My recent obsession with precious metals has been getting some ribbing, but that’s OK. I think there’s no market more important to spelling out our financial future, and as I’ve said repeatedly, it’s the one asset whose ascent I applaud.

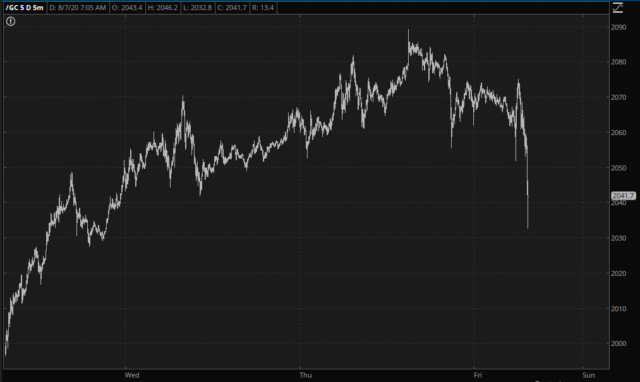

Paradoxically, I am quite pleased to see gold finally start to take a tumble.

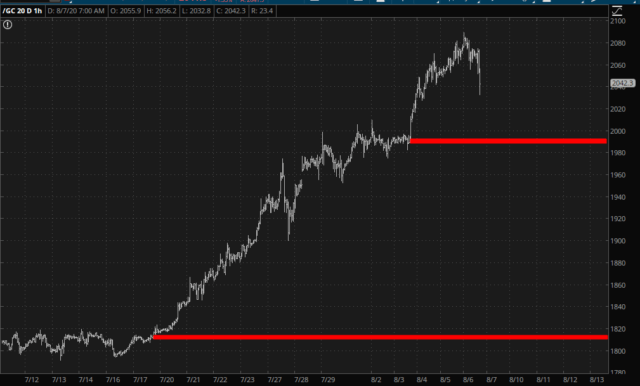

It got very close to $2,090 an ounce and then did an about-face. I would say the first level of meaningful support is around $1,980, and a much, much more solid level of support is way down around $1,800.

Perhaps my lifelong fixation on being different from the crowd made me uneasy supporting an asset that had been garnering so much attention. But honestly, in spite of my long-term target of $6,400/ounce, there needs to be shake-outs and breathers along the way.

The old “Tim’s visits to the bullion shop fade indicator” doesn’t work any more. I’ve actually been doing quite well with my buys and sells. I sold some of my gold recently since I just had too damned much of the stuff, and I would be absolutely delighted to march right back in there and gobble up a bunch closer to $1,800.

In the meanwhile, I am cheerfully short XME (NYSE:XME), which I think could be one of the best ETF shorts for the rest of the year.