With Q1 results from only 34 S&P 500 members still awaited at this stage, the earnings season is effectively now behind us. The Retail sector is the only one that has a significant number of reports still awaited; 16 of the remaining 34 companies are retailers. But even for the Retail sector, we have seen Q1 results from 74.8% of the sector’s total market capitalization already, with not that much room for major surprises.

We will get Q1 results from 117 companies this week, including 23 S&P 500 members. This week’s line-up of retailers include Home Depot (HD)), Lowe’s (LOW), Best Buy (BBY), Target (TGT)) and others. Beyond, we have a few bellwether operators from other sectors coming out with results this week as well, like Hewlett-Packard (HPQ) and Salesforce.com (CRM).

Target has had its share of operational issues lately, so its report wouldn’t likely tell us much beyond what we saw already from Wal-Mart’s (WMT) underwhelming report. The home-improvement retailers will be interesting; not so much their actual Q1 reports, but their commentary about the state of the housing sector. There is growing concern that the housing market has lost some of its recent momentum and that the sector’s Q1 weakness may have been more than just weather related.

Strong results from a couple of retailers notwithstanding, it has been a tough environment for the sector. Total earnings for the 27 retailers in the S&P 500 that have reported results already (out of a total of 43) are up +0.9% on +3.6% higher revenues, with a very low 40.7% of them beating earnings estimates and a respectable 44.4% coming ahead of top-line expectations. Combining the Retail sector earnings for the 27 companies that have come out with the 16 still to come, the sector’s total earnings in Q1 should be flat (0.0%) on +3.9% higher revenues and lower margins. Same-store sales improved markedly in April, with pent up demand following Q1’s harsh weather and the Easter shift benefiting the numbers.

The broad trends about the Q1 earnings are fairly well established by now and the coming reports are unlikely to change them in any material way. These trends pertain to anemic growth, fewer top-line surprises and continued negative guidance that is prompting estimates for the current period to come down.

Scorecard for 2014 Q1 (as of Friday, May 16th)

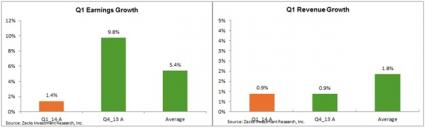

Total earnings for the 466 S&P 500 members that have reported results are up 1.4% from the same period last year, with a ‘beat ratio’ of 69.1% and a median surprise of +4.1%. Total revenues are up +0.9%, with a revenue ‘beat ratio’ of 52.1% and the median company beating top-line expectations by 0.2%.

The table below shows the current scorecard for all 16 Zacks sectors. As you can see, the earnings season has come to an end for 10 of the 16 Zacks sectors, with results from just 5% of the index’s total market capitalization still awaited.

The chart below shows how the earnings and revenue growth rates for Q1 thus far compare to what these same companies reported in 2013 Q4 and the 4-quarter average.

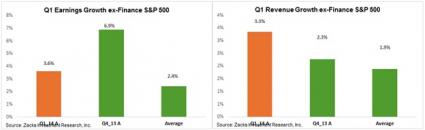

The Q1 earnings growth picture is no doubt weak, but we should keep two things in mind while evaluating this growth picture. Firstly, it’s not news to the market, as expectations had fallen sharply ahead of the start of the reporting season. As such, as shocking as the above picture seems to be, nobody is exactly shocked at seeing them. Secondly, the growth picture actually isn’t as bad as the above picture is making it out to be once the drag from the Finance sector (which itself is a function of weak results at Bank of America) is excluded from the aggregate results.

The comparison chart below of ex-Finance results clearly shows this.

This chart of ex-Finance growth is showing that the earnings and revenue growth rates in Q1 are roughly comparable to historical averages. Nothing exciting about that finding, but it is actually an improvement over what was expected just a couple of weeks back.

Looking at the composite Q1 picture, meaning combining the actual results from the 466 companies that have reported with estimates for the 34 still-to-come reports, total earnings are expected to be up 1.4% on +1.1% higher revenues. The table below presents the (composite) summary picture for Q1, showing the year-over-year change in total earnings, revenues and margins for all 16 Zacks sectors.

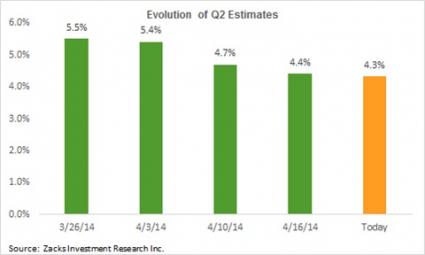

As we are seeing in the Q1 results already, the low expectations are making it easy for companies to come out ahead of them. Roughly two-thirds of the S&P 500 members beat earnings expectations every quarter any way and we are right around that level in Q1 as well. What we haven’t seen for a while is positive guidance and favorable comments from management teams about business outlook. And Q1 is largely along those same lines, causing estimates for the current period to come down, as the chart below of evolving Q2 estimates shows.

With retailers a bigger part of the reporting docket in the coming days, the negative revisions trend will most likely only accelerate in the reminder of this reporting season.

The downtrend in Q2 estimates is consistent with the trend that has been in place for almost two years now. Stocks made impressive gains over the last two years even though estimates were coming down during that time period, with the Fed QE keeping alive hopes of an eventual growth recovery. It will be interesting to see if investors will respond any differently to the coming period of negative revisions.

For a detailed look at the earnings picture, please check out our weekly Earnings Tends report.

Monday-5/19

- Not much on the economic calendar today, with Campbell Soup (CPB) as the key earnings report in the morning and Urban Outfitter (URBN) reporting after the close.

Tuesday -5/20

- Nothing on the economic calendar, but Home Depot (HD), Staples (SPLS) and TJX Companies (TJX) will report Q1 results in the morning while Salesforce.com (CRM) will report after the close.

Wednesday-5/21

- Minutes of the last FOMC meeting will be in the spotlight, with many looking for clues to the Fed’s exit plans.

- Target (NYSE:TGT), Lowe’s (NYSE:LOW) and Tiffany (NYSE:TIF) will be the notable reports in the morning, while William-Sonoma (NYSE:WSM) and L Brands Inc (NYSE:LTD), the operator of Victoria’s Secret chain, will report after the close.

- Zacks Earnings ESP or Expected Surprise Prediction, our proprietary leading indicator of positive earnings surprises, is showing Tiffany coming out with a positive earnings surprise.

- Our research shows that companies with Zacks Rank of 1, 2 or 3 and positive Earnings ESP are highly likely of beating EPS estimates. Tiffany currently has Zacks Rank #3 (Hold) and Earnings ESP of +1.3%.

Thursday -5/22

- April Existing Home sales will be the key economic report coming out in the morning in addition to weekly Jobless Claims. The expectation is that Existing Home sales will increase to 4.7 million from March’s 4.59 million annualized pace.

- Best Buy (NYSE:BBY), Dollar Tree (NASDAQ:DLTR) and Sears Holding (NASDAQ:SHLD)) will report in the morning, while Hewlett-Packard (NYSE:HPQ)), GameStop (NYSE:GME), and Gap (NYSE:GPS) will report after the close.

- Zacks Earnings ESP is showing Gap coming out with positive earnings surprise. Gap has Zacks Rank #3 (Hold) and Earnings ESP of +1.8%.

Friday-5/23

- Will get the April New Home Sales numbers, with expectations of 430K tally, up from March’s 384K level.

- Foot Locker (NYSE:FL) and Hibbett Sports (NASDAQ:HIBB)) are the only notable reports today.

Here is a list of the 117 companies reporting this week, including 23 S&P 500 members and 22 S&P 600 members.

| Company | Ticker | Current Qtr | Year-Ago Qtr | Last EPS Surprise % | Report Day | Time |

| CAMPBELL SOUP | CPB | 0.59 | 0.62 | 4.11 | Monday | BTO |

| URBAN OUTFITTER | URBN | 0.27 | 0.32 | 7.27 | Monday | AMC |

| ANGLOGOLD LTD | AU | 0.18 | 0.33 | 22.22 | Monday | N/A |

| COMPUGEN LTD | CGEN | -0.11 | -0.09 | N/A | Monday | BTO |

| CUI GLOBAL INC | CUI | -0.03 | -0.04 | -1000 | Monday | AMC |

| PARAGON SHIPPNG | PRGN | -0.12 | -0.31 | -71.43 | Monday | AMC |

| PERFECT WORLD | PWRD | 0.49 | 0.43 | -11.36 | Monday | AMC |

| RRSAT GLBL COMM | RRST | 0.13 | 0.1 | 8.33 | Monday | BTO |

| TARENA INTL-ADR | TEDU | 0.01 | N/A | N/A | Monday | AMC |

| VALSPAR CORP | VAL | 1.04 | 0.91 | 4.48 | Monday | BTO |

| ANALOG DEVICES | ADI | 0.56 | 0.5 | 2.08 | Tuesday | AMC |

| SALESFORCE.COM | CRM | -0.03 | -0.07 | -37.5 | Tuesday | AMC |

| HOME DEPOT | HD | 0.99 | 0.83 | 4.29 | Tuesday | BTO |

| INTUIT INC | INTU | 3.4 | 2.87 | -600 | Tuesday | AMC |

| MEDTRONIC | MDT | 1.12 | 1.1 | 0 | Tuesday | BTO |

| STAPLES INC | SPLS | 0.21 | 0.27 | -15.38 | Tuesday | BTO |

| TJX COS INC NEW | TJX | 0.67 | 0.62 | -2.41 | Tuesday | BTO |

| APOLLO INV CP | AINV | 0.21 | 0.19 | -4.76 | Tuesday | BTO |

| BIOLINE RX LTD | BLRX | N/A | -0.2 | -11.11 | Tuesday | BTO |

| CATO CORP A | CATO | 1.04 | 1.05 | 0 | Tuesday | BTO |

| DONALDSON CO | DCI | 0.47 | 0.46 | 8.33 | Tuesday | BTO |

| DICKS SPRTG GDS | DKS | 0.53 | 0.48 | 0.91 | Tuesday | BTO |

| CHINA DISTANCE | DL | 0.02 | 0.02 | 42.86 | Tuesday | AMC |

| DYCOM INDS | DY | 0.22 | 0.17 | 0 | Tuesday | AMC |

| E-HOUSE CHINA | EJ | -0.03 | -0.02 | 53.33 | Tuesday | BTO |

| EUROSEAS LTD | ESEA | -0.09 | -0.1 | -88.89 | Tuesday | AMC |

| HEICO CORP | HEI | 0.41 | 0.35 | 5.71 | Tuesday | AMC |

| HHGREGG INC | HGG | -0.17 | 0.31 | -41.38 | Tuesday | BTO |

| LA QUINTA HLDGS | LQ | 0 | N/A | N/A | Tuesday | AMC |

| MARKS&SPENCER | MAKSY | N/A | N/A | N/A | Tuesday | N/A |

| PROSENA HLDG BV | RNA | 0.01 | -0.16 | 14.29 | Tuesday | BTO |

| RED ROBIN GOURM | RRGB | 0.73 | 0.66 | 5.08 | Tuesday | BTO |

| SOC QUIMICA MIN | SQM | 0.35 | 0.58 | -21.21 | Tuesday | AMC |

| STAGE STORES | SSI | -0.4 | -0.02 | 1 | Tuesday | BTO |

| CHINA DIG TV | STV | N/A | 0.13 | N/A | Tuesday | AMC |

| TAOMEE HOLDINGS | TAOM | 0.04 | 0.03 | 350 | Tuesday | BTO |

| TIDEWATER INC | TDW | 0.61 | 0.95 | 0 | Tuesday | AMC |

| VODAFONE GP PLC | VOD | N/A | N/A | N/A | Tuesday | N/A |

| VIASAT INC | VSAT | 0.01 | 0.08 | -33.33 | Tuesday | AMC |

| HORMEL FOODS CP | HRL | 0.56 | 0.49 | 0 | Wednesday | BTO |

| L BRANDS INC | LB | 0.51 | 0.48 | 2.48 | Wednesday | AMC |

| LOWES COS | LOW | 0.61 | 0.49 | 0 | Wednesday | BTO |

| NETAPP INC | NTAP | 0.62 | 0.55 | 3.57 | Wednesday | AMC |

| PETSMART INC | PETM | 1.02 | 0.98 | 5.79 | Wednesday | BTO |

| TARGET CORP | TGT | 0.7 | 1.05 | 54.76 | Wednesday | BTO |

| TIFFANY & CO | TIF | 0.77 | 0.7 | -3.29 | Wednesday | BTO |

| AMER EAGLE OUTF | AEO | 0 | 0.18 | 3.85 | Wednesday | BTO |

| AEGEAN MARINE | ANW | 0.17 | 0.13 | 0 | Wednesday | AMC |

| BOOZ ALLEN HMLT | BAH | 0.32 | 0.39 | -5.71 | Wednesday | BTO |

| BRISTOW GROUP | BRS | 1.26 | 1.01 | -27.35 | Wednesday | AMC |

| CONCORD MED-ADR | CCM | 0.05 | 0.07 | N/A | Wednesday | AMC |

| CNINSURE IN-ADR | CISG | 0.09 | 0.07 | -20 | Wednesday | AMC |

| CITI TRENDS INC | CTRN | 0.5 | 0.42 | 10 | Wednesday | BTO |

| 8X8 INC | EGHT | 0 | 0.04 | -133.33 | Wednesday | AMC |

| EATON VANCE | EV | 0.55 | 0.52 | -3.33 | Wednesday | BTO |

| GIANT INTERACTV | GA | 0.25 | 0.21 | 21.74 | Wednesday | AMC |

| LIGHTINTHEBOX-A | LITB | -0.11 | N/A | 125 | Wednesday | BTO |

| MAKEMYTRIP LTD | MMYT | -0.1 | -0.25 | 77.78 | Wednesday | BTO |

| NAVIOS MARI HLD | NM | -0.13 | -0.1 | -157.14 | Wednesday | BTO |

| QIWI PLC-ADR | QIWI | N/A | 0.24 | 0 | Wednesday | BTO |

| RAVEN INDS INC | RAVN | 0.34 | 0.38 | -28.13 | Wednesday | BTO |

| RENREN INC-ADR | RENN | -0.04 | -0.01 | 440 | Wednesday | AMC |

| REXNORD CORP | RXN | N/A | 0.31 | 0 | Wednesday | AMC |

| SINA CORP | SINA | -0.09 | -0.06 | 11.76 | Wednesday | AMC |

| SEMTECH CORP | SMTC | 0.2 | 0.36 | -5 | Wednesday | AMC |

| SYNOPSYS INC | SNPS | 0.4 | 0.59 | 61.29 | Wednesday | AMC |

| SPARTAN STORES | SPTN | 0.44 | 0.48 | 24 | Wednesday | AMC |

| SINOVAC BIOTECH | SVA | -0.04 | -0.04 | N/A | Wednesday | AMC |

| TRINA SOLAR LTD | TSL | -0.01 | -0.92 | 225 | Wednesday | BTO |

| VALUEVISION MDA | VVTV | 0.04 | 0.02 | -200 | Wednesday | AMC |

| WILLIAMS-SONOMA | WSM | 0.44 | 0.4 | 2.22 | Wednesday | AMC |

| BEST BUY | BBY | 0.2 | 0.32 | 22.77 | Thursday | BTO |

| DOLLAR TREE INC | DLTR | 0.67 | 0.59 | -2.86 | Thursday | BTO |

| GAMESTOP CORP | GME | 0.57 | 0.46 | -1.04 | Thursday | AMC |

| GAP INC | GPS | 0.56 | 0.71 | 3.03 | Thursday | AMC |

| HEWLETT PACKARD | HPQ | 0.88 | 0.87 | 5.88 | Thursday | AMC |

| PATTERSON COS | PDCO | 0.66 | 0.62 | 0 | Thursday | BTO |

| ROSS STORES | ROST | 1.16 | 1.07 | 0 | Thursday | AMC |

| AEROPOSTALE INC | ARO | -0.72 | -0.16 | -16.67 | Thursday | AMC |

| ARUBA NETWORKS | ARUN | 0.02 | -0.09 | -900 | Thursday | AMC |

| AMER SCI & ENG | ASEI | 0.66 | 0.57 | -68.75 | Thursday | BTO |

| BUCKLE INC | BKE | 0.78 | 0.78 | 1.65 | Thursday | BTO |

| BON-TON STORES | BONT | -1.55 | -1.4 | 13.01 | Thursday | BTO |

| BRADY CORP CL A | BRC | 0.38 | 0.55 | -32.43 | Thursday | BTO |

| BROCADE COMM SY | BRCD | 0.16 | 0.14 | 16.67 | Thursday | AMC |

| COLUMBUS MCKINN | CMCO | 0.52 | 0.37 | -6.06 | Thursday | BTO |

| COMPUWARE CORP | CPWR | 0.06 | 0.04 | 25 | Thursday | AMC |

| DRYSHIPS INC | DRYS | 0.02 | -0.1 | -200 | Thursday | AMC |

| ITT EDUCATIONAL | ESI | 0.71 | 1.33 | -145.37 | Thursday | BTO |

| JAMES HARDI-ADR | JHX | N/A | 0.35 | 4.17 | Thursday | N/A |

| KIRKLANDS INC | KIRK | 0.1 | 0.1 | 2.99 | Thursday | BTO |

| LTX-CREDENCE CP | LTXC | 0.03 | -0.08 | 31.58 | Thursday | BTO |

| MENTOR GRAPHICS | MENT | -0.01 | 0.06 | 8.43 | Thursday | AMC |

| MONRO MUFFLER | MNRO | 0.35 | 0.25 | 6.82 | Thursday | BTO |

| MOVADO GRP INC | MOV | 0.32 | 0.32 | 53.33 | Thursday | BTO |

| MARVELL TECH GP | MRVL | 0.15 | 0.13 | 22.22 | Thursday | AMC |

| NORDSON CORP | NDSN | 0.9 | 0.84 | -8.2 | Thursday | AMC |

| NEPTUNE TEC&BIO | NEPT | -0.08 | -0.01 | N/A | Thursday | BTO |

| OCEAN RIG UDW | ORIG | -0.02 | 0.05 | 114.29 | Thursday | AMC |

| PERRY ELLIS INT | PERY | 0.28 | 0.62 | 100 | Thursday | BTO |

| CHILDRENS PLACE | PLCE | 0.61 | 0.83 | 2.13 | Thursday | BTO |

| ROYAL BANK CDA | RY | 1.28 | 1.25 | 18.52 | Thursday | BTO |

| SABMILLER PLC | SBMRY | N/A | N/A | N/A | Thursday | N/A |

| SHOE CARNIVAL | SCVL | 0.47 | 0.47 | -25 | Thursday | AMC |

| SEARS HLDG CP | SHLD | N/A | -1.29 | 61.6 | Thursday | BTO |

| SILVERCORP METL | SVM | N/A | 0.04 | -100 | Thursday | AMC |

| TORONTO DOM BNK | TD | 0.92 | 0.93 | 0 | Thursday | BTO |

| FRESH MARKET | TFM | 0.42 | 0.46 | -7.14 | Thursday | AMC |

| TIVO INC | TIVO | 0.06 | -0.09 | 25 | Thursday | AMC |

| TORO CO | TTC | 1.45 | 1.32 | 15.79 | Thursday | BTO |

| 21VIANET GP-ADR | VNET | N/A | 0.05 | 0 | Thursday | AMC |

| 58.COM INC-ADR | WUBA | 0.04 | N/A | N/A | Thursday | BTO |

| YOUKU.COM- ADR | YOKU | -0.23 | -0.22 | 100 | Thursday | AMC |

| ZUMIEZ INC | ZUMZ | 0.04 | 0.13 | 6.56 | Thursday | AMC |

| AUTONAVI HL-ADR | AMAP | N/A | 0.12 | -66.67 | Friday | BTO |

| FOOT LOCKER INC | FL | 1.05 | 0.91 | 9.33 | Friday | BTO |

| HIBBET SPORTS | HIBB | 1.1 | 1 | -7.25 | Friday | BTO |