The Japanese yen continues to have a quiet week. USD/JPY is showing little movement on Tuesday, trading at 131.84.

Tokyo Core CPI hits 4.0%

Tokyo Core CPI, a key inflation indicator, was higher than expected and in December hit 4.0% for the first time since 1982. This was up from 3.6% in November and above the forecast of 3.8%. Food and energy costs were the drivers behind the uptick, but higher prices were broad-based, casting doubt on the Bank of Japan’s argument that inflation is mainly due to import costs. The BoJ says that inflation is close to a peak, but inflation indicators such as Tokyo Core CPI don’t corroborate that view.

The markets were caught flat-footed by the BoJ in December when it suddenly widened the yield curve control band, and wary investors are on the lookout for further policy changes, such as another widening of the band or eliminating its yield curve control target for long-term bonds. Higher inflation is putting pressure on the BoJ to respond, and the monthly policy meetings are no longer sleepy affairs that have no bearing on the markets. The BoJ meets again on January 18th and in addition to announcing policy will update its inflation forecasts.

High inflation has taken its toll on consumers, and Household Spending declined in November for the first time since June, with a reading of -1.2%. This was down from 1.2% in October and missed the consensus of 0.6%. The government has introduced an economic stimulus package that includes subsidies for electric bills and is counting on the measures to push inflation lower. Still, the package isn’t expected to make an impact until February, which means inflation could continue to accelerate in January.

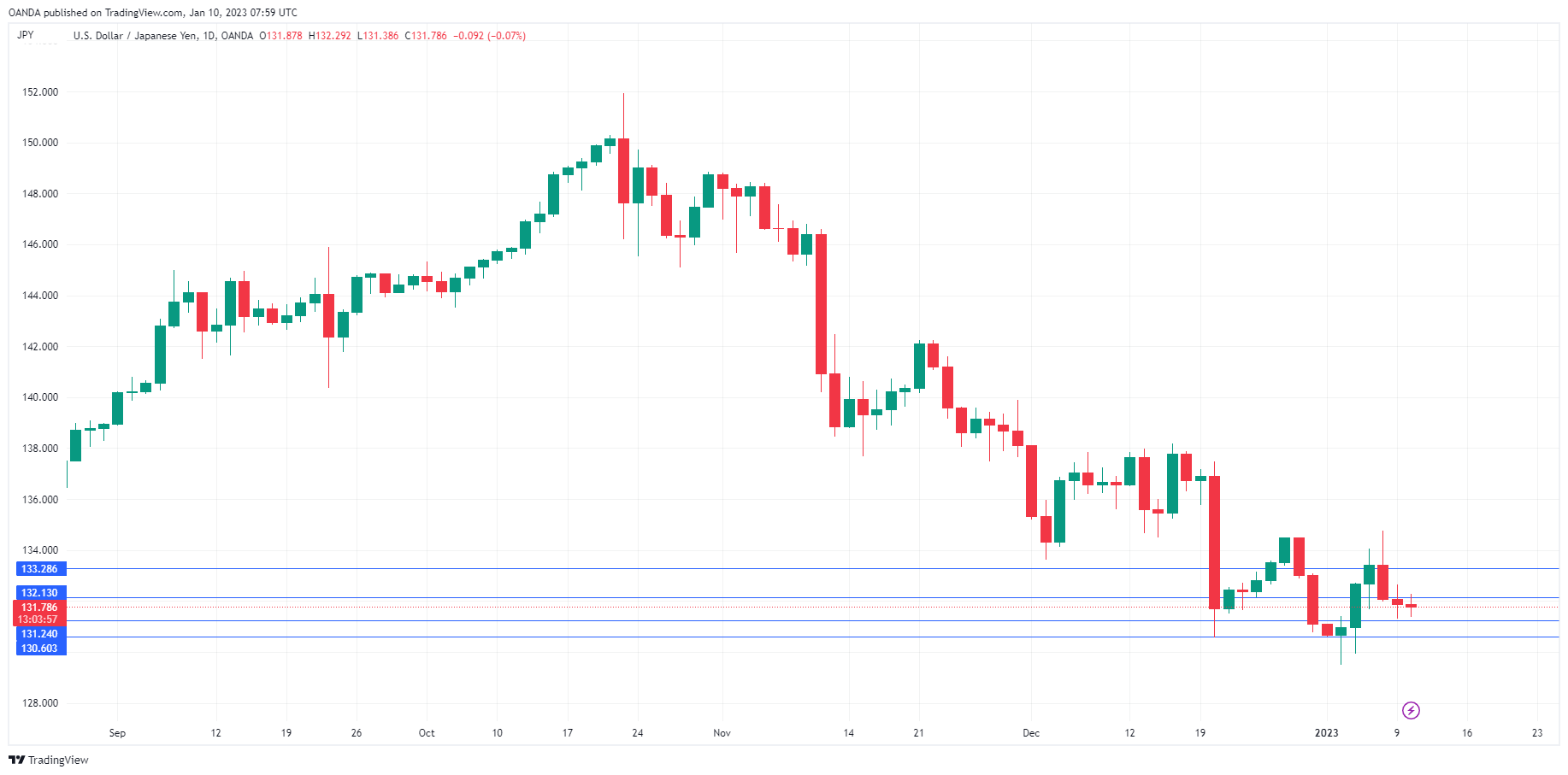

USD/JPY Technical

- There is weak resistance at 132.13, followed by 133.30

- 131.25 and 130.60 are the next support lines