Stock market today: S&P 500 climbs as ongoing AI-led rebound pushes tech higher

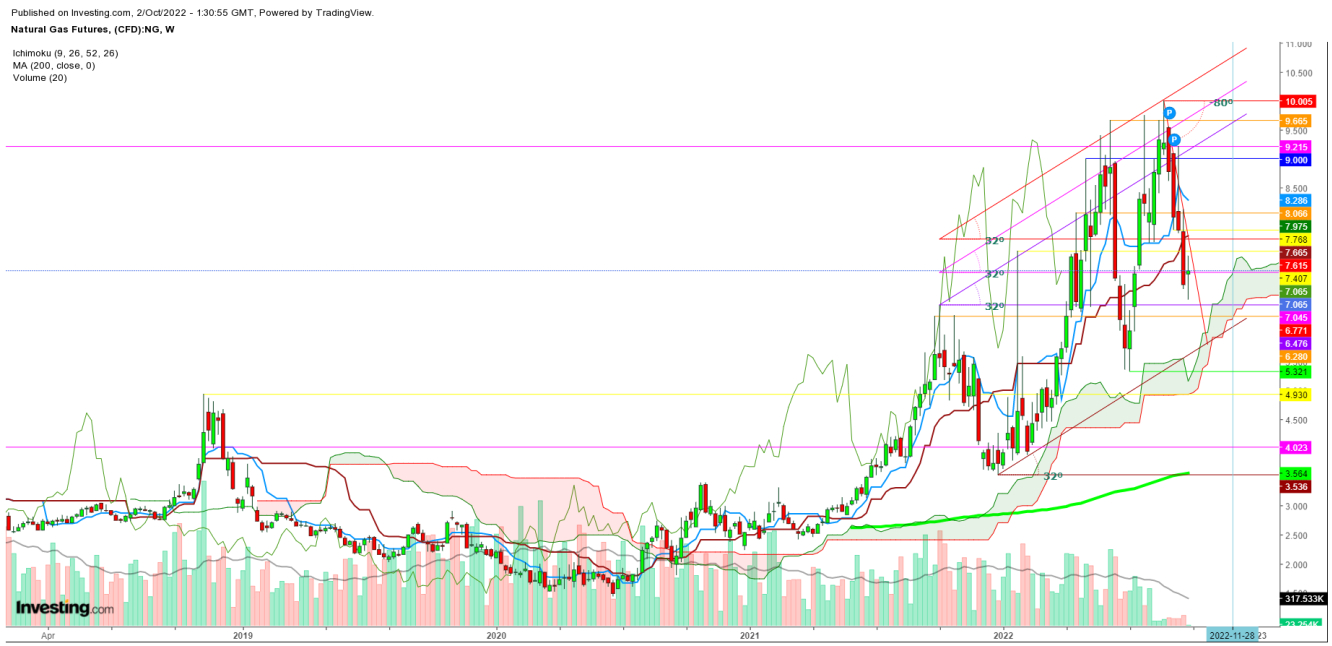

Analyzing the movements of natural gas since the formation of a seasonal peak on Aug. 23, 2022, a steep slide continues at an 80º angle, on course to hit the low at $6.566 on Sept. 28, 2022, as the major leaks that suddenly erupted in the Nord Stream gas pipelines have generated plenty of theories but few clear answers about who or what caused the damage.

This blame game could continue till the real culprit is found, as the ruptures on the Nord Stream natural gas pipeline system under the Baltic Sea are likely to be the biggest single release of climate-damaging methane ever recorded.

Fundamentally, this may lead to a trade tussle between the major countries facing inflationary pressure due to increased energy prices. During the last few months, they have started to find means and ways to negate the impact of oil and gas supply disruption caused by these leaks in the Nord Stream gas pipelines.

This may result in a steep fall in oil and gas prices to the same level as seen in the last week of August 2022. Natural gas could see wild price swings during the upcoming week as the bears are still in the driver’s seat amid cool weather conditions since hurricane Ida hit the Gulf of Mexico.

On the other hand, the oil and gas rig count, an early indicator of future output, rose to 765 in the week to Sept. 30, energy services firm Baker Hughes Co said in its closely followed report on Friday.

Baker Hughes said the total rig count is up 237, or 45% more than last year.

Technically speaking, in a weekly chart, natural gas is looking weak despite some recovery from the lower levels since last Wednesday, trading below 26 DMA.

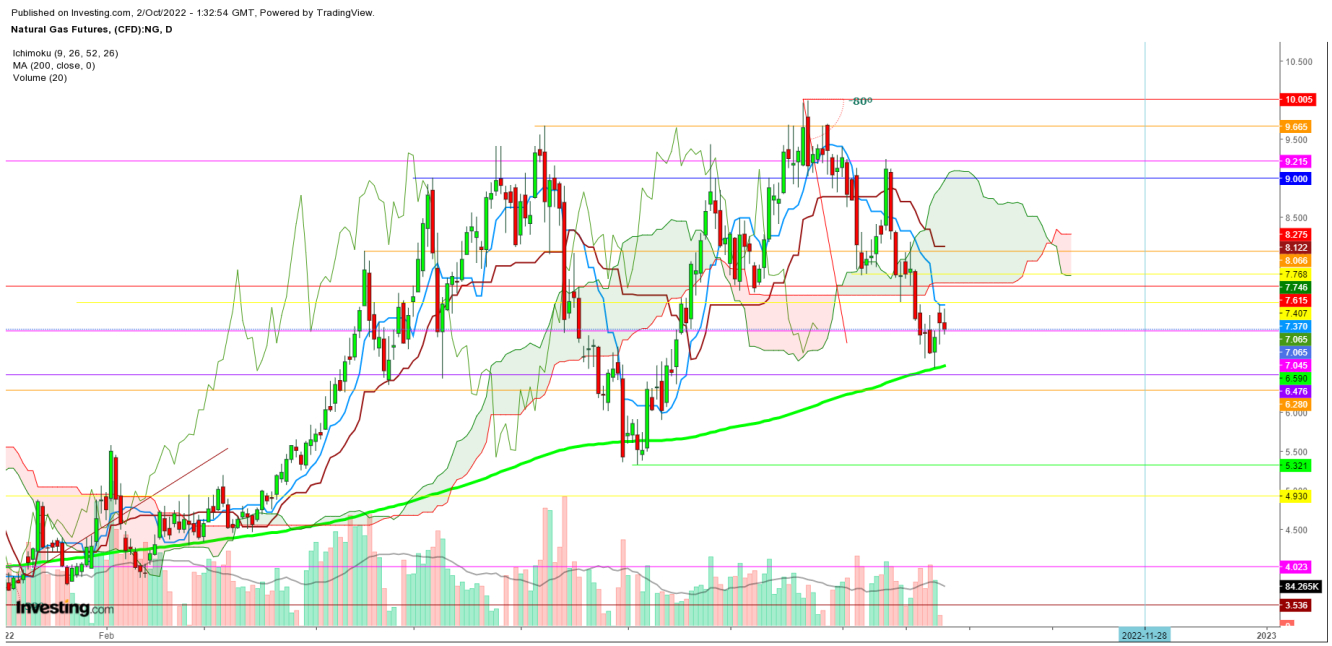

In a daily chart, natural gas faces stiff resistance at 9 DMA despite some recovery from Wednesday’s low at 200 DMA. Friday’s move has formed an exhaustive candle that could result in a gap-down opening on the first trading session of the upcoming week.

The WTI Crude Oil Futures could follow the same slide as the weakness persists due to uneven demand and supply until the current blame game continues concerning the Nord Stream leakage.

The WTI Crude Oil futures could also attract the bears on every upward move from the current levels.

Disclaimer: The author of this analysis does not have any position in Natural Gas and WTI Crude Oil futures. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.