Freight transportation company Knight-Swift Transportation (NYSE:KNX) stock has been getting crushed by the benchmark indices. As one of the nation’s largest diversified freight companies, the business is experiencing strong tailwinds as revenues rose nearly 50% in its fiscal Q1 2022.

Inflationary pressures have driven up transportation costs, equipment, maintenance, labor, fuel, and freight rates. Margins were improved by the shorter length of hauls as they boosted revenues by 22.9% per loaded mile. Knight-Swift Transportation operates over 18,000 tractors and 71,000 trailers with 14% of revenue in multi-year contracted truckload business.

To accommodate ESG measures, the Company achieved a (-4.5%) reduction in CO2 emissions per mile in 2019. Trailer capacity remains at a premium, while sourcing and retaining labor simultaneously remains challenging. Prudent investors seeking exposure in the logistics segment can watch for opportunistic pullbacks in shares of Knight-Swift Transportation.

Q1 Fiscal 2022 Earnings Release

On Apr. 20, 2022, Knight-Swift released its fiscal first-quarter 2022 results for March 2022. The Company reported an earnings-per-share (EPS) profit of $1.35 versus consensus analyst estimates for $1.26, a $0.09 beat. Revenues rose 49.4% year-over-year (YoY) to $1.83 billion versus $1.76 billion consensus analyst estimates.

The truck count of 17,965 average tractors rose from 17,955 in fiscal Q4 2021. The shorter length of haul opportunities partially contributed to a 22% increase in reverse per loaded mile and a (-9.6%) decrease in miles per tractor.

The Company handled 18,783 less-than-truckload (LTL) shipments daily at an average weight of 1,098. LTL accounted for 13% of revenues while 30% came from Logistics, intermodal, and others. The Company purchased five terminals in Texas and one in Las Vegas.

Upside Guidance

The Company provided upside guidance for fiscal full-year 2022 for EPS between $5.20 to $5.40 versus $5.24 consensus analyst estimates.

Conference Call Takeaways

Knight-Swift CEO David Jackson briefly talked about the LTL business generating over $900 million in top line generating free cash flow of $352 million, up from $52 million during the last conference call. In the last call, there was $99.6 million of adjusted net income compared to $225 million for this quarter. This was performed all the while de-risking and diversifying its operating model. Swift Transportation has grown into the most profitable truckload carrier in the industry.

The objective has been to build a successful industrial growth company that delivers double-digit returns on tangible net assets. CEO Jackson explained,

“This requires multiple growth avenues that require diversification of revenue streams to mitigate seasons and cycles, it requires massive network building to accumulate economies of scale, which we have done with over 200 facilities representing approximately 3000 acres in the right places with employees, equipment and execution for our customers that enables us to operate with industry-leading cost efficiency and create value for our customers that yields abundant revenue opportunities.”

The company’s trailers have a technological advantage that removes friction and maximizes the use of the platform. Organic LTL growth and Iron Truck services are growth drivers. Its revenue diversity enables the company to remain resilient. The company has over 200 sites across the U.S. and Mexico. Its network size and scale allow them to offer full end-to-end services and provide the opportunity to link different solutions that optimize every brand. CEO Jackson feels their network is without rivals.

KNX Opportunistic Pullback Levels

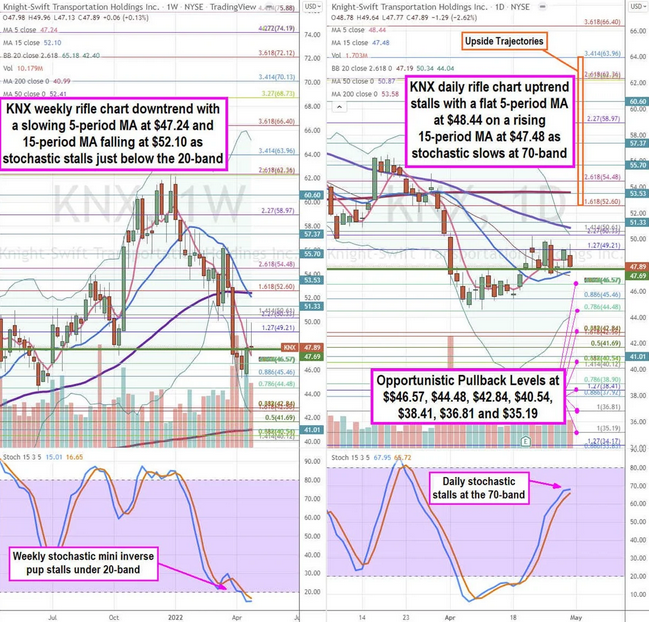

Using the rifle charts on the weekly and daily time frames enables a precise view of the playing field for KNX stock. The weekly rifle chart peaked near the $62.36 Fibonacci (fib) level. Shares proceeded to fall sharply as it formed a weekly inverse pup breakdown through the weekly 50-period moving average (MA) at $52.41 as it formed a bottom near the $44.48 fib.

The weekly downtrend is being tested as share attempt to hold above the weekly 5-period MA at $47.24 as the 15-period MA continues lower at $52.10. The weekly stochastic has a stalled mini inverse pup at the 10-band with weekly lower Bollinger Bands at $42.40.

The weekly market structure low (MSL) buy trigger sits above the $47.69 level. The daily rifle chart uptrend has stalled with a flat 5-period MA at $48.44 and a rising 15-period MA at $47.48 setting up a potential pup breakout. The daily 50-period MA is at $50.87, sitting above the daily upper BBs at $50.34. The daily 200-period MA resistance sits at $53.58.

The daily stochastic oscillation is slowing near the 70-band. Prudent investors can watch for opportunistic pullback levels at the $46.57 fib, $44.48 fib, $42.84 fib, $40.54 fib, $38.41 fib, $36.81 fib, and the $35.19 fib level.