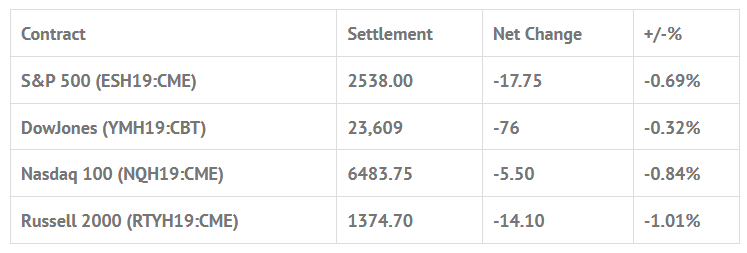

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

As of 8:00 AM EST

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, Current Account 8:30 AM ET, Existing Home Sales 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, FOMC Meeting Announcement 2:00 PM ET, FOMC Forecasts 2:00 PM ET, and Fed Chair Press Conference 2:30 PM ET.

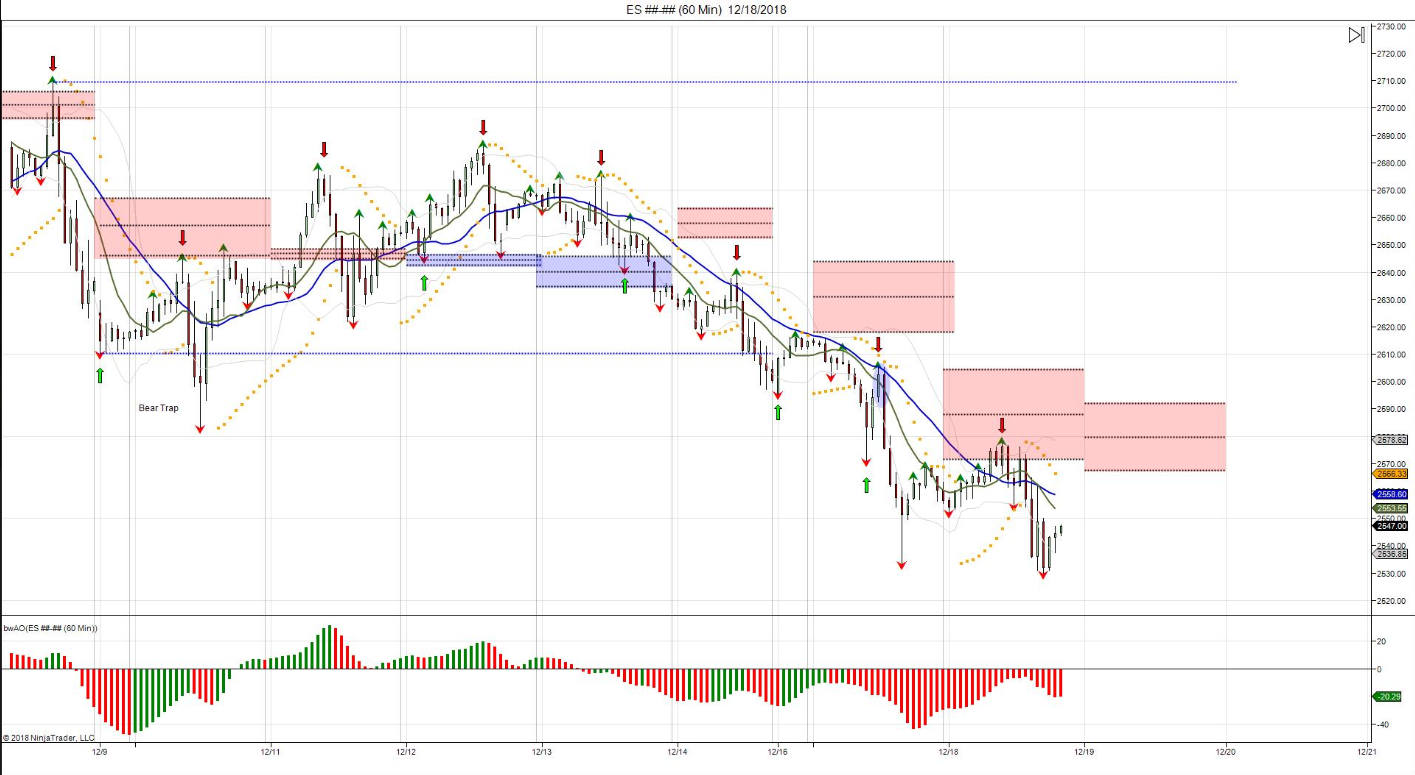

S&P 500 Futures: 2532.50 Retest

Chart courtesy of @Chicagostock – $ES_F Tuesday’s trade saw buyers fail to overcome 3D pivot resistance, keeping sellers in control. Wednesday’s range also above MKT to provide overhead resistance for sellers to defend, buyers to overcome. Bull need close >2580 to attempt reverse of negative trend.

After trading higher on the globex session, the S&P 500 futures opened Tuesday’s RTH at 2570.00, and in the first half hour traveled up to what would be the high of day at 2577.75. From there, the futures turned lower, selling off down to a 2554.75 morning low, before rallying back up to 2576.25 in the midday.

However, the afternoon saw another lower turn for the ES, as they once again set their sites on new lows, trading down to 2531.00 just after the turn into 2:00. The final hour saw a futures rally back up to 2562.50, a 31.50 handle move, but then again turned lower into the close, printing 2548.75 at 3:00, and settling the day at 2536.75, down -18.75 handles, or -0.75%.

In the end, the day was about more failed bull rallies, as they were unable to hold the morning gains. Bears, once again, made a series of lower highs and lower lows, and after the close Fedex reported lower guidance, which helped stocks continue to see pressure in the after hours.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.