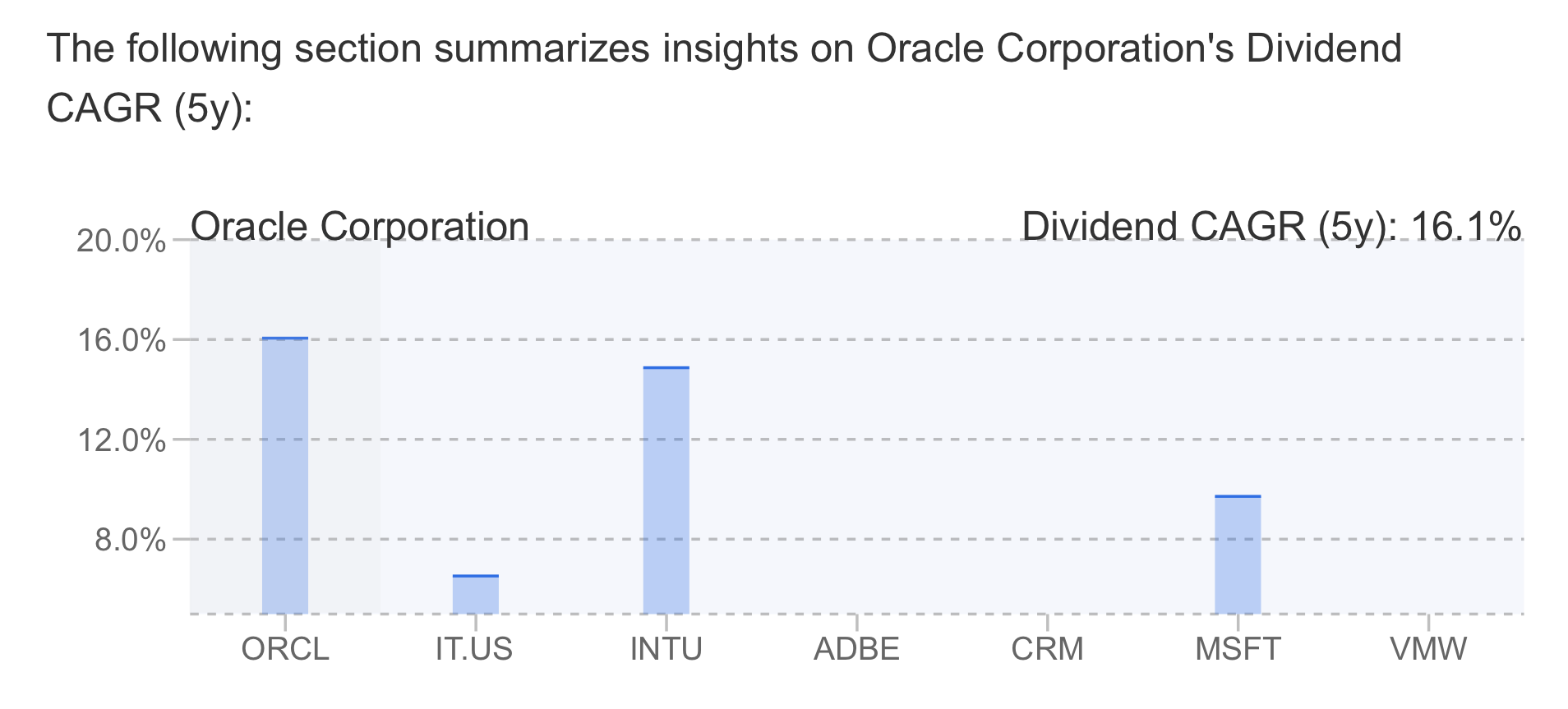

Oracle's Positive Outlook: Consistent Dividend Growth

When considering the positive factors for Oracle based on InvestingPro data, one notable aspect is the company's track record of dividend growth. Over the past nine years, Oracle has consistently increased its dividend. Currently, the dividend yield for Oracle is calculated at 1.3%. This indicates that the company continues to share its earnings with investors through its regular dividend payment policy.

The consistent dividend growth demonstrates Oracle's commitment to rewarding its shareholders and can be viewed as a positive signal for income-focused investors. Despite the relatively modest dividend yield, the steady increase in dividends over the years highlights the company's financial strength and its dedication to returning value to shareholders.

Source: InvestingPro

Oracle also has a positive outlook in terms of revenue growth. The company, which has achieved steady growth momentum, especially since the second half of 2020, has increased its momentum since last year.

Source: InvestingPro

Conclusion

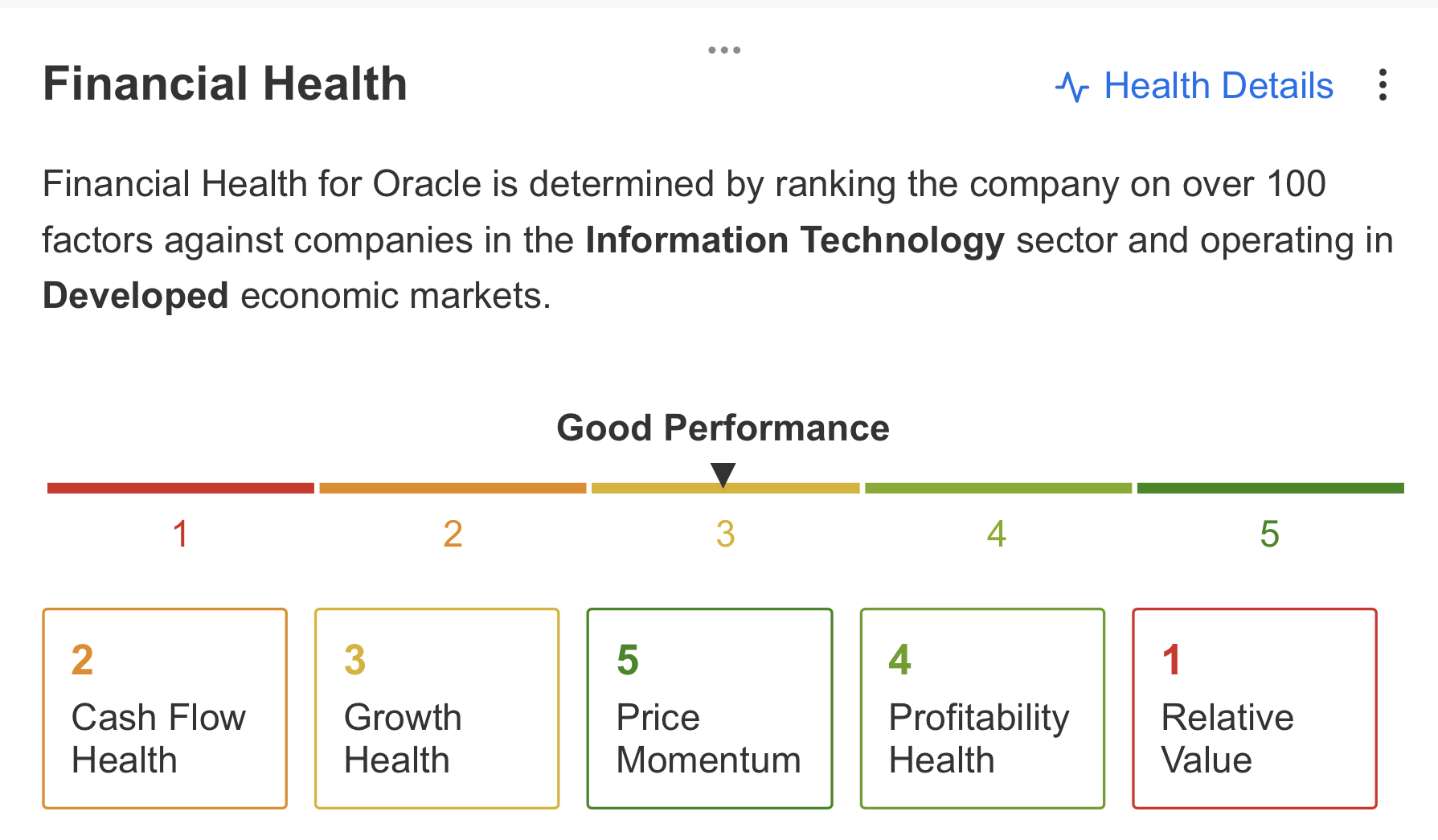

In conclusion, based on the analysis of InvestingPro data, Oracle demonstrates several strengths in its financial health. The company's profitability and price momentum stand out as positive aspects.

Oracle's growth outlook is also performing well, indicating promising prospects for the future. However, there are areas of improvement, such as cash flow and relative value, which can be considered weaknesses.

Overall, Oracle's financial health is deemed good based on the available data. But, currently, the stock seems a little overextended, and investors should wait for a correction before buying.

The InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

You can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, saving you time and effort.

Start your InvestingPro free 7-day trial now!

***

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling or suggestion to invest. We remind you that all assets are evaluated from different perspectives and are extremely risky, therefore the investment decision and the associated risk rests with the investor