The environment remains challenging, but La Doria (LON:0F2Qmi) has posted a robust set of FY17 results. The company has announced its updated three-year rolling industrial plan, and as part of this there will be a major investment plan to expand capacity while streamlining the business to reduce costs. The result should be an expansion of the higher margin lines, allowing the company to drive revenue growth by increasing volumes, while also structurally improving margins in the longer term. We adjust our forecasts to reflect the investment plan and the competitive environment, hence trimming our near-term sales and EBITDA forecasts, while increasing our net debt assumptions. Our fair value moves to €16.10 from €16.90.

Solid FY17 results

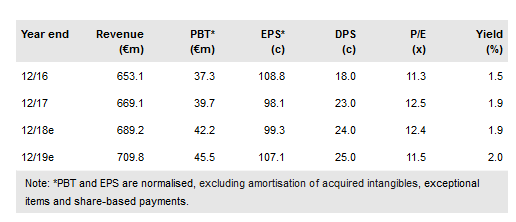

Group results were impressive, with organic growth of 6.2%. This was mainly driven by volume growth in the sauces and vegetable lines. Group EBITDA margin also improved, despite the competitive backdrop and management’s previous expectation that it would contract. The tomato-based products and fruit lines remained under pressure as a result of the challenging competitive environment in those segments.

To read the entire report Please click on the pdf File Below: