The Japanese yen is showing little movement today, after gaining 1% on Wednesday. In the European session, USD/JPY is trading at 146.15, down 0.16%. Earlier in the day, USD/JPY touched a low of 146.11, its lowest level since October 7th.

Yen Is On A Roll, But For How Long

After falling close to the 152 line last Friday, the Japanese yen has turned things around. Japan’s Ministry of Finance (MOF) intervened on Friday and Monday, in what has been described as “stealth intervention” as the MOF has refused to comment. The MOF has engaged in sharp rhetoric against the yen’s prolonged slide, and Finance Minister Shunichi Suzuki has been blunt, saying that the government was “facing off with speculators via markets.”

The currency intervention appears to have worked, with the yen improving to around 146. This latest round of interventions is much larger than the one in September, which only slowed the yen’s decline for a few days. Still, I remain skeptical about whether unilateral action such as intervention is the answer to the yen’s woes. Japan has maintained a monetary policy mix that is contradictory and likely unsustainable. The Bank of Japan has kept its ultra-loose policy, in order to support the fragile economy. This has meant intervening in the fixed-income markets in order to cap yields on 10-year JGB at 0.25%. The price for this policy has been a tumbling yen, as the US/Japan rate differential continues to widen as the Fed continues its aggressive tightening. The MOF has thrown a lifeline to the yen by intervening, but it’s far from clear that this will be an effective policy.

This sets the stage for a key Bank of Japan meeting today and Friday, and the meeting could well be a “do or die” moment for the Japanese yen. If the BoJ’s message to the markets is business as usual, the yen will likely be under pressure, and the ball could revert back to the MOF and the possibility of further intervention if the yen sags and approaches the 150 line.

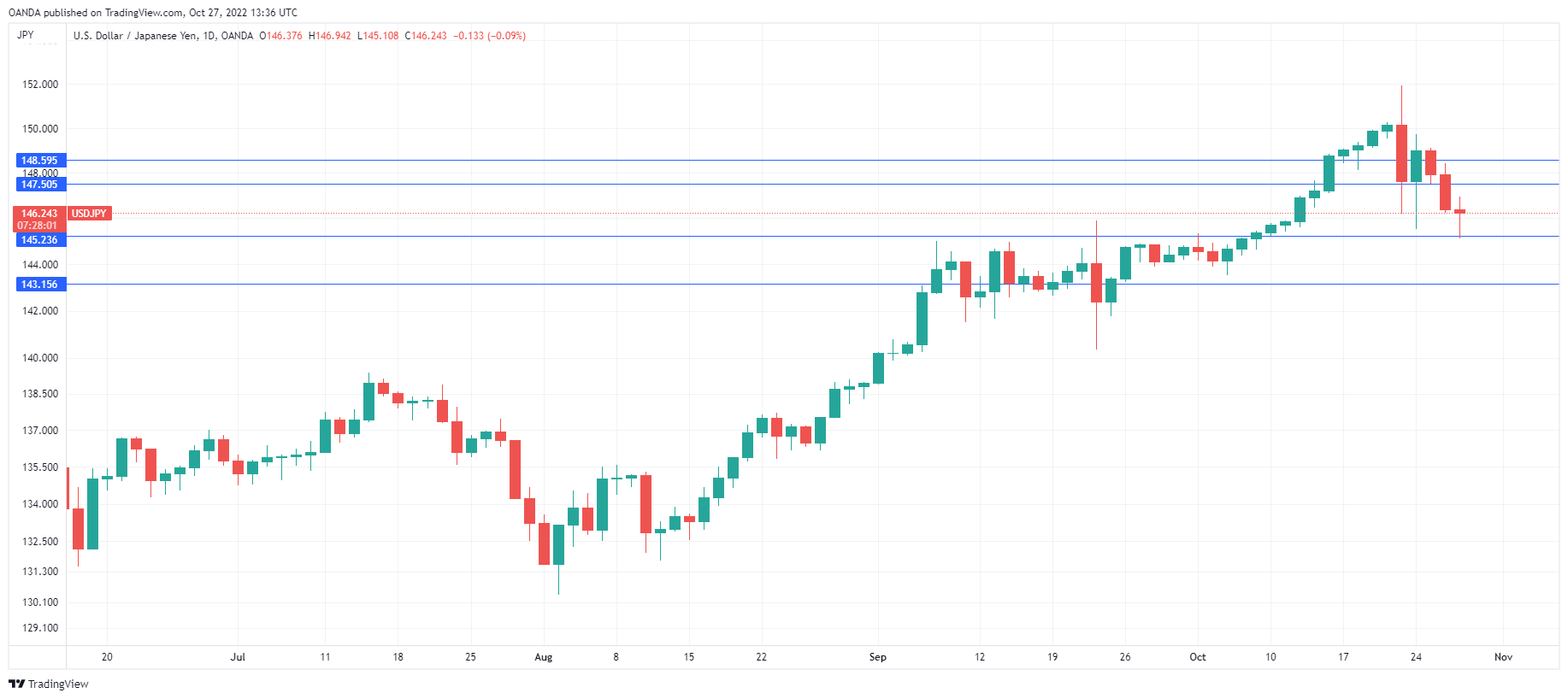

USD/JPY Technical

- USD/JPY faces resistance at 147.50 and 148.59

- There is support at 145.23 and 143.14