Micron shares soar on very strong guidance amid AI-led memory demand

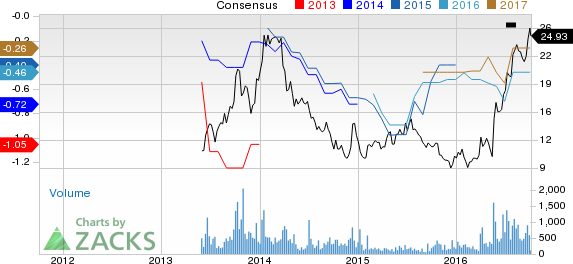

Share price of Mazor Robotics (NASDAQ:MZOR) , a developer of innovative guidance systems and complementary products, rallied to a new 52-week high of $26.48 on Oct 3, eventually closing a tad lower at $24.93.

This represents a stellar one-year return of approximately 115.1%, much better than the S&P 500’s 8.7% over the same period. In fact, since the last earnings release of second-quarter fiscal 2016, the company’s share price gained 10.3% till yesterday’s close.

Currently, Mazor Robotics carries a Zacks Rank #3 (Hold). Notably, the stock has a market cap of $614.54 million.

Catalysts

The ‘Mazor robotics renaissance guidance system’ (Renaissance System) is a key catalyst for the company. Recently, Mazor Robotics and The Center for Musculoskeletal Disorders (CMD) announced the first installation of this system in an ambulatory outpatient setting. In this regard, the Renaissance platform is a flagship product of Mazor Robotics that transforms spine surgery from freehand procedures to highly-accurate and state-of-the-art procedures. On a global basis, Mazor Robotics ended the second quarter of 2016 with installation of 122 systems, of which 74 have been placed in the U.S.

Network expansion has been another major growth driver for the company as it expanded operations in the Myrtle Beach area with Grand Strand Medical Center installing the Renaissance platform. Notably, this development marked the second installation of this high-end system in the state of South Carolina and the ninth HCA-affiliated facility to buy a Renaissance system.

Of the other developments in the recent past, Mazor Robotics announced the receipt of a massive $20 million equity investment from Medtronic (NYSE:MDT) , a leading medical device company. Notably, in May 2016, Medtronic made an initial investment of $11.9 million in Mazor Robotics and currently owns a 7.2% stake.

Estimate Revisions

Over the last three months, the Zacks Consensus Estimate for fiscal 2016 narrowed by 24 cents, forecasting a loss of 46 cents.

Stocks to Consider

Better-ranked stocks in the broader medical sector are GW Pharmaceuticals Plc. (NASDAQ:GWPH) , and Lantheus Holdings Inc. (NASDAQ:LNTH) . Notably, all two stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

GW Pharmaceuticals has a solid year-to-date return of 91%, way better than the S&P 500’s 5.7% over the same time frame. Notably, the company posted a positive earnings surprise in the last four quarters, the average being 41.6%.

Lantheus Holdings posted a stupendous year-to-date return of 143.4%. The company expects earnings growth rate of 12.5% over the next 3 to 5 years.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

MEDTRONIC (MDT): Free Stock Analysis Report

GW PHARMA-ADR (GWPH): Free Stock Analysis Report

MAZOR ROBOTICS (MZOR): Free Stock Analysis Report

LANTHEUS HLDGS (LNTH): Free Stock Analysis Report

Original post

Zacks Investment Research