What a market. Our mantra for months now (and if you follow our stream you will have heard this a number of times) is don’t worry about indices, just trade individual set-ups. As long as there are individual set-ups, stay long. However, it takes some effort to to follow our own advice. Why? Because often when markets get this extended they have sharp, quick pullbacks that can maim the longs. All our experience tells us to be wary, and yet we ultimately will always defer to price-action, and this keeps us long. As you can see, there’ s some conflict in how we feel, and the same wariness is present in the minds of many veteran traders. Conflict isn’t however a bad thing — it makes us nimble, keeps our ego in check, and on our toes.

We aren’t that present on Twitter these days — so we thought we’d give a quick update of where we are:

We went to cash on Wednesday afternoon — felt pretty smart by Thursday as market pulled back, only having to go back into swings on Friday as market moved forward. We are wrong all the time, but we’re pretty good at not staying wrong for long.

On the plus side, the stocks we sold on Wednesday were extended, and the stocks we entered on Friday were close to bases and gave us a cushion of profit by the close which made us feel a bit more “safe”. That’s what we’ve been trying to do all year long — sell out of extended stocks and entering fresh breakouts close to bases. Albeit the latter is becoming more scarce.

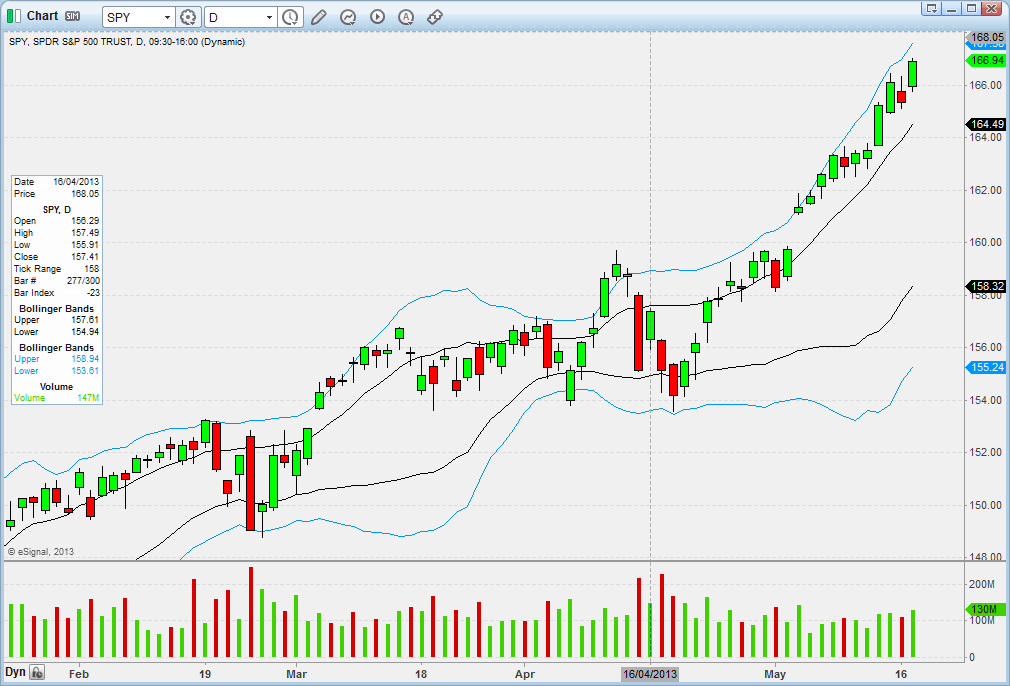

SPY chugging happily along in between standard deviation 1 and 2. First big red flag would be a break of standard deviation 1.

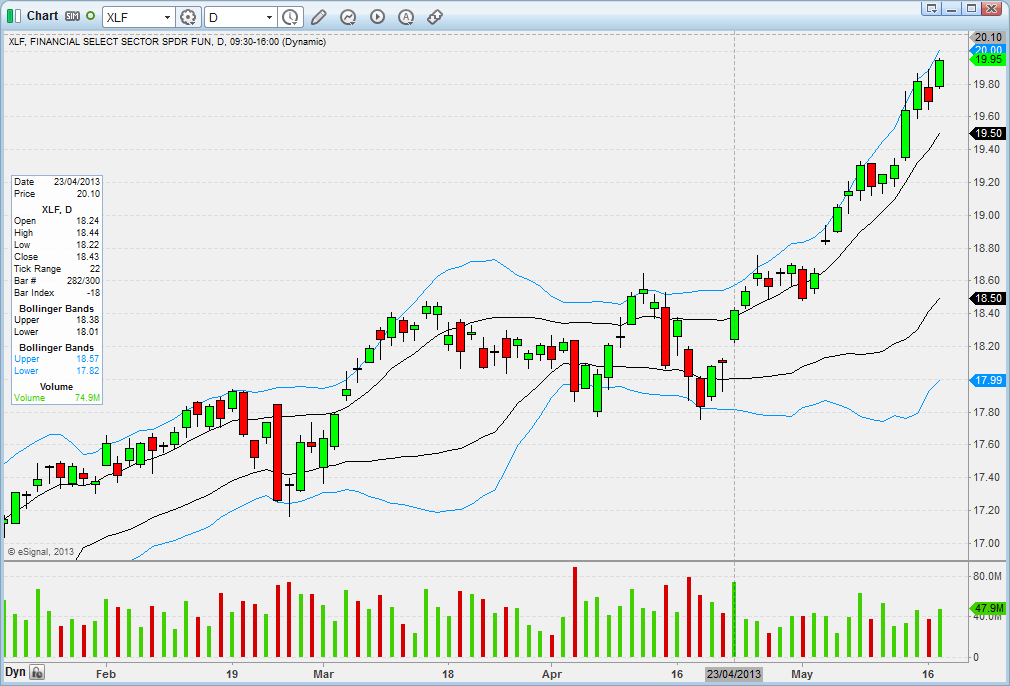

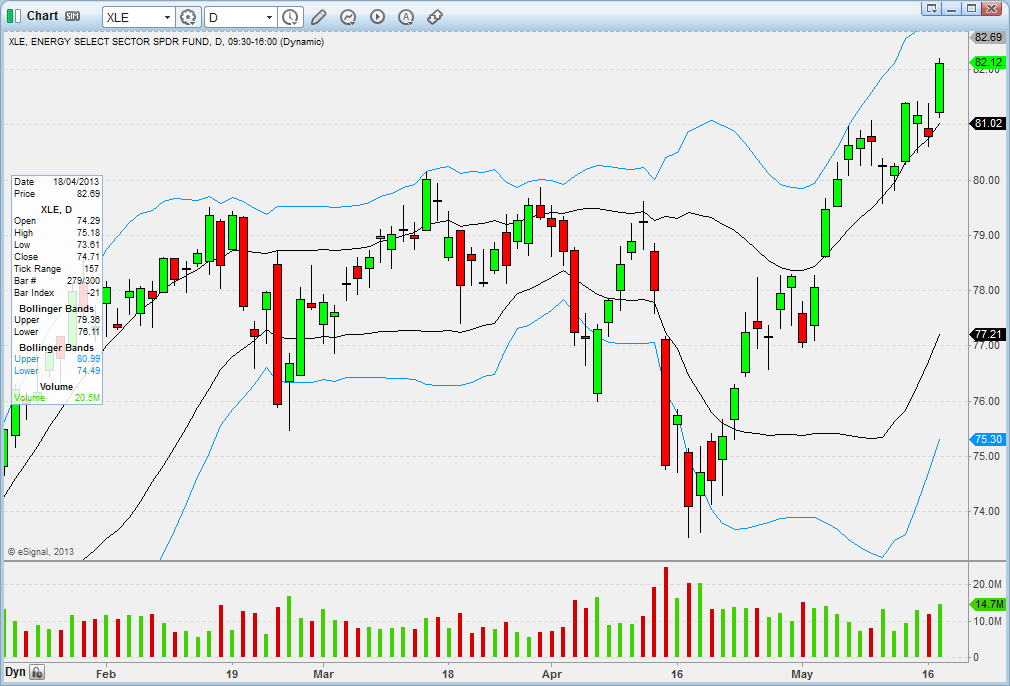

Financials getting to top of Bollinger Band® which usually means they’re due for a rest. We sold out of our JP Morgan Chase (JPM), Goldman Sachs (GS) swings on Wednesday. We’ll be watching to see if this means simple rotation into other sectors (like the Energy Select SPDR ETF (XLE) which caught momentum on Friday) or whether it cools the market as whole.

We bought four small positions Friday and swung all of them — three out of the four belong to the XLE. The oil sector is one of the few non-extended sectors out there right now.

As our readers know we prefer to go long on oversold markets in longer term bull trends — that’s our favorite spot to bite. This means for example buying a pullback to bottom of bollinger band on daily while the weekly is still in uptrend. It’s kind of like short-term reversion to mean within longer term trend.

However, when markets go to top of Bollinger Bands we don’t go short swing (but will do quick fades on day-trades) since in our experience that doesn’t nearly work as well –in bull trends of course, but we would argue it doesn’t work as well/messier strategy even in bear markets. Fear of missing opportunity > fear of losing money.

Right now we’re close to the top of the BBs in a bull market — this means, keep swimming long, but keep an eye for changes of character, and rotate into stocks that are close to bases.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Market Advice: Keep Swimming But With An Eye On The Shore

Published 05/19/2013, 02:45 AM

Updated 07/09/2023, 06:31 AM

Market Advice: Keep Swimming But With An Eye On The Shore

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.