Digital media company LiveOne (NASDAQ:LVO) stock has been in a nasty downtrend after peaking in March in anticipation of its social media boxing event. Formerly known as LiveXLive, LiveOne changed its name and symbol. The Company was expected to receive significant top-line growth from its post-pandemic live pay-per-view Social Gloves Battle of the Platforms event with YouTubers vs. TikTokers event.

Unfortunately, the event turned into a flop and resulted in a $100 million lawsuit against its promoter Social Gloves owned by infamous YouTuber Austin McBroom. The Company claims the event was doomed from the get-go as McBroom projected nearly $500 million in revenues without the use of television pay-per-view marketing.

The actual revenue numbers were projected under $15 million. The Company recently acquired Palm Beach Records to expand its music operations and accelerate the launch of its full-service podcast recording studio. The Company continues to pursue its original strategy of building out an on-demand and streaming music, live events, entertainment, and podcast network.

The Company has over 100 live shows featuring over 300 artists planned throughout fiscal 2022, as well as the spin-off of its pay-per-view division. Risk tolerant speculators seeking exposure in the streaming podcast segment can watch for opportunistic pullbacks in shares of LiveOne.

Q2 Fiscal 2022 Earnings Release

On Oct. 28, 2021, LiveOne released its fiscal second-quarter 2022 results for the quarter ending September 2021. The Company reported earnings-per-share (EPS) losses of (-$0.19). Revenues came in at $21.9 million, up 51% year-over-year (YoY), bringing the six-month total to $60.7 million.

The Company added over 170,000 paid members in fiscal 2022 and closed Q2 2021 with $16.7 million in cash and cash equivalents. LiveOne CEO Robert Ellin commented,

“With the return of live music events, we expect an increase in revenue from nearly every aspect of our flywheel – subscriptions, live ticket sales, live stream, pay-per-view, advertising, sponsorship, NFTs, and specialty merchandise.

We continue to focus on the long-term objective of building and owning sustainable, valuable franchises in audio music, live music and events, podcasting/vodcasting, OTT, pay-per-view, and live streaming."

Conference Call Takeaways

CEO Ellin set the tone,

“We have multiple subsidiaries, multibillion-dollar addressable markets in each music subscription, live events, live streaming, OTT, specialty merchandising, and podcasting. We are thrilled to see the return of live music events, and we expect to report record revenues for each of the next 2 quarters. Although we had unfortunate and challenging weather conditions, we held our first major live music festival springer ranking, music festival, autumn Equinox, which is the Midwest largest all electronic music vessel on October 2 and third in Chicago, and we sold 33,000 tickets.

We signed 25,000 members. We currently have booked a lineup of over 100 live concerts and festivals featuring over 300 artists performing over the next 6 months. As I touch on shortly going forward, while all ticket purchases, all pay per views, all merchandise and any of our live user paper view events will receive a paid 1 year paid membership that provides for discounts to future like in-person and pay-per-view events discounted merchandise, and NFPs and the enormous amount of created music and podcast content. Our wholly-owned subsidiary, PodcastOne continues to experience robust growth.

The entire podcast team has done an outstanding job, both recruiting new entertainment podcasts as well as aggressively pursuing advertising and sponsorship deals. -- podcast metrics continue to impress, and growth has added over 2.48 billion podcast downloads in the trailing 12 months ending September 30. And its franchise of exclusive shows has grown to more than 235 with over 50 new podcasts now producing over 300 podcast episodes per week. We continue to grow our paid subscribers with our Slacker radio streaming audio service and now over 1.25 million paid subscribers.”

He continued,

“We had a keen eye on expanding the reach of Slacker, adding over 35,000 subscribers a month. As many of you may know, to a 9-year exclusive partnership with Tesla (NASDAQ:TSLA), a LiveXLive Slacker radio subscription is preinstalled as the default radio in every Tesla car sold in North America, and LIV-1 is paid directly by test for those subscriptions. The Lixilackrap is pre-installed now in 85 other automobiles as well as across major cell carriers, Verizon (NYSE:VZ), Sprint, and T-Mobile, which allows Slacker subscribers to listen in their cars as well as across their mobile devices.

We are seeing compelling growth opportunities for Slacker by partnering with other automotive OEMs as a default radio service, especially outside the U.S. as well as the other white-label B2B partnerships through Android Automotive. Since launching pay-per-view, Pay-per-view 1, our new subsidiary platform in May of 2020, we have generated over $26 million in pay-per-view related sales and live pay-per-view events.

As of October, alone, pay-per-view live events and tickets sold more than 25,000 new subscribers and over 1 million live stream views. -- coming off the outstanding success of Social gross pay-per-view events in June, we look forward to owning and producing our own next hybrid pop culture franchise pay-per-view in the January 2022 quarter called self-made K.

This event will come on boxing exhibitions, featuring women and prominent social media inputs and esports entertainment all buying for over 1 million in prices as well as a lineup of renowned music artists and bands. Social gloves drove over 136,000 pay-per-views in 136,000 members of LiveOne.”

Pay-Per-View Spin-Off

CEO Ellin also touched upon the expected spin-off.

“As many of you hopefully know, in September 2021, we announced our intention to spin out our existing pay-per-view business as a separate public company and plan to distribute a portion of the new company's equity Live 1 shareholder. We anticipate that spin-out to take place before Mar. 31, 2022. In our last call, I spoke about the significant investment in commit LiveOne is making for original programming, content, and marketing events.”

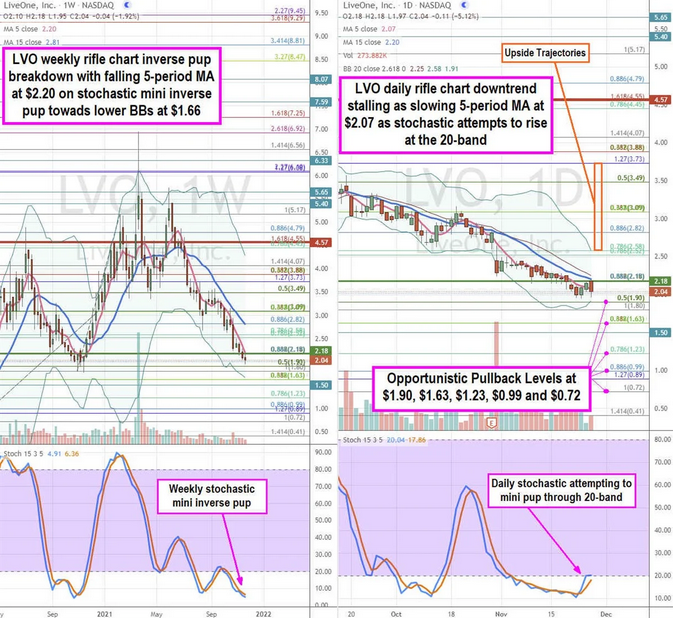

Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a near-term precision view of the playing field for LVO shares. The weekly rifle chart formed an inverse pup breakdown with a falling 5-period moving average (MA) resistance near the $2.18 Fibonacci (fib) level, followed by the weekly 15-period MA at the $2.82 fib.

The weekly lower Bollinger Bands sit at $1.66 as the stochastic formed a bearish mini inverse pup under the 10-band. The daily rifle chart downtrend is stalling as the 5-period MA resistance stalls at $2.07. The daily stochastic finally crossed up but stalled at the 20-band, awaiting either a mini pup to spike it or cross back down to smother it.

The daily market structure low (MSL) buy trigger forms on the $2.18 breakout. The daily upper BBs sit at the $2.58 fib. Risk-tolerant speculators can watch for opportunistic pullback levels at the $1.90 fib, $1.63 fib, $1.23 fib, $0.99 fib, and the $0.72 fib. Upside trajectories range from the $2.58 fib up towards the $3.73 fib level.