If it was not enough for you to try to figure out what is happening in the US markets, foreign markets are also getting a bit antsy in their moves. Setting aside Europe, as it has added drama from the Greeks, the Asian markets are at points of reflection. I wrote about the Shanghai Composite 2 weeks ago, so lets focus on the Japanese Market today.

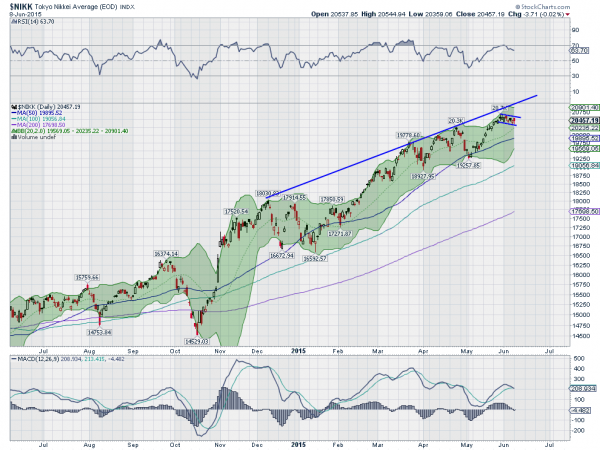

Japan is an interesting market for many reasons. It had stagnated after the 2000 high for a decade. And it was one of the early adopters of Quantitative Easing. Two weeks ago, the stock market benchmark Nikkei Average peaked, just shy of the peak in 2000 over 20,800. Since then it has pulled back in a shallow, orderly manner. This would be described as a bull flag by technicians and seen as a consolidating move. After a ruin higher, the market has some net sellers but not an overwhelming amount, so a slow move lower.

The bull flag often marks the middle of a run higher, and in this case, that would mean another 1500 point move to the upside. The momentum indicators are bit mixed, but this happens in a bull flag. The RSI is holding firmly in the bullish zone, but the MACD is about to cross down. This is where the risk lies. What if the bull flag is not a bull flag but rather a top and reversal lower? You can’t tell until the price of the Average moves back over the bull flag that it was one.

Until then the short term trade is to the downside. If you have been holding for a long time (via NYSE:DXJ or NYSE:EWJ), then it is time to protect the down side or make sure your stop is at the right level. And if you have been waiting for the right time to enter, then keep watching for the Average to break back over the bull flag.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.