Nike stock plunges 10% on margin fears despite Q2 earnings beat

It would only be natural to expect some level of selling to occur after weeks of gains for U.S. indexes. A similar attempt after the last swing high failed, and now the most recent pivot from the November swing high looks destined to fail too.

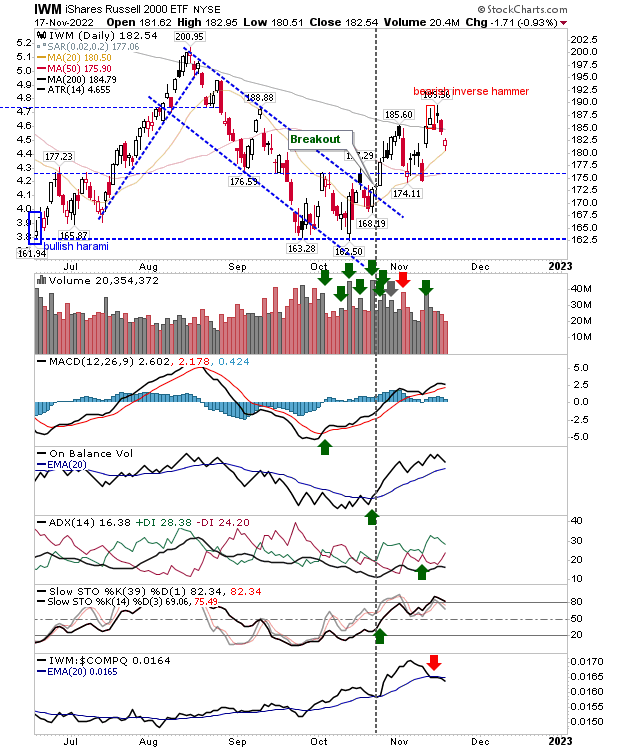

In the case of the iShares Russell 2000 ETF (NYSE:IWM), today's gap down undercut its 200-day MA but did enough to hold on to 50-day MA support. Technicals are net bullish, although the index is underperforming the Nasdaq. Also, on the positive side is the drop in volume on sell-off days.

Last week, I noted a bearish inverse hammer on the small-cap index. If there is a close above this high, then this pattern will be denied.

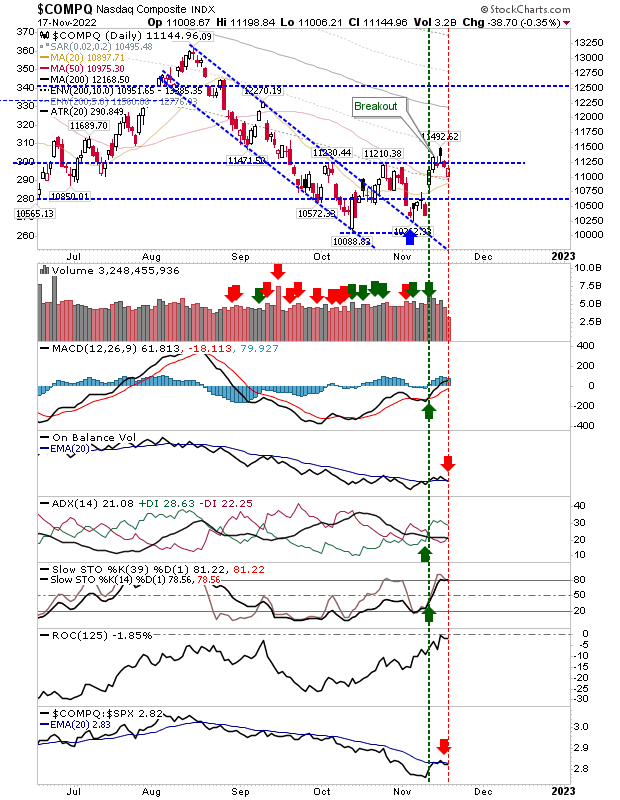

The Nasdaq was able to recover most of the morning gap down, having successfully defended its 50-day MA. There was a bit of a wobble with the 'sell' trigger in On-Balance-Volume, but other technicals are net positive. I like the action here from a bullish perspective. However, it will be up to market participants to decide.

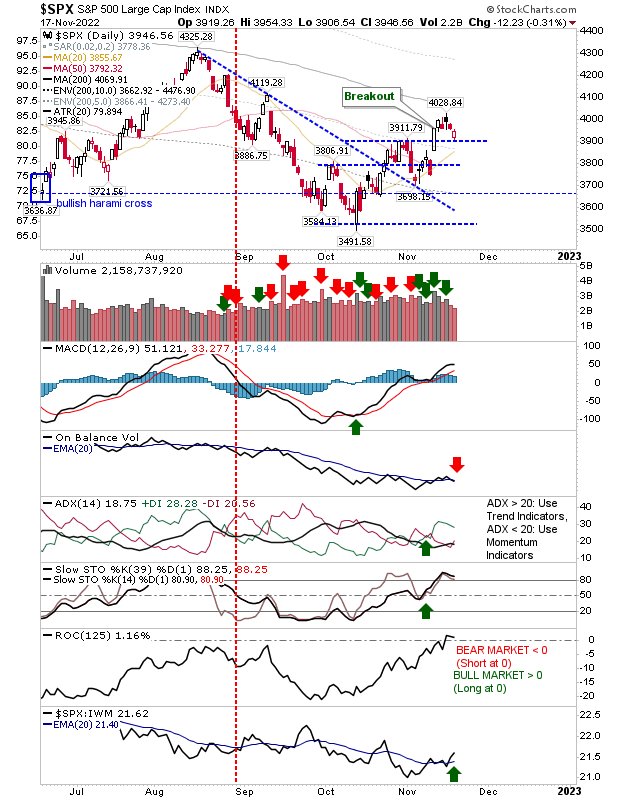

The S&P 500 is doing slightly better than its peer indexes. The breakout established last week has evolved into a successful test of a greater breakout this week. There is a 'sell' trigger for On-Balance-Volume, but other technicals are positive—including an improvement in relative performance over the Russell 2000.

So, we are left today with generally more bullish setups, despite today being an expansion of the rollover top, which had looked to have been the case on Tuesday's peak.

Markets are set up for a positive Friday, which will also have consequences for a strong end-of-week close. There are no guarantees, but I would look for a solid, white candlestick.