S&P 500 at 8,000, gold at $5,400, Tesla to double: Here are top trades for 2026

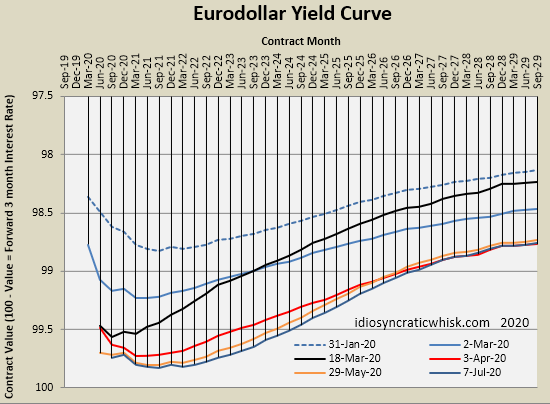

The yield curve remains at about the same place it was a month ago.

Since the mid-March peak of optimism after the initial reactions to COVID-19, yields have declined, which would suggest that the Fed could do more in terms of basic nominal stimulus. But, the decline in long-term yields (using Eurodollar Futures) has been real. Inflation expectations have inched upward, though tepidly.

I don't have an opinion about the various lending programs in place, but it seems like there is plenty of room for the Fed to simply buy Treasuries until inflation expectations move above 2%. A steeper yield curve would be a good sign.

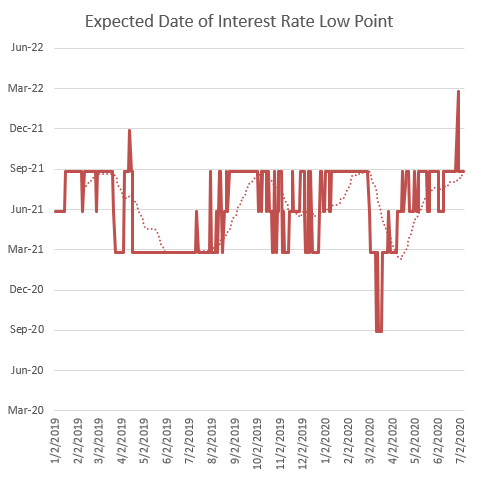

In the meantime, the low point of the inversion looks like it's moving ahead in time, which is not a good sign. Along with a steeper yield curve, it would be nice to see market expectations of sooner increases in short term rates. The Fed can't cure COVID-19, but it can minimize the costs and dislocations caused by nominal decreases in incomes. There is no reason for the Fed to let the market expect the yield curve to be inverted until 2022, but we might be headed there.

That being said, the Fed has been more active than what I would have expected. I appreciate the new direction. They aren't creating nominal economic crises like they did back in 2008. But, there are parallels, still.

In 2008, during the month after Lehman Brothers failed, when markets were being tossed to and fro, and intensive debates raged about bailouts, TARP, and all the rest, the Fed sat on a 2% Fed Funds target rate—a target rate that was so disastrously high they never really managed to hit it. In the midst of all the debates about unconventional policy efforts, it seems that it didn't occur to anyone to do conventional monetary policy and lower the rate.

We have sort of a similar issue now, with all the special lending programs, all the kvetching online about who got it and who didn't, etc., and in the meantime, the Fed could be purchasing many more Treasuries than they currently are.