Natural gas futures reach pandemic lows

Oversold signals present; confirmation above 1.65

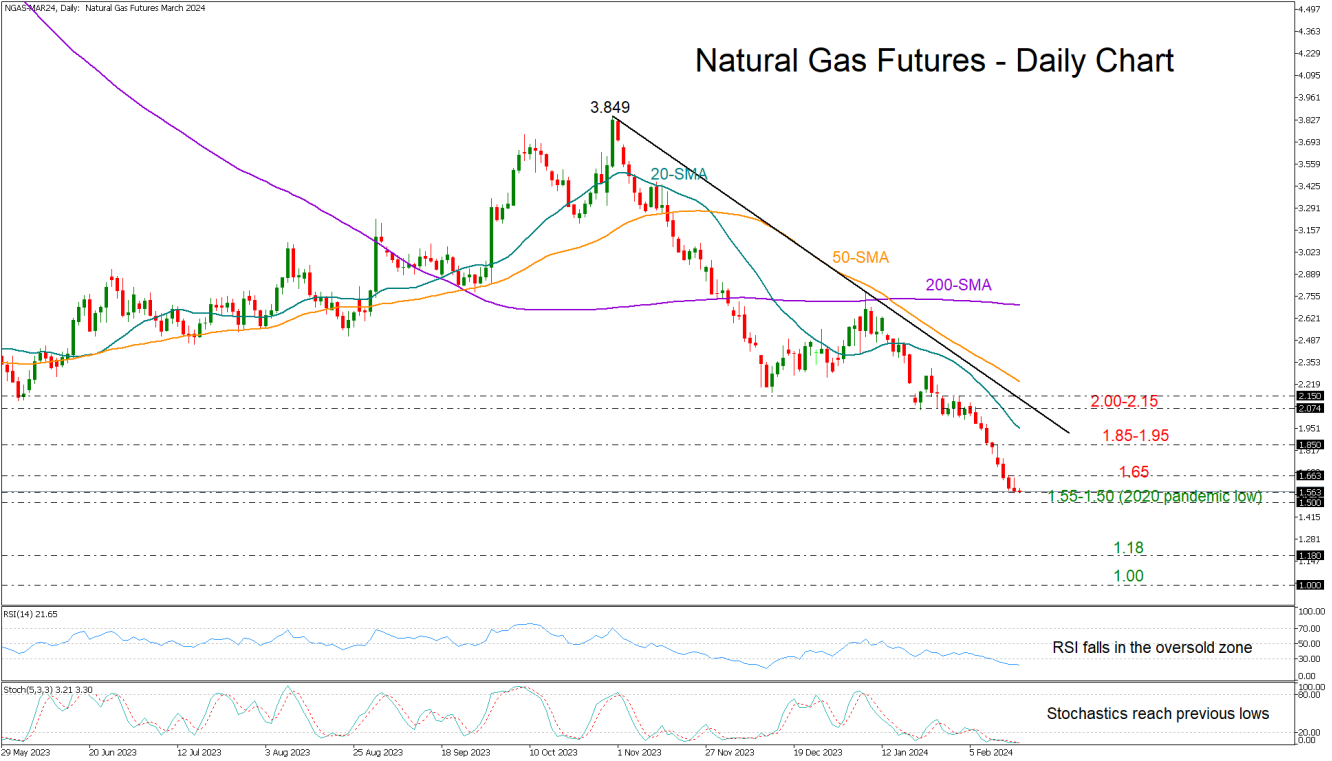

Natural gas futures (March delivery) experienced another painful week, plummeting towards the pandemic floor of 1.50, which halted the 2014-2016 downtrend too.

The RSI and the stochastics have detected oversold conditions, while Thursday’s candlestick, which seems to have the shape of an inverse hammer, is adding to the optimism that the price could soon change direction to the upside.

Yet, a clear extension below the 1.50 threshold could cancel this bullish scenario, activating a new bearish wave towards the 1.18 level, which coincides with the 261.8% Fibonacci extension of the December-January upleg. Failure to pivot there could bring the case of parity under the spotlight.

Should selling forces fade out, the price may reverse up to test the nearby resistance zone of 1.65. A break higher would validate the bullish hammer candlestick pattern, bolstering buying appetite towards the 1.85 territory. A steeper increase above the 20-day simple moving average (SMA) and the 2.00 round level might provide direct access to the tentative resistance trendline from November’s high at 2.07. However, buyers may not gain confidence unless the recovery continues sustainably above the 2023 constraining region, around 2.16.

In short, natural gas futures have been sold aggressively, reaching attractive levels for a bullish reversal. For that to happen, though, the price will have to set a strong foothold within the 1.50 area.