- GDP data suggest the economy remains very strong

- However, there are signs that inflation may not go away easily

- This may call for more action by the Fed

The latest quarterly GDP data suggest the economy may be holding together quite well, along with a robust job market. The economy has also seen a boost recently as financial conditions have materially eased over the past few months.

Financial conditions, which are one way that Fed can transmit monetary policy, had become restrictive in the fall of 2022. Yet, the economy managed to grow at a very healthy rate in the third and fourth quarters, as the unemployment rate remained historically low.

Economic Tailwind

The recent easing of financial conditions suggests the environment is not restrictive. If financial conditions ease even further, it could aid in further economic stability and growth, but it could also lead to a resurgence in inflation.

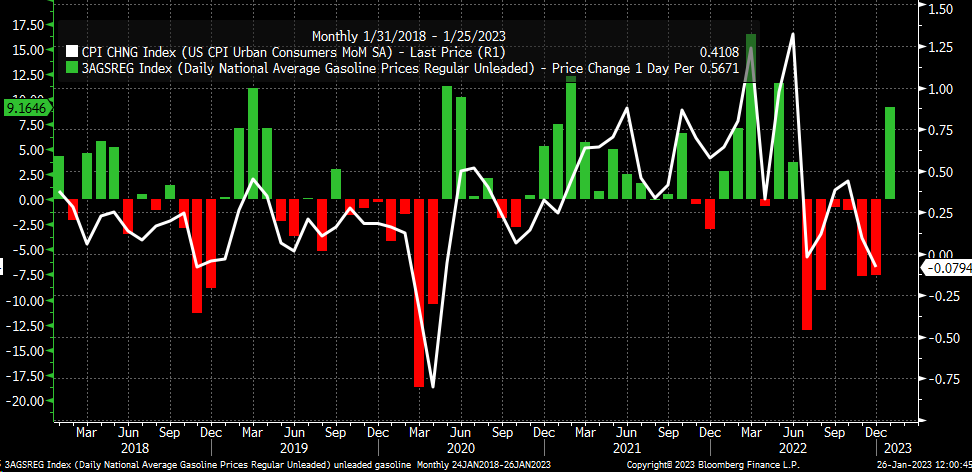

Effects of the easing of financial conditions have resulted in a resurgence in many commodity prices, like lumber, which has surged by more than 20% this month, and metals, like copper, have surged by more than 10% this month, as unleaded gasoline has also risen by almost 10% this month.

So, with financial conditions easing, the US economy holding together very well, and inflationary impulses showing a heartbeat again, one has to wonder if the Fed will have to do even more down the road to kill off the inflationary impulses that are not going away quickly.

Inflation Reaching Sticky Point

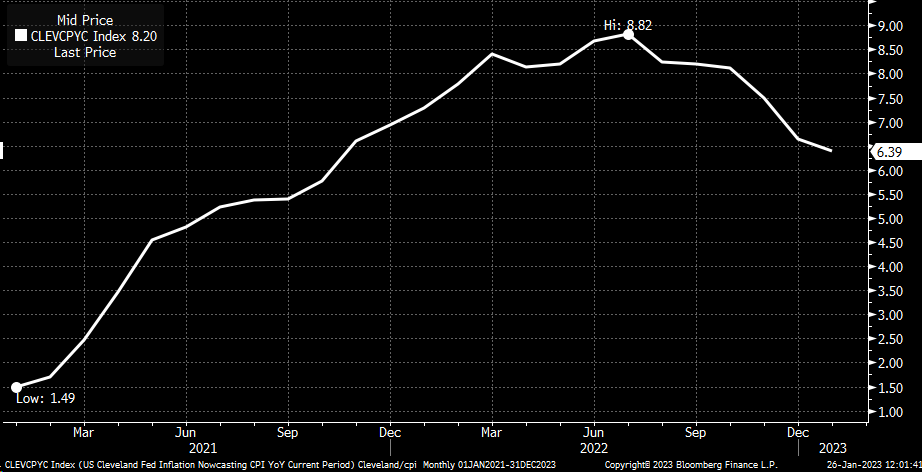

The Cleveland Fed is projecting CPI to rise by 0.6% in January and 6.4% yearly. That would be an acceleration month over month and practically flat on a year-over-year basis. In December, CPI fell by 0.1% month-over-month and declined to 6.5% year-over-year.

The significant risk is if the Fed needs to raise rates above 5% in 2023 because the market has allowed financial conditions to ease so much that commodities like oil can move higher. Some signs suggest that may happen, too, with the price getting closer to breaking out of a consolidation phase and surging back toward $90, adding another inflationary impulse to an economy that is also struggling to break the inflationary cycle.

This may work against the market in the long run because the market is so focused on looking at old data and trying to figure out when homeowners' equivalent rent is going to roll over that it is not paying attention to the surge in key commodity prices, which help to drive the direction of prices across the economy.

If the economy continues to hold together, the unemployment rate doesn't rise, and inflation stays elevated, it calls for the Fed to do even more.

***

Disclosure: This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment. Michael Kramer and Mott Capital received compensation for this article.