- An attack on Aramco (SE:2222)

- No response just yet

- Iran is not going away soon

- Oil-related shares continue to lag the energy commodity

- Watch Brent Oil Futures: The BNO ETF on price dips

Crude oil is the energy commodity that powers the world. Over half of the world’s petroleum reserves are in the Middle East, which is the most turbulent political region on the face of the earth. Meanwhile, the United States is the leading consumer of crude oil.

For many years, the US dependence on Middle Eastern oil contributed to its price variance. The Arab-Israeli War in the 1970s led to an oil embargo and gasoline shortages in the US. When I first got my driving license, the US was on a program where gas was only available on alternate days each week depending on if a license plate had an odd or an even last digit. In 1979, the Islamic revolution in Iran led to a hostage crisis and supply concerns in the oil market.

In 1990, Saddam Hussein’s foray into Kuwait caused extreme volatility in the oil market as did the Arab Spring in 2010. Meanwhile, technological advances when it comes to extracting crude oil from the crust of the earth in the US, together with regulatory reforms, has made the US the world’s largest producer of petroleum. Over recent years, the US surpassed both Saudi Arabi and Russia when it comes to daily output, which is around a record level at 12.5 million barrels per day. The US is now a net exporter of the energy commodity.

The tensions surrounding Iran in the Middle East boiled over during the weekend of September 14. After a period of calm over the summer weeks, hopes for negotiations or talks between Washington and Teheran increased after the departure of John Bolton, a hardliner in the Trump administration. At the same time, the Saudis began talking about an IPO of Aramco once again even though their ideas on valuation at the $2 trillion level is more than a little too high. However, that all went up in smoke with half of Saudi Arabia’s oil production when seventeen drones strategically hit oil fields in the Kingdom.

An Attack On Aramco

On Saturday, September 14, the coordinated drone attack took out half of the world’s biggest oil company’s output. The supply decline of over five million barrels per day amounts to around six percent of the world’s supplies. In the past, such an attack would likely have caused the price of oil for nearby delivery to double in value in a heartbeat as it did in 1990 around the time when Iraq first marched into Kuwait. However, the rise of US production to 12.5 million barrels per day caused a less dramatic price reaction to the attack that had Iran’s fingerprints. Since late May, the price of November futures on NYMEX had traded in a range between $50.48 and $60.77 per barrel. The contract settled at $54.79 on September 13.

Source: Barchart

The chart of November Brent futures shows that the price moved from $60.22 to $71 per barrel from September 13-16, a rise of 17.9%. The Brent futures closed last week around the $64.50 per barrel level.

No Response Just Yet

The Saudis and the US have been very quiet in the aftermath of the attacks. Secretary of State headed to Riyadh last week for discussions with the Saudi King and Crown Prince. President Trump instructed his Secretary of the Treasury to tighten sanctions on Iran. However, there have been no signs of a military response to the attacks.

As the price of crude oil moved lower when the dust settled and fires diminished in the wake of the attacks, an eerie quiet seemed to settle over the oil markets.

Meanwhile, the prospects for a new era of nuclear nonproliferation discussions between Washington and Teheran is off the table along with an IPO of Aramco. The risk quotient of the offering rose dramatically with the latest attack.

Iran has denied involvement, but at the same time, voices in Teheran have blamed the Saudis and US for the attacks. The Iranians have pointed their fingers at the rebels in Yemen saying the attack on infrastructure is a message to the Saudi government. While the US is a close ally of Saudi Arabia, Russia has stood behind Iran. Therefore, a response to the latest attack could be another move in a high-stakes chess game. With sanctions choking Iran, the Russians are likely to be supportive of the theocracy complicating matters.

Iran Is Not Going Away Soon

Iran has been problematic in the Middle East since the late 1970s. Even after the 2015 nuclear nonproliferation agreement, the Iranians continue to call the US “the Great Satan” and call for the destruction of Israel. The period between the 2015 agreement and President Trump’s moved to walk away and tighten sanctions was a sign that Iran looked to spread their influence in the Middle East and around the globe. While the Iranian regime considers the US an enemy, they hate the Saudis even more, and the feeling is mutual.

When President Trump tightened the economic noose around the theocracy’s neck, Iranian President Rouhani said that if Iran cannot ship its oil to customers around the world, they will make sure their neighbors in the Middle East suffer the same fate. The attack on Saudi oil fields was a move to follow through on that promise. The Iranians have said that they are prepared to respond to any military response to the Aramco attack swiftly. The tension in the Middle East has not been at this level in many years, and Iran is not going away any time soon. The price of crude oil is likely to experience wide price volatility over the coming weeks and months as the assault on Aramco is likely not the last provocation from Teheran. The US could be facing a catch 22 in the Middle East. A response could ignite a war in the region, while the Iranians could interpret no response as a sign of weakness leading to future hostile actions.

Oil-Related Shares Continue To Lag The Energy Commodity

Crude oil shares have outperformed the energy commodity throughout 2019, and last week was no exception. On a weekly basis, the price of NYMEX November crude oil futures rose by around 6%.

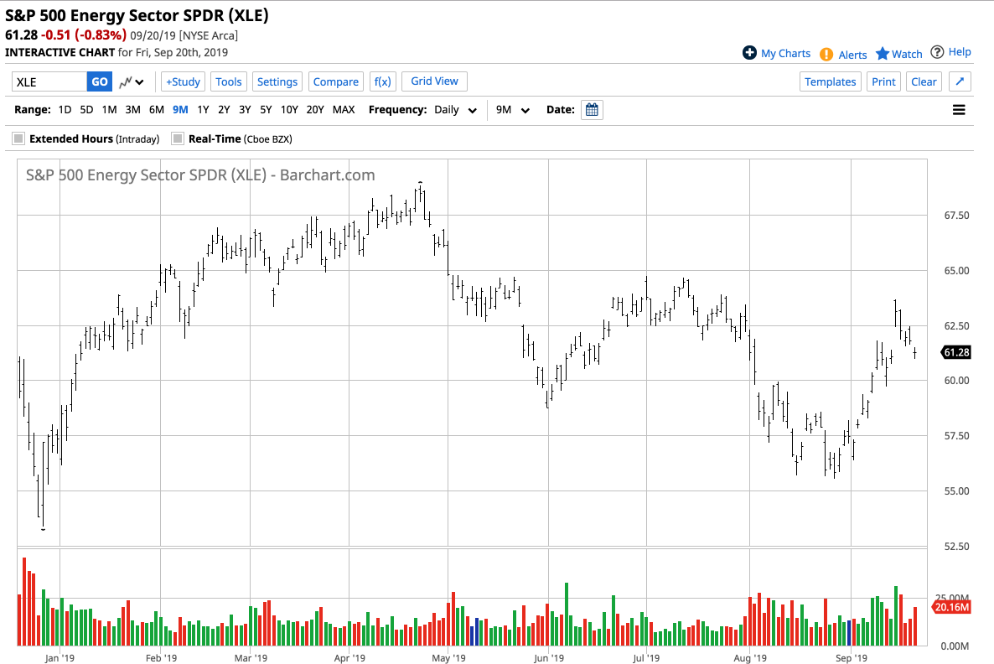

Source: Barchart

The Energy Select Sector SPDR (NYSE:XLE) holds shares in many of the world’s leading oil-related companies. After closing at $61.08 on September 13, the XLE was up only 0.33% at the $61.28 level on Friday, September 20.

The higher price of oil did not support the prices of oil-related shares over the past week.

Watch Brent Futures: The BNO ETF On Price Dips

I believe that the situation with Iran is a dangerous geopolitical chess game and that provocative actions from Teheran will continue to intensify. Therefore, the price spike in crude oil from September 13 through the 16 is likely not the last. Brent crude oil is the benchmark pricing mechanism for Middle Eastern crude oil. We could see the most dramatic price volatility in Brent futures over the coming weeks and months. Therefore, I am a buyer of Brent on dips.

The most direct route for a risk position in the Brent oil market is via the futures and futures option on the Intercontinental Exchange. The United States Brent Oil Fund (United States Brent Oil (NYSE:BNO)) is an ETF that provides an alternative to the futures arena.

BNO has net assets of $85.33 million and trades an average of around one million shares each day. The ETF charges an expense ratio of 0.90%. Brent crude oil appreciated by 17.90% from September 13-16.