The real estate market is currently navigating a period of instability, driven primarily by Treasury yields surging to their highest levels in over 15 years. With interest rates having risen at the fastest pace in modern history, both individuals and businesses seeking credit have been impacted.

As access to credit becomes increasingly challenging, this change has profound effects on the dynamics of the real estate market, given that securing loans or mortgages is crucial for most prospective property buyers.

It is not surprising, therefore, to see a cooling of the American real estate market as buyers pull back due to pressure from higher mortgage rates. The current average interest rate for the benchmark 30-year fixed mortgage is above 7.8% as of 6 October 2023— the highest level in 23 years. Mortgage applications are falling accordingly and with reduced demand, a growing number of home listings show price cuts.

This scenario creates a feedback loop where reduced buyer activity leads to falling prices, which may discourage potential sellers from entering the market, contributing to increased volatility within the sector.

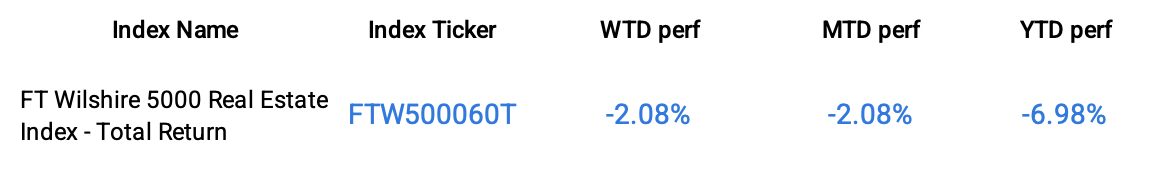

The iShares Mortgage Real Estate Capped ETF declined by -5.79% over the week and recorded outflows amounting to $1 million, while the FT Wilshire 5000 Real Estate Index lost -2.08%

Group Data: Real Estate

Index Data

Funds Specific Data: IYR, DFAR, REM, MORT

This content was originally published by our partners at ETF Central.