In a surprise beat on the estimates, New Zealand's first quarter inflation rate nudged higher, rising 1.0% in the quarter, sending the inflation rate to 2.2%. It was the highest in more than 5-years as inflation edged back into the RBNZ's target range. The NZD/USD posted strong gains, rising 0.43% at the time of writing, trading near intraday highs of 0.7033.

Elsewhere, the British pound managed to hold on its gains from earlier in the week. The UK parliament approved Mrs. May's calls for early elections by an overwhelming majority setting the stage for a June election. The Eurostat confirmed that inflation eased in the Eurozone yesterday, rising 1.5% on the headline and 0.7% on the core as per the preliminary report.

Lack of any clear catalysts during the day saw most of the currencies trading on local cues. Looking ahead, the economic calendar today is void of any major news events. U.S. Treasury Secretary Steven Mnuchin is expected to speak later today while on the data front, the weekly jobless claims and the Philly Fed manufacturing index will be released.

EUR/USD intra-day analysis

EUR/USD (1.0719): After EUR/USD rose to a one-month higher yesterday; prices retreated pulling back from the highs of 1.0736 to close on a bearish note. With prices above 1.0700, there is strong indication that EURUSD could remain consolidated above 1.0700 in the near term. The bias remains to the upside above 1.0700, targeting 1.0800 resistance level. However, this could change in the event of a breakdown below the support at 1.0700. We could expect to see a decline towards the lower support at 1.0600.

GBP/USD intra-day analysis

GBP/USD (1.2794) maintained some of the gains from the day before, but prices were seen consolidating after rallying to 1.2800 level. As mentioned in yesterday's daily report, we can expect to see GBP/USD slide back towards 1.2600 in the short term where support is most likely to be established. This level also marks the top of the descending triangle pattern from which we saw an upside breakout in prices. Establishing support at 1.2600 will signal a continuation to the upside in GBP/USD as a result.

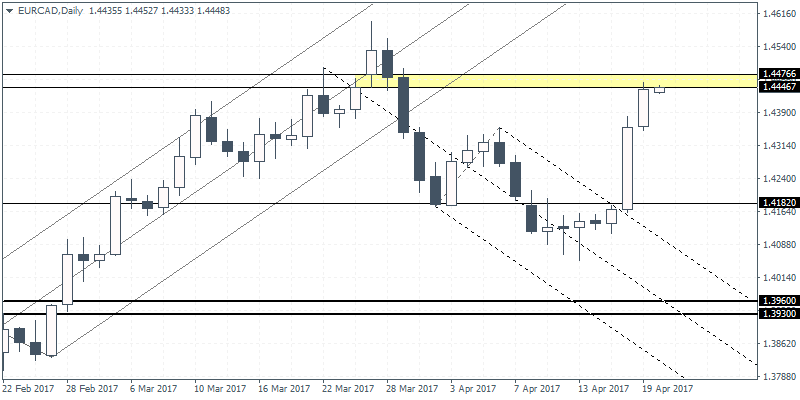

EUR/CAD daily analysis

EUR/CAD (1.4448) posted strong gains in the past two days which saw prices rallying back to test the resistance level at 1.4450. If a lower high is formed here, relative to the previous highs formed near 1.4547, we can expect to see some downside in prices. The support at 1.3960 remains the downside target in EUR/CAD which is most likely to be tested if we get to see a reversal candlestick pattern in EUR/CAD and a breakdown below the minor support at 1.4182. Tomorrow's inflation data from Canada is likely to be the catalyst for the downside bias in EUR/CAD.