The political situation in Japan squeezes fresh longs and has bears desperate to put back on their JPY shorts – but we could get lots more two-way volatility if risk appetite stays in the dumps here.

BoE Inflation report

The Bank of England Quarterly Inflation was actually supportive of the front end of the UK yield curve despite all of the dovishness in evidence from the report, which suggested that growth would disappoint and come in more like 1% rather than the 2% suggested in previous reports, and that inflation would be generally lower. We can juxtapose this with suddenly much higher than expected CPI data yesterday.

There was also a bit of belly-aching about the pound’s “strength” as a worry, which is likely the cause of further GBP selling here in the near-term. As well, the pound is generally weak because it tends to trade as the anti-euro of late, and euro shorts have been getting squeezed since yesterday on the rumours of generosity being thrown Greece’s way.

But there was a reaction in the UK interest rate market, which saw the likes of the December 2013 STIR future off by a few ticks even as King wouldn’t rule out more QE. Despite that statement, there is a general feeling that the King and others are disappointed with the potential for monetary policy to stimulate the desired recovery.

In GBP/USD, keep an eye on the 1.5850 area – it’s a key one as the 200-day moving average has served as an important bone of contention for months. In EUR/GBP, I see little potential for upside from here, with the 200-day moving average around 0.8085 as a mental line in the sand for now.

AUD weak as EUR squeezes higher

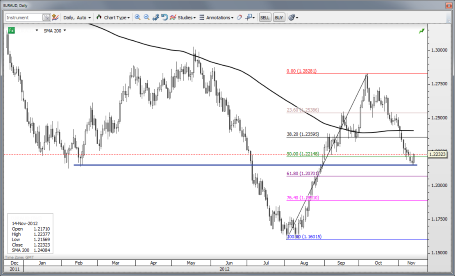

Chart: EUR/AUD

Note how the euro recovery – or “squeeze” or call it what you will – that started yesterday has seen some AUD underperformance today, even despite the very JPY negative moves in the market. This suggests to me that very large EUR/AUD shorts have been building and there could be some positioning pain out there in long AUD trades.

With USD/CAD still trading firm here and the kiwi looking like a spacewalker that has been severed from his tether, one wonders how long the AUD can stick out like a sore thumb to the strong side. As for the EUR/AUD chart specifically, the huge rally from the major summer low disrupted the down trend and the latest down-wave is all about guessing which Fibonacci is the right one…. The 0.618 is the classic retracement Fibonacci at market turnarounds and is even lower at 1.2075 or so, but anything from the 50% retracement already crossed to the actual lows is fair game.

US Data

The US Retail Sales data for October was rather weak and the PPI data was very weak, all suggesting a more activist Fed of course, with Yellen’s speech last night on targeting economic growth very much on the market’s mind and leading to a slightly weaker USD (and of course, a knee-jerk move higher in risk). Just wait until we see the payroll tax cut expire on January 1 and we could be seeing very weak US consumption data even if other fiscal cliff risks are avoided.

Looking ahead

With Mr. Noda rolling a grenade into the FX trading trenches with the call to elections, the JPY situation has become even more ad hoc than usual. There will be plenty of potential for violent back and forth swings near term. It feels like the market was just unwinding its JPY shorts recently and adding to JPY longs when this news hit the wires. If risk stays off and bond yields remain low and lower, we can hardly expect an uninterrupted weakening from here – quite the opposite at times, one suspects – so please stay on your toes and appreciate the potential for JPY volatility in nervous times.

Still, there is a longer run potential on the other side of this election that we eventually see more radical measures and some degree of BoJ losing its independence as Japanese determination to do something about deflation, its debt load and its strong currency as some of its key giant companies are on life support will only grow from here. We’ll have plenty more to say on the election in coming days.

On the calendar, we have the Fed’s FOMC minutes tonight, which should be more interesting than the actual meeting was the last time around. Look for what degree of nuclear the dovish FOMC contingent is willing to progress towards on the accommodation front if US economic data fails to satisfy in the months and quarters ahead.

Tomorrow is the main event for the rest of the week, with UK Retail Sales and eurozone GDP data, including for Germany separately. Then in the US, we have the US CPI (note the unusually high petrol prices for this time of year in the US) and US jobless claims and both the US Empire and US Philly Fed manufacturing surveys. Late in the day, we have Bernanke out speaking on the Housing and Mortgage market in Atlanta.

On Friday, we have a sprinkling of minor data, including the US October Industrial Production and Capacity Utilization data and TICs data.

Be careful out there - volatility is heating up with this JPY move.

Economic Data Highlights

- New Zealand Q3 Retail Sales ex Inflation out at -0.4% QoQ vs. +0.4% expected and +1.3% in Q2

- Australia November. Westpac Consumer Confidence out at 104.3 vs. 99.2 in October

- UK October Jobless Claims Change out at +10.1k vs. 0.0k expected and +0.8k in September

- UK September Employment Change (3 Months/3 Months) out at +100k vs. 135k expected and 212k in Aug.

- Eurozone September Industrial Production out at -2.5% MoM and -2.3% YoY vs. -2.0%/-2.2% expected, respectively and vs. -1.3% YoY in August

- Switzerland Nov. Credit Suisse ZEW Survey out at -27.9 vs. -28.9 in October

- US October Producer Price Index out at -0.2% MoM and +2.3% YoY vs. +0.2%/+2.6% expected, respectively and vs. +2.1% YoY in September

- US October PPI ex Food and Energy out at -0.2% MoM and +2.1% YoY vs. +0.1%/+2.4% YoY expected, respectively and vs. +2.3% YoY in September

- US October Retail Sales ex Autos and Gas out at -0.3% MoM vs. +0.4% expected

- US FOMC Meeting Minutes (1900)

- US Weekly API Crude Oil and Product Inventories (2130)

- New Zealand October Business PMI (2130)

- New Zealand Nov. ANZ Consumer Confidence (0000)

- Australia Nov. Consumer Inflation Expectations (0000)

- Australia October New Motor Vehicle Sales (0030)