Markets have been drowning in a sea of negatives in recent months. Between a torrent rise in yields, partially driven by a runaway US deficit, a multi-month rally in the US dollar, and now a sudden geopolitical escalation risk with the new Israel-Hamas war there is plenty to be concerned about.

All of these factors have now brought recession risk back to the front and center amid rising concerns that something could break. And it’s true something could always break. It’s not a comfortable period for investors that have seen outsized gains in tech this year, but precious little else as small caps, banks equal weight and other sectors remain solidly in the red for the year.

Clearly not a warm and fuzzy market environment to navigate through.

Yet amid all the negatives, there are also positives emerging and as market technicians we keep an eye on evolving market behavior, especially at times of market extremes, be it to the upside or the downside.

This week SPX and other indices made new lows versus the earlier October lows while yields made new highs resulting in a fair amount of fear.

One of the key signal tools market technicians look for are signs of divergences as they often signal a shift in coming market trends. In the case of market tops, they are referred to as negative divergences where price makes a new high but underlying signals do not. The polar opposite is true in case of new market lows coming on positive divergences which is what we want to focus on today.

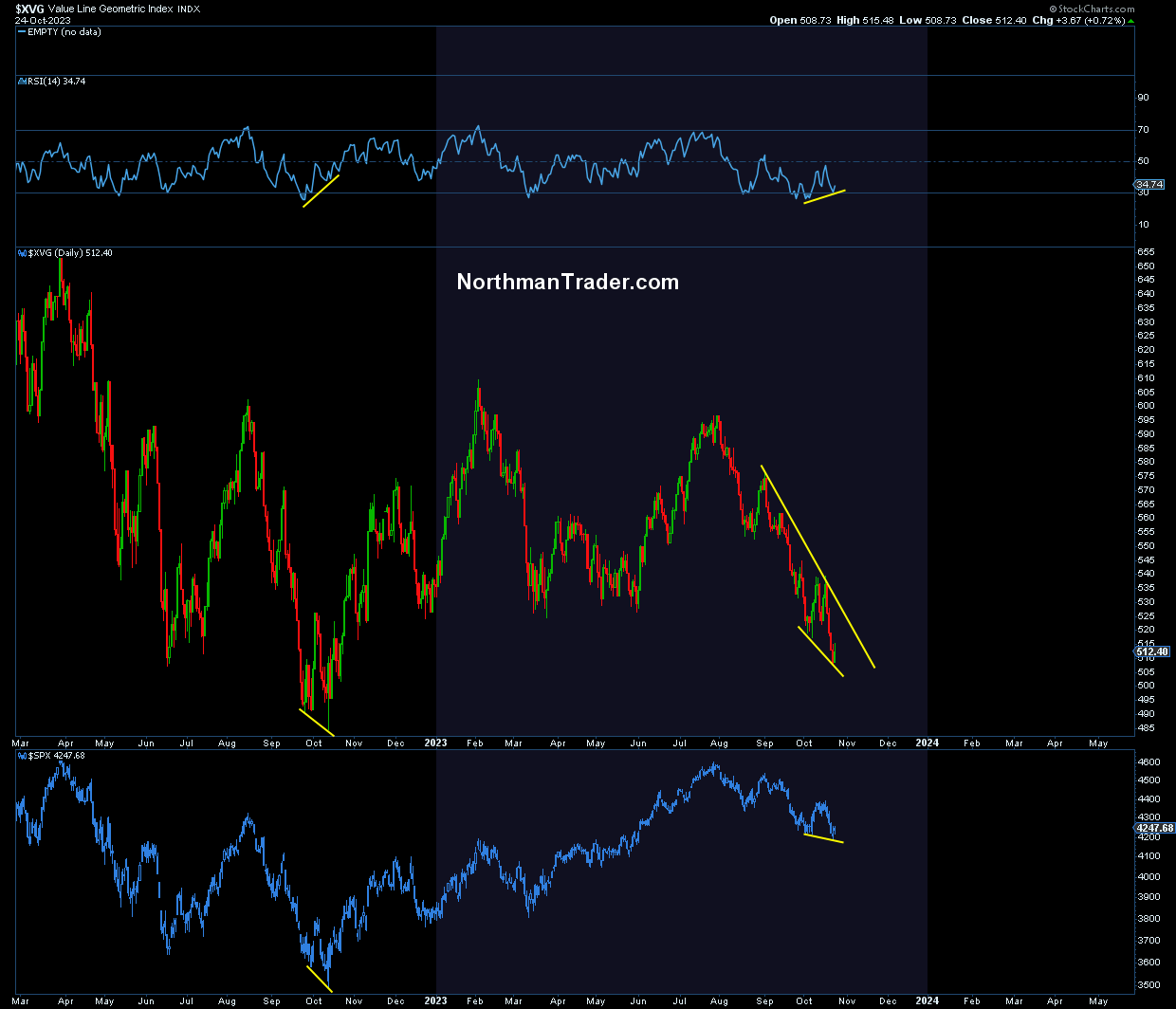

On recent new lows markets have shown a number of positive divergences even in the most vulnerable sectors.

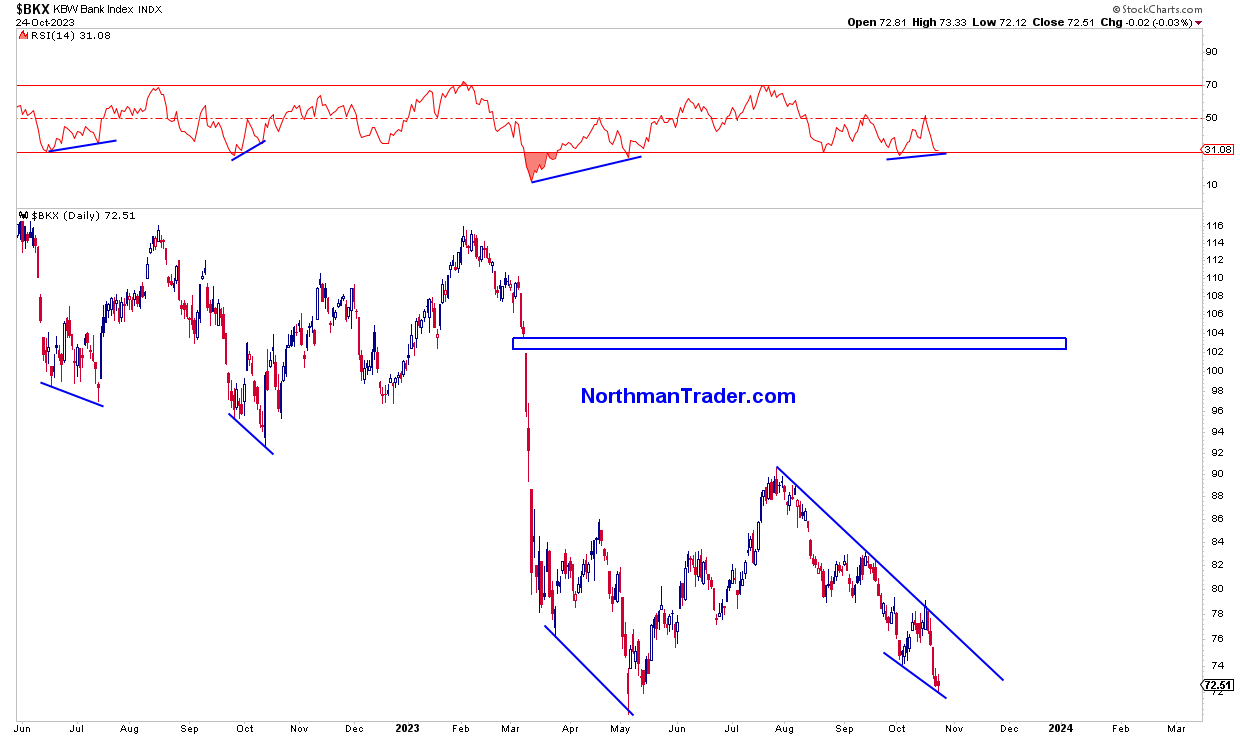

Let’s start with perhaps the most vulnerable sector: Banks

The new low on a positive RSI divergence, meaning a higher low similar to previous ones seen over the past year, all followed by a rally.

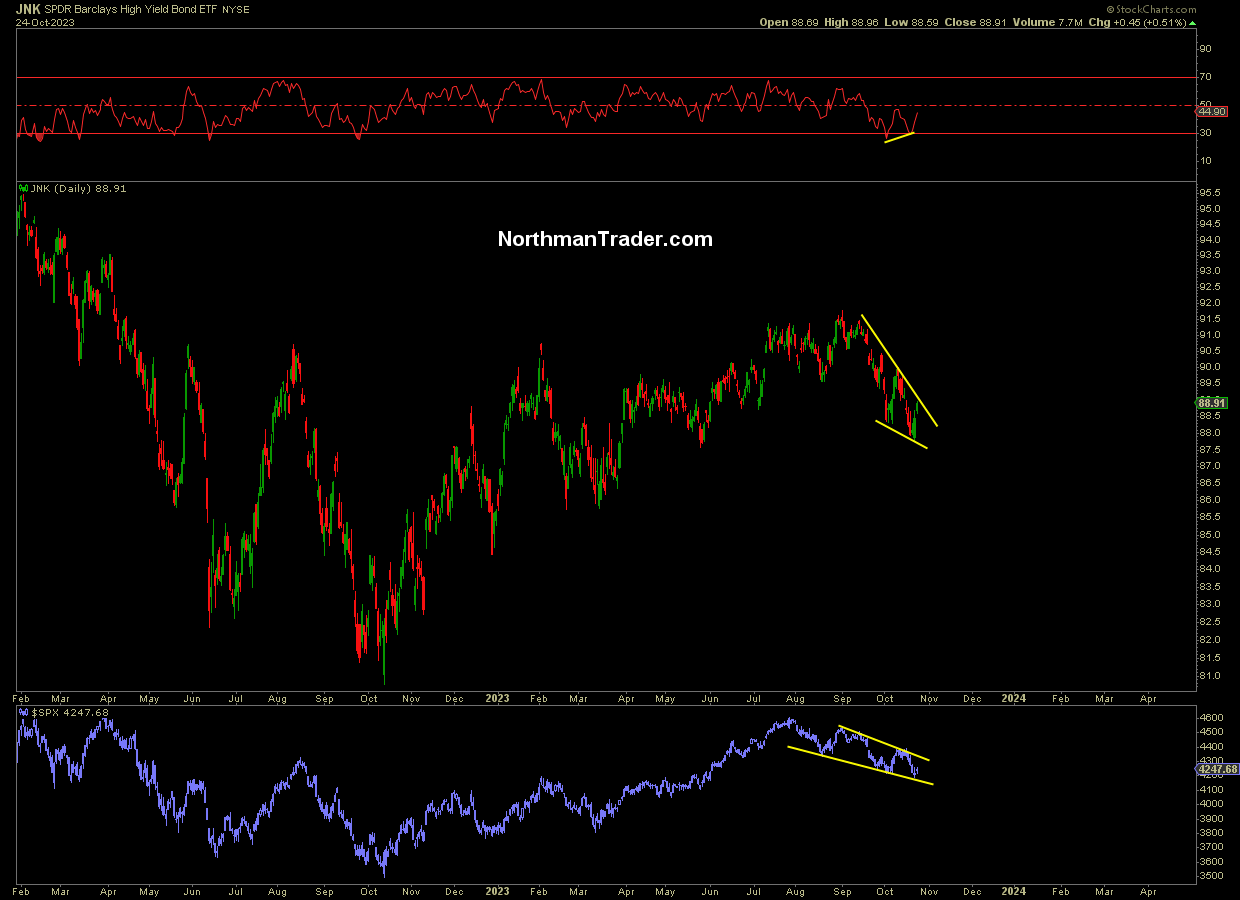

Another key risk factor for markets is high-yield credit. Even here we can note a pronounced positive divergence:

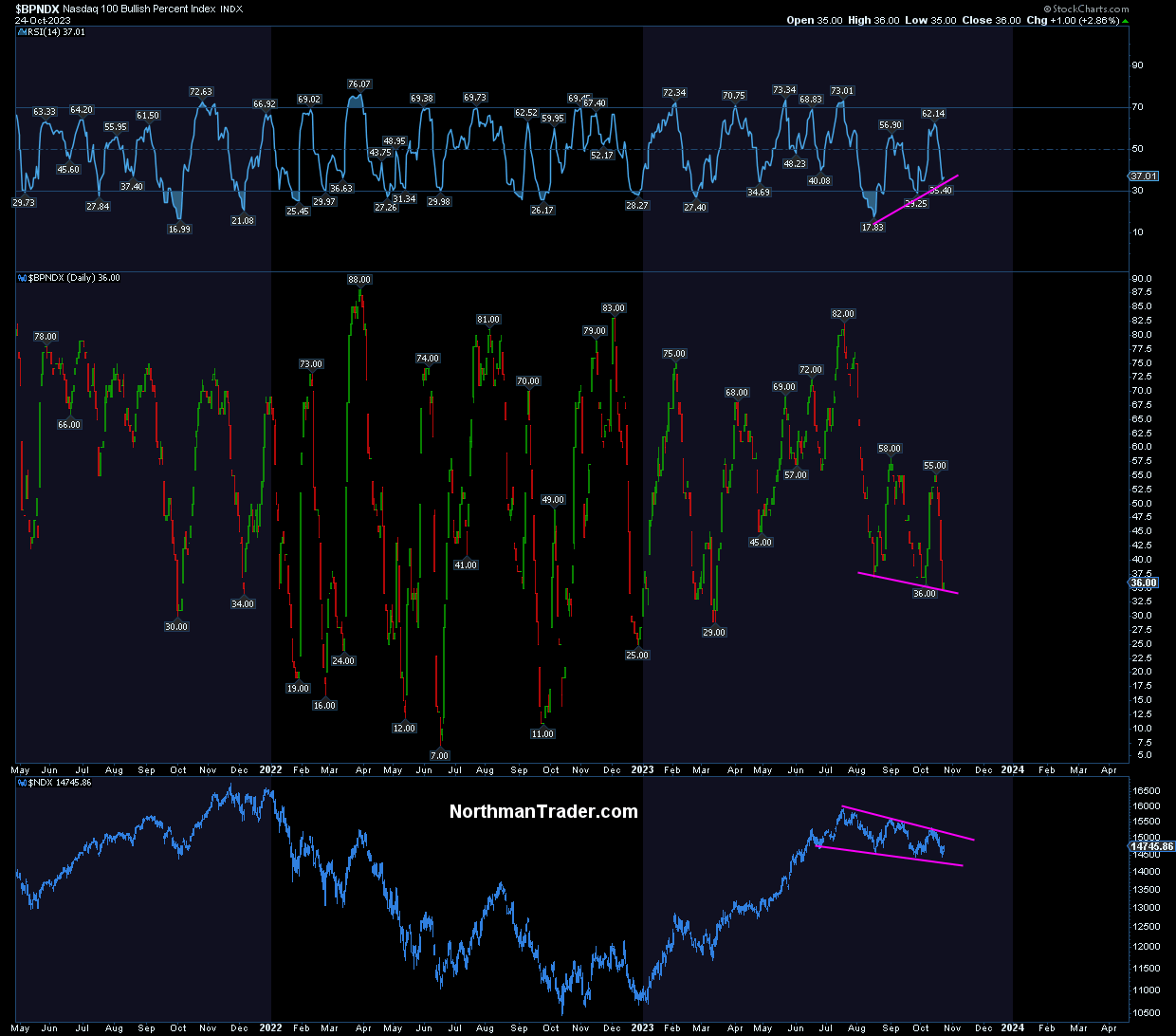

On tech, arguably the strongest sector this year, we can note a positive divergence on the bullish percentage indicator the $BPNDX:

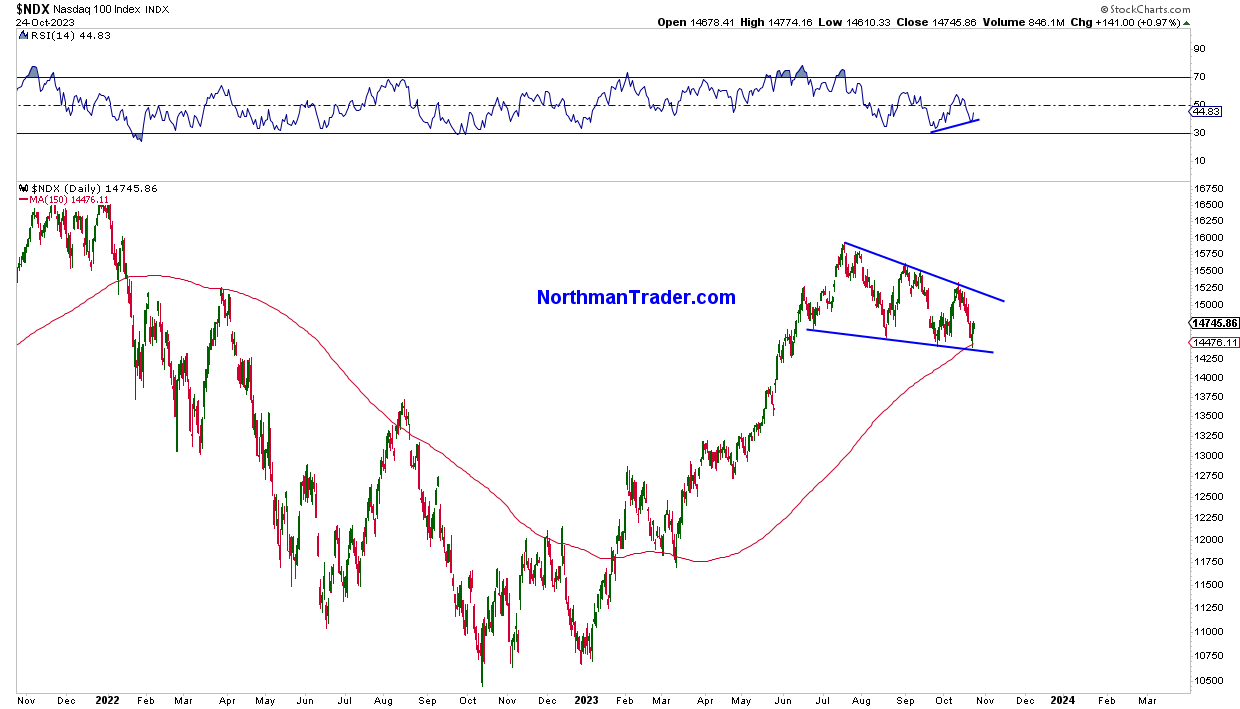

While NDX itself remains in a clean pattern that has not broken down, indeed has the potential for a bull flag on the broader index, also showing a positive divergence on its recent marginal new low while defending its 150MA:

What about the broader market? Equal weight has again shown a poor performance in 2023 following a disastrous 2022. But here too we can note a distinct positive divergence on new lows:

Similar to October last year.

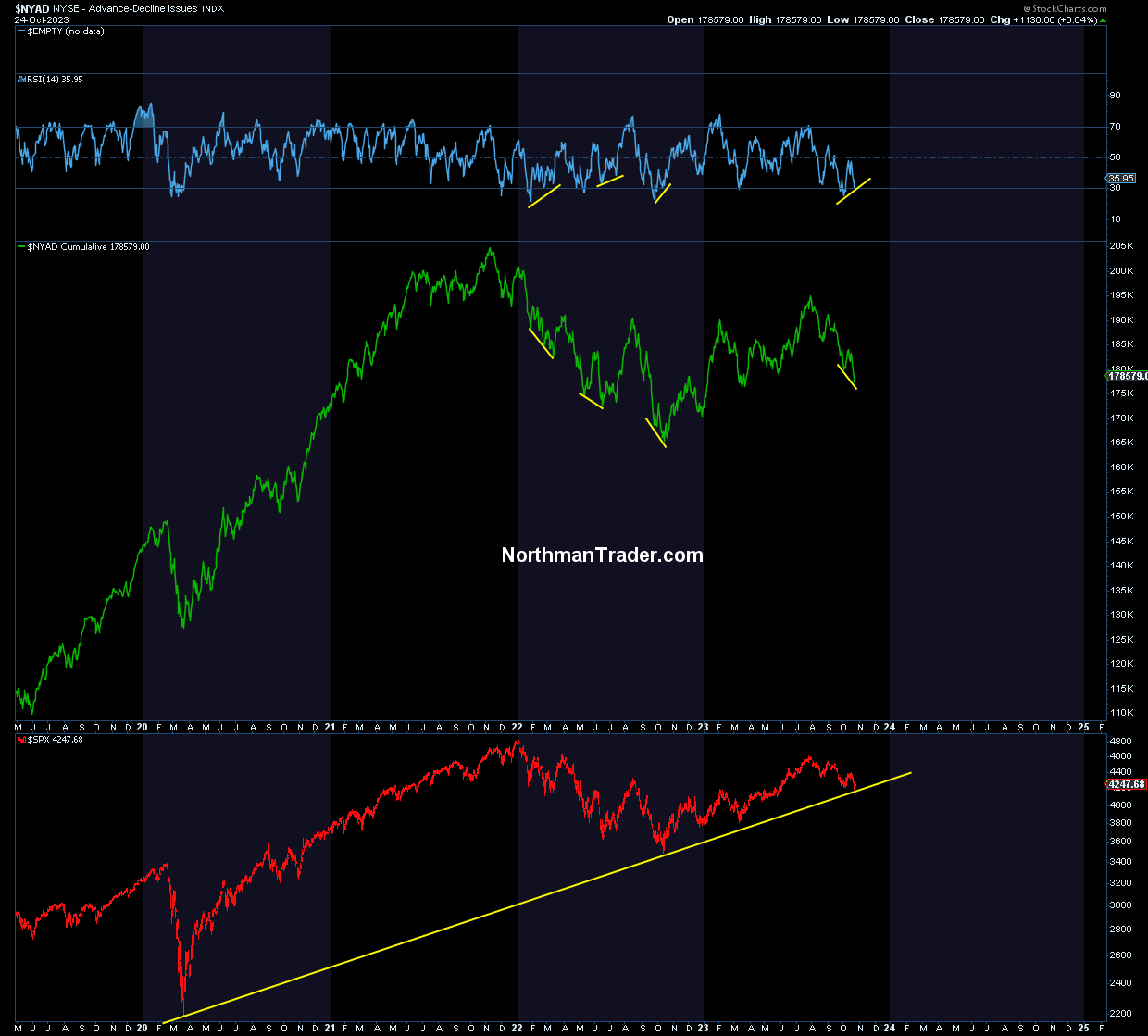

The same is true for the cumulative advanced/decline index:

While $SPX is so far defending its trend.

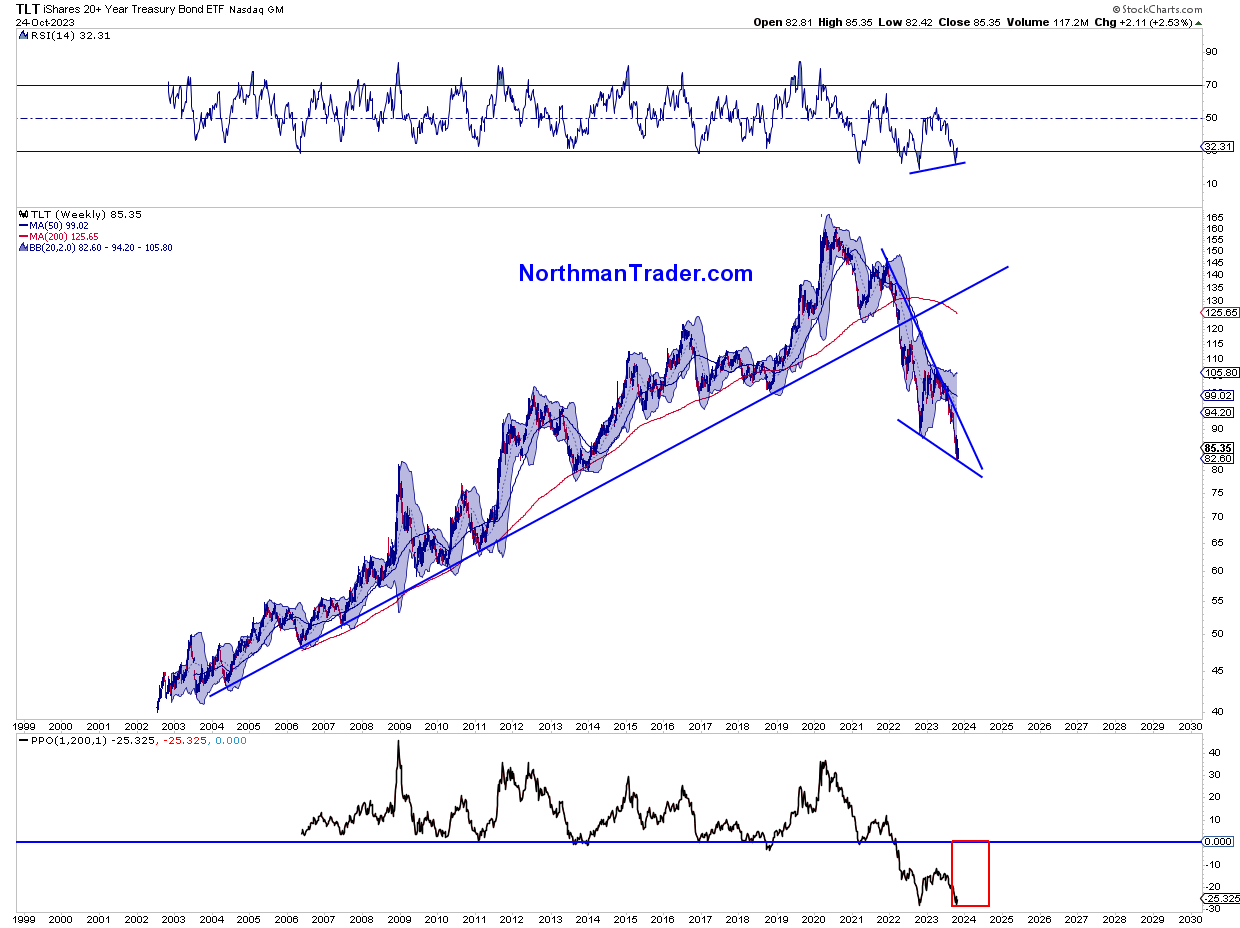

Of interest also a positive divergence also on yields as I pointed out last Friday:

The weekly long-term chart gives additional context:

Not only a positive divergence but also seeing price radically disconnected from its weekly 200MA, a historic technical imbalance only seen once last year when yields ended up reversing for a few months.

A word of caution: Divergences are reliable signals only once confirmed by sustained price action in the opposite direction, i.e. a confirmed reversal in trend. In this case, if price action deteriorates further then these positive divergences can disappear and will have represented a false signal.

But nevertheless, they are present in a multitude in markets at this time but require confirmation

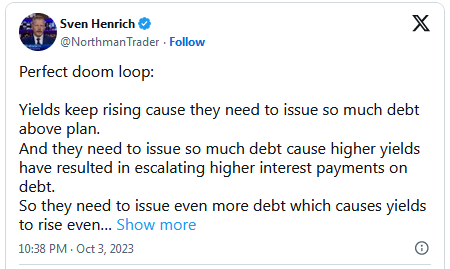

The future direction in yields is of particular importance. Our debt-laden economic construct is currently beholden to the doom loop I highlighted the other week:

And with it comes the risk of over-tighening:

A hard landing would follow with it. Some may even say the damage is already done and a hard landing is unavoidable. Perhaps.

But I say don’t underestimate the runway of relief that comes with a peak in yields. At least initially.

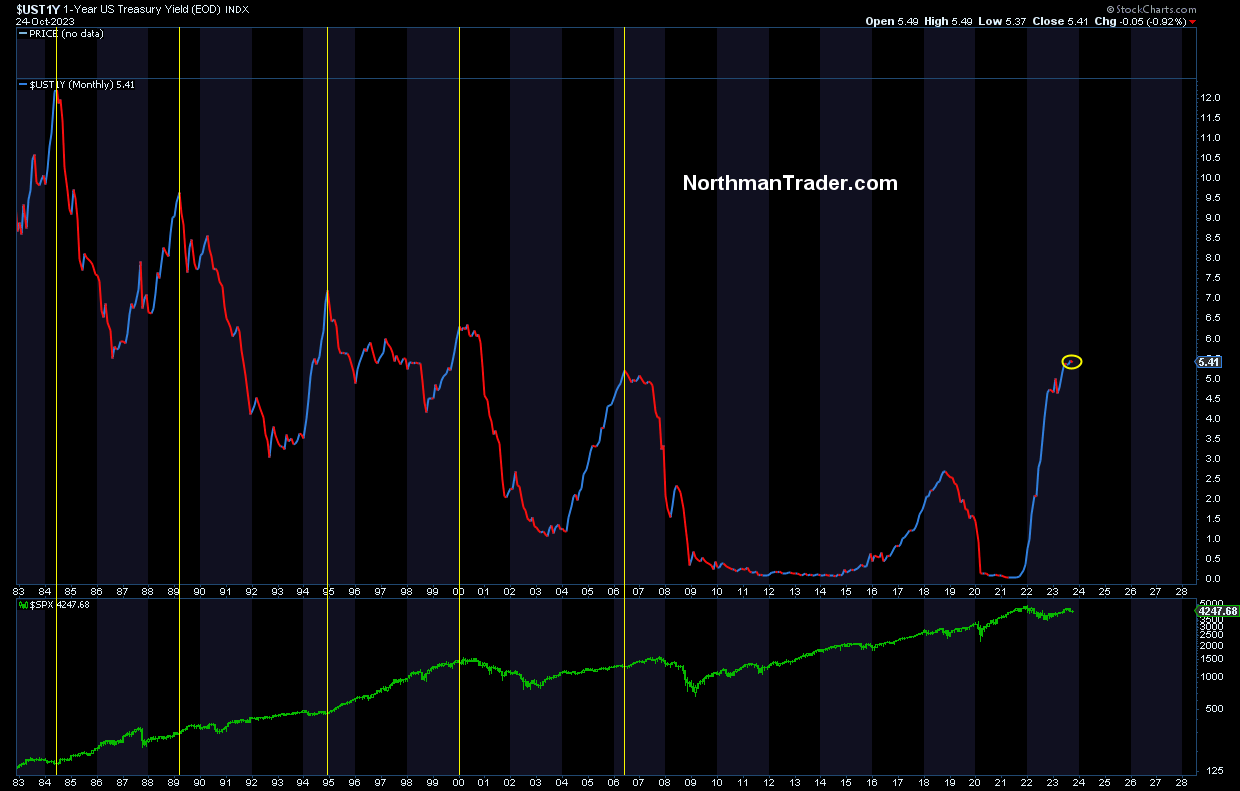

For reference here’s what happens historically to markets when the 1 year rolls over from its peak:

Markets tend to rally hard until then something actually does break. That runway could be months, it could be years.

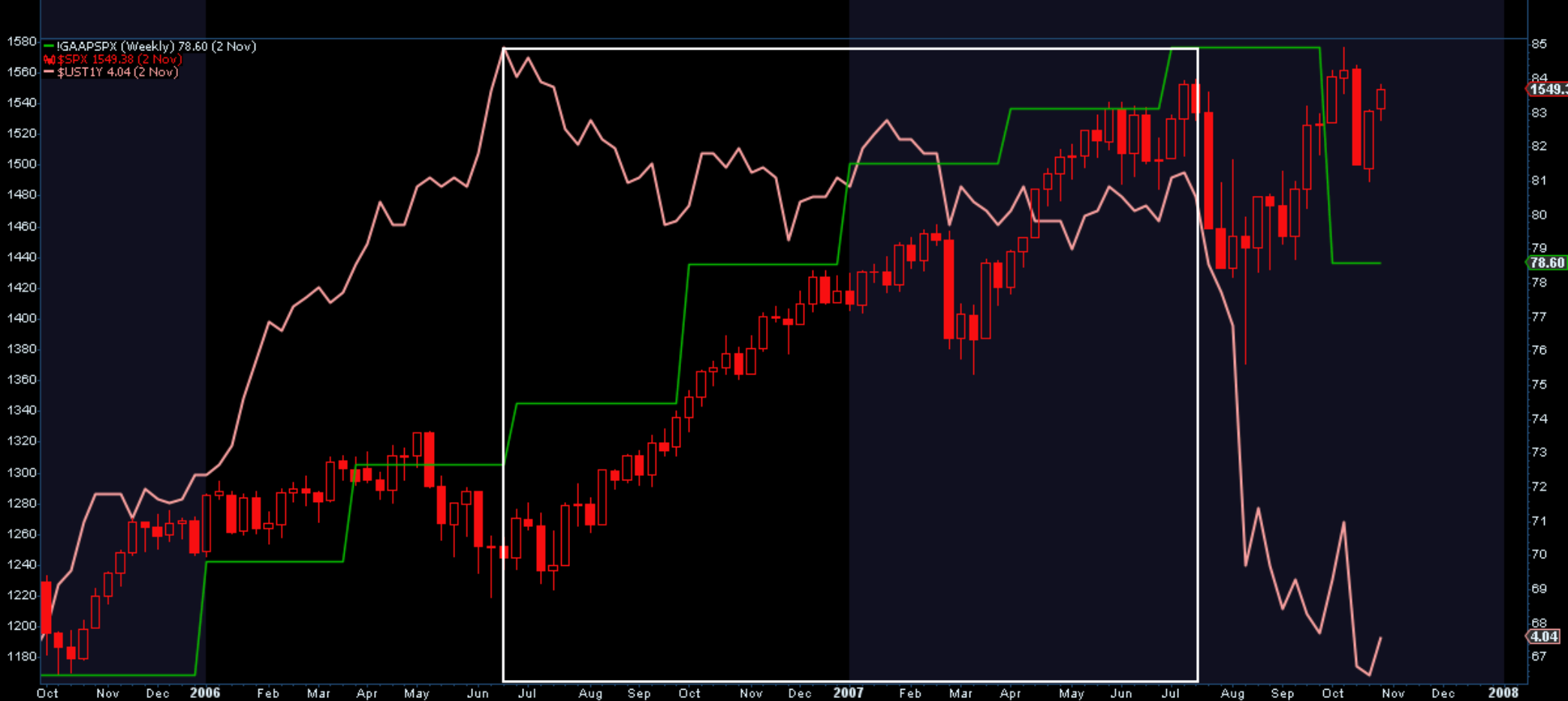

Why? Because a reversal in yields not only actually acts as a psychological relief boost it actually tends to translate into expanding earnings, something we also saw during the last rate hike cycle which ended in 2006:

The 1-year yield rolled over and GAAP earnings grew and markets exploded higher ending in new all-time highs first before anything broke.

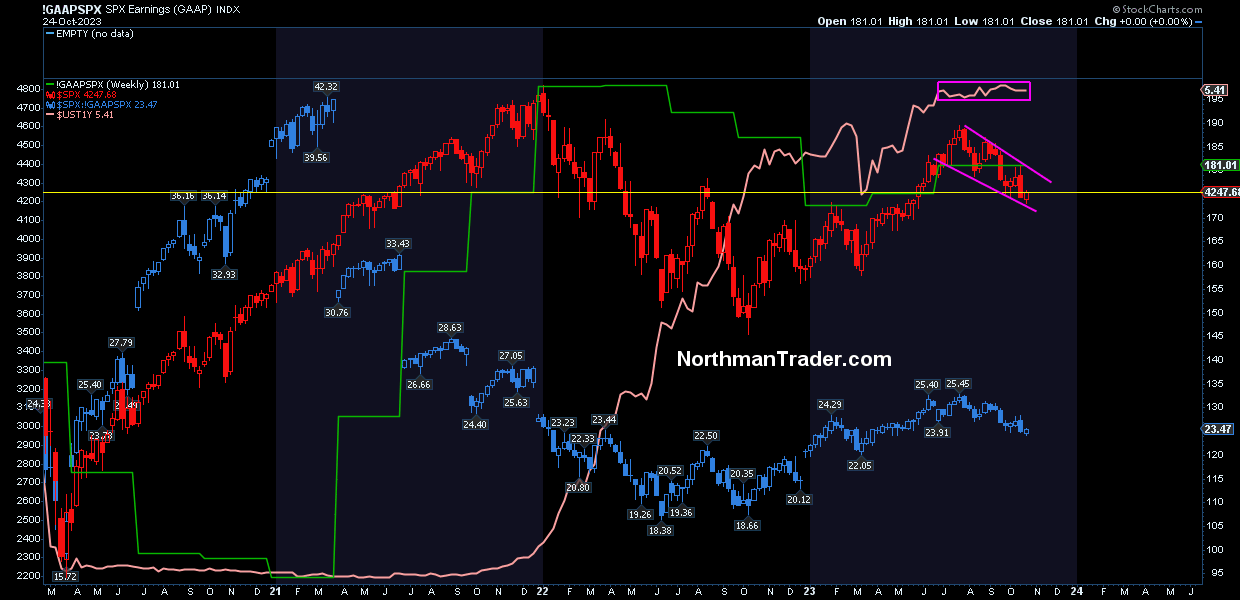

Where are we now? GAAP earnings are actually slightly higher than they were 2 years ago and have been rising:

Despite longer duration yields such as the 10-year having risen dramatically in recent weeks the 1-year yield has been stalling in recent months. What happens if it reverses and these positive divergences currently seen in markets trigger? If 2006 is any indication markets may well explode higher.

No, the risks are very much dominant in this environment, sentiment is dire and markets are at the edge of breaking down it seems and either one of the current three Death Stars as I call them, yields, dollar & wars, may well take them over the edge.

But I submit that while we all can exclusively focus on the negatives keeping an eye on the lurking positives is an equally worthwhile exercise for many things can go wrong, but what if some things go right?