- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Market Freefall And Volatility Restrained, But Risks Loom

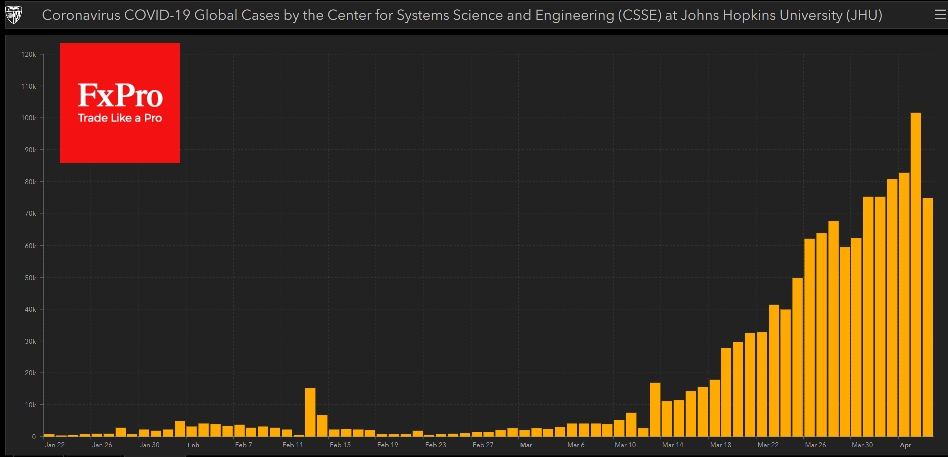

The world markets start the week with growth on the background of signs of stabilization of COVID-19 spreading rates. Previously, we have repeatedly noted that markets can get support when the daily increase of new cases decreases. Of course, this does not mean the end of the disease, and it won’t be evidence of solving all economic problems. But it can be the point where markets can form the basis for further growth. The incidence statistics now looks like a more reliable economic indicator than the actual data, which is noticeably lagging. Economists are catastrophically far from reality in their estimates, but markets do not notice this.

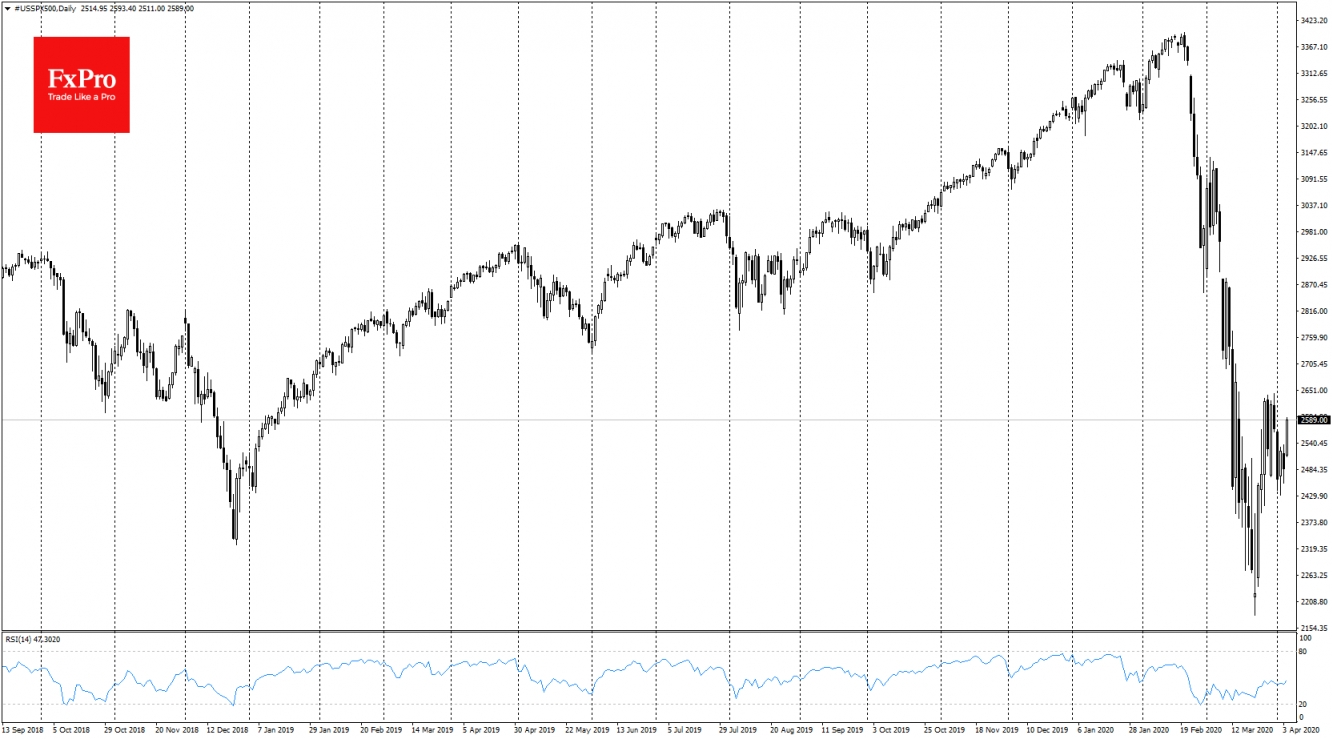

Extreme monetary easing and unprecedented stimulus announced by major governments have allowed markets to soften the decline and move away from lows. Unprecedented restrictive measures managed to reduce the spread of the disease, which restrained the market’s freefall and reduced their volatility.

We may cautiously speak about some decline of the uncertainty because, with the decreasing rate of spreading the infection, the measures to contain it are also softening.

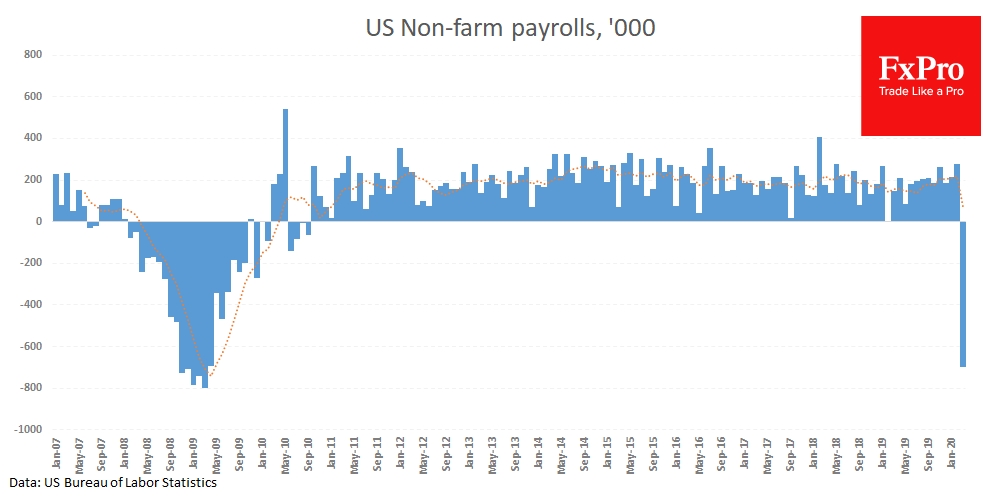

The US labor market data published on Friday showed a decline in employment by 701k in March, compared to expected 100k. However, the employment estimates are based on data from the first half of March – even before there were 10 million initial claims for unemployment benefits in two weeks.

If the situation does not improve significantly in April, the number of lost jobs could reach millions this month. The good news is that the markets are not scared. They probably took this into account in asset prices earlier during the decline in March.

Another critical factor, as we mentioned above, was pumping the financial system with liquidity. As a result, we are witnessing the financial markets flooded with money, which reduces their value. By flooding the markets with liquidity, central banks are raising stock prices as if the tide is lifting all the boats in the harbor. However, the water in the sea is stormy, and the bottom is still rocky.

The FxPro Analyst Team

Related Articles

When the yield curve flattens and eventually inverts, you worry.But it’s when a recession hits, the Fed cuts rates and the curve steepens that you become s**t scared. Yield...

When it comes to the financial markets, investors have a litany of investment vehicles to choose from. The choices are nearly unlimited, from brokered certificates of deposit to...

Investors are gearing up for what is expected to be an eventful week ahead. CPI inflation and retail sales data will be in focus. In addition, Home Depot and Walmart report...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.