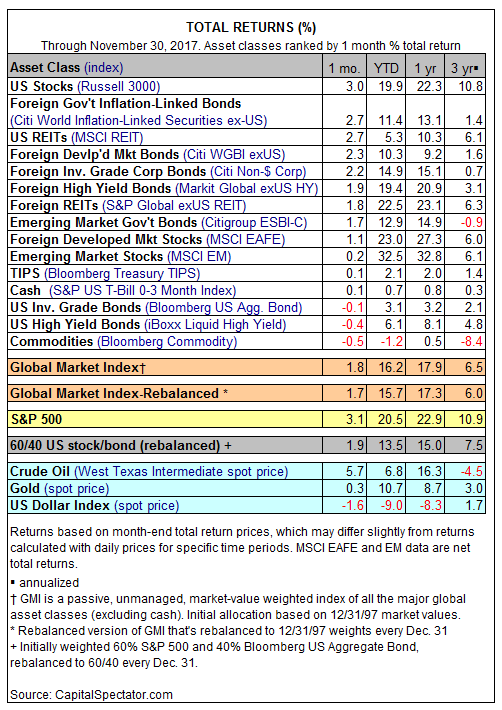

US stocks resumed the lead in November as the top performer for the major asset classes. The Russell 3000 Index gained 3.0% last month, the strongest advance since February and the 13th consecutive month of positive total returns for the benchmark.

Most asset classes posted gains in November, with only a handful of exceptions. The red ink was mild and limited to US investment-grade and junk bonds and broadly defined commodities, last month’s worst performer. The Bloomberg Commodity Index ticked down 0.5% after rising 2.1% in October.

Meantime, the tailwind continued to blow for the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. The index posted a 1.8% total return for November (the 12th straight monthly increase) and is up a sizzling 16.2% year to date. The monthly winning streak through November marks the longest run of monthly gains in GMI’s 20-year history, edging out the previous record – an 11-month marathon in 2006-2007.

Disclosure: Originally published at Saxo Bank TradingFloor.com