The easy work for bulls is done, now the real graft begins if overhead supply is to be consumed. A couple of indices sit at resistance levels more suited to short positions, but shorts haven't had too many opportunities beyond the recent 'bull traps'.

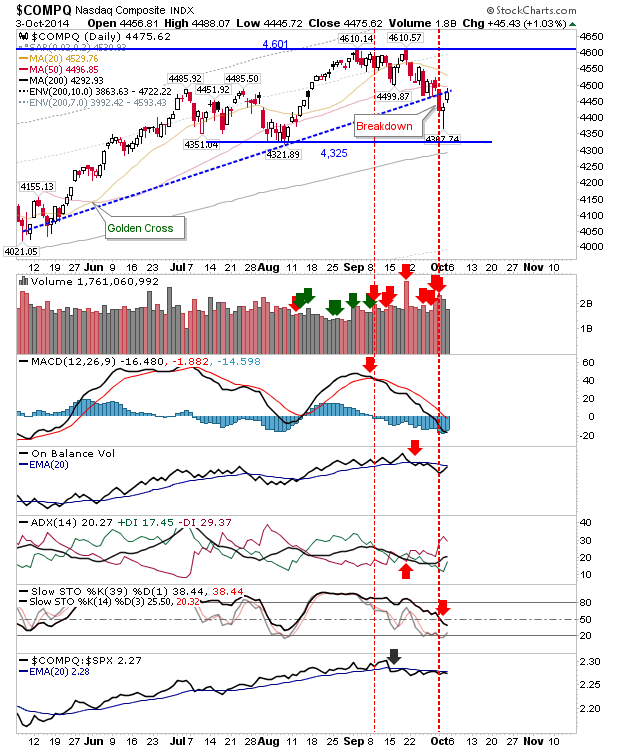

The NASDAQ is perhaps the most vulnerable. It tagged former support turned resistance with the 50-day MA just overhead. Another leg down to test 4,325 would appear more likely, although a strong start on Monday would put a short position on hold.

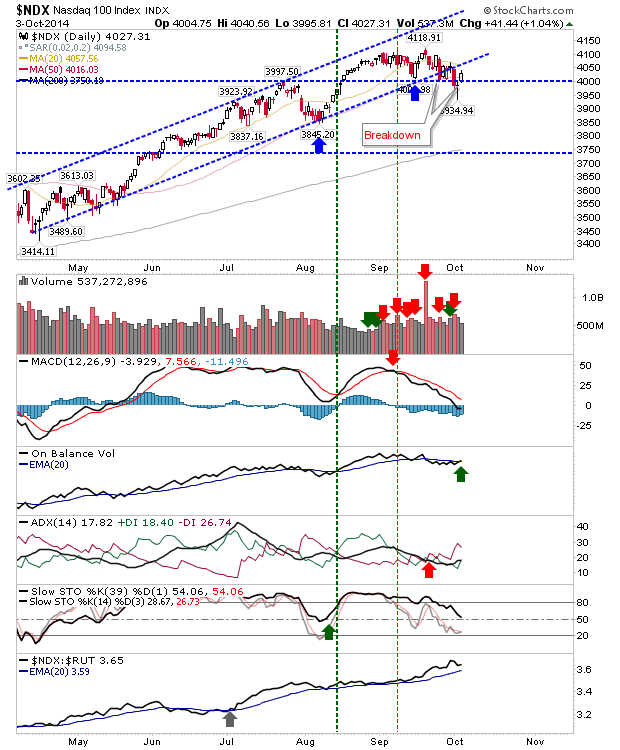

The NASDAQ 100 is also vulnerable, although it didn't finish Friday at channel support turned resistance, and did close above its 50-day MA and key support of 4,000. There isn't a short position here yet, and longs may get some joy for another day or two of gains.

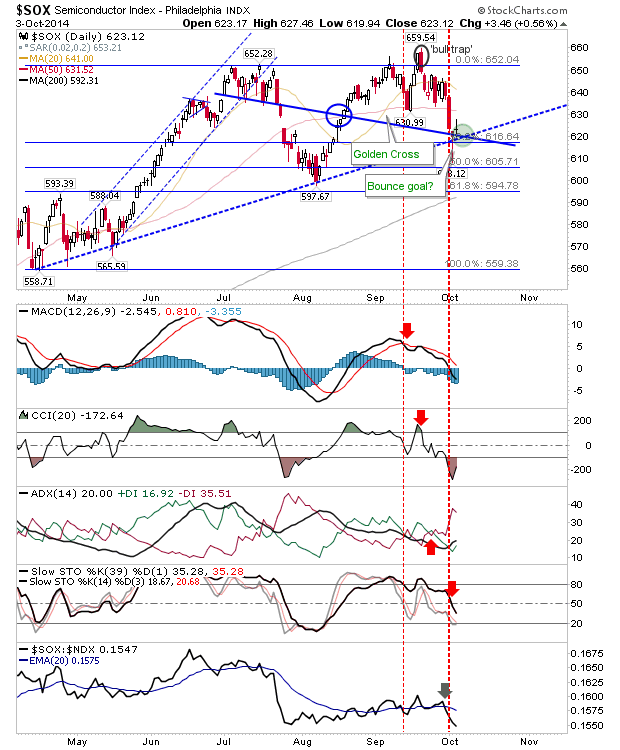

Helping the NASDAQ 100 is the Semiconductor Index. It's trading in an area where I would look for a bounce to develop. It doesn't mean it will, but there are a few convergence points to help bulls at this point. Supporting technicals actually favour more downside, so this is more of a price-based bounce than a technical one.

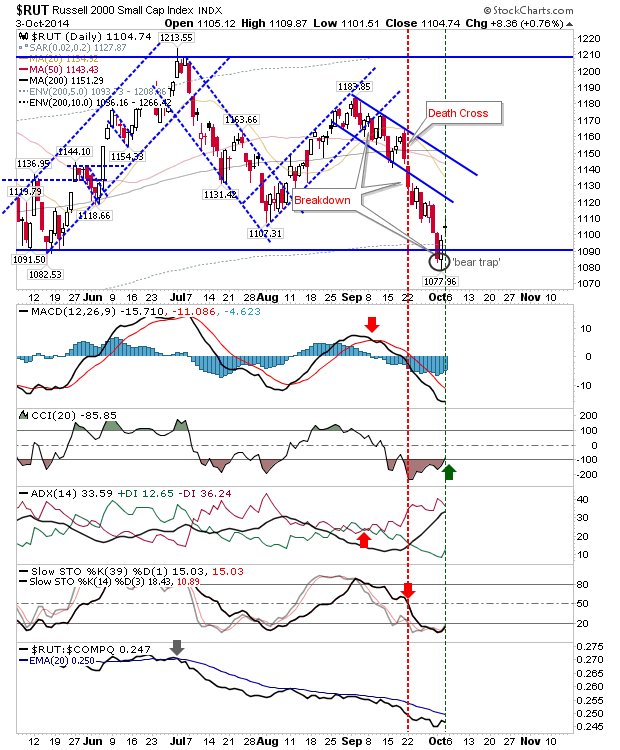

The Russell 2000 has confirmed the 'bear trap'. I would not be surprised to see this index make another pass at the 200-day MA, but longs wouldn't want to hold for too long if 1,077 is violated.

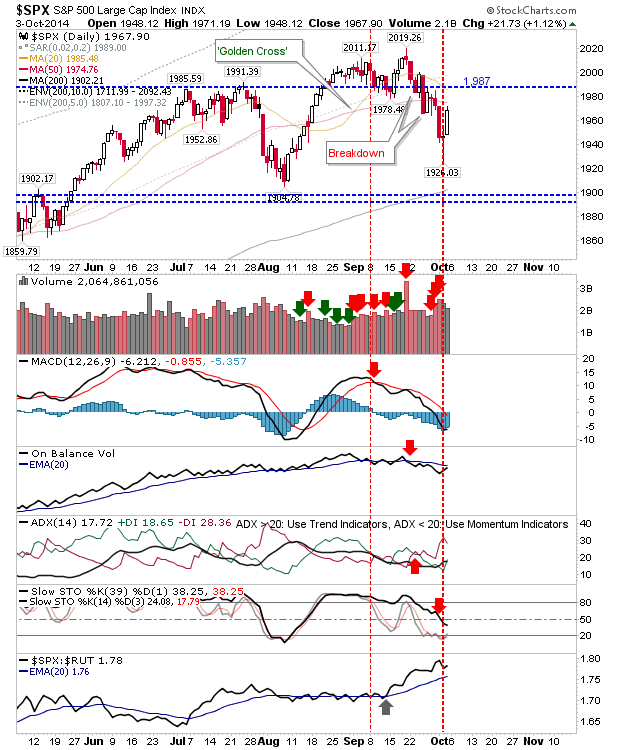

The S&P 500 is caught in a bit of a no-mans land. It's below its 50-day and above its 200-day MA. Not excited about it either way: a push above the 50-day MA would make longs more comfortable, but then 1,987 resistance comes into play. A stall-out at the 50-day MA would favour short activity for a push back to 1,900.

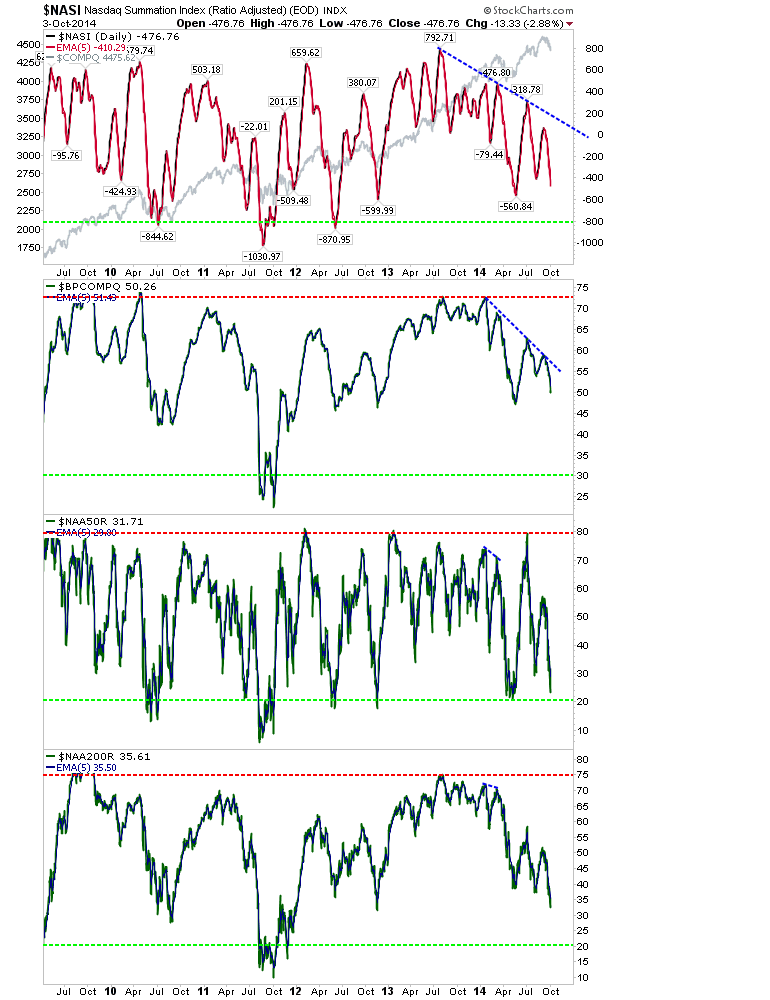

As a final note, NADSAQ breadth is about to make its first pass at oversold levels with the Percentage of NASDAQ stocks above their 50-day MA, but other breadth metrics are more neutral, although bounces have occurred in the past at current levels for other breadth indicators, even though these aren't oversold.

If bulls make a bright start today (and futures are looking good), then the resistance levels for the NASDAQ S&P and NASDAQ 100 (to a lesser degree) could be breached quite early. It would then be important for these levels to hold for the day, and certainly finish with a close above them. Any fade out during the day or late afternoon would give shorts an advantage into Tuesday.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is The Relief Rally Done?

Published 10/06/2014, 06:53 AM

Updated 07/09/2023, 06:31 AM

Is The Relief Rally Done?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.