Stock market today: S&P 500 climbs as ongoing AI-led rebound pushes tech higher

Is It Time to Move Part of Your Portfolio to Bitcoin?

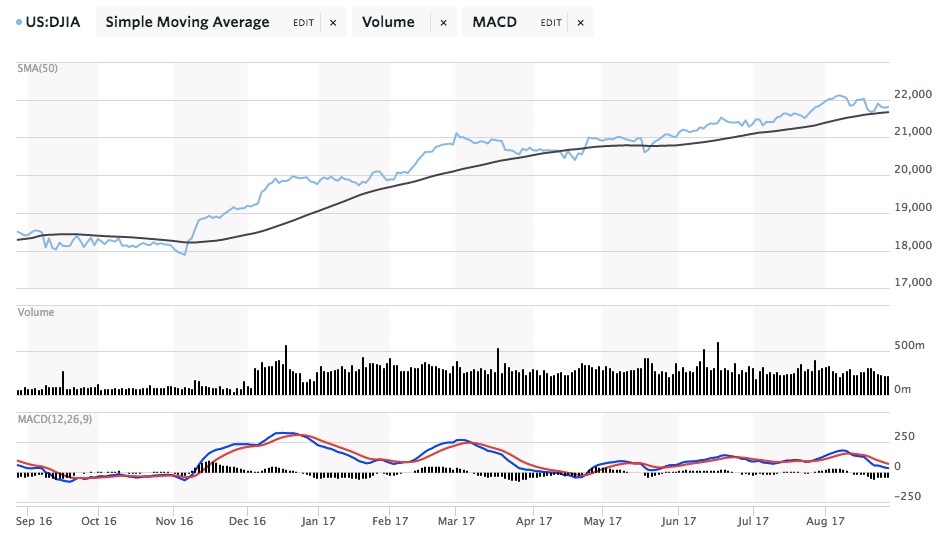

There’s no denying that the stock market has had an excellent year. The Dow Jones Industrial Average has seen gains to its highest-ever levels, crossing over 21,800 in recent trading. The Nasdaq has come slightly off its highest point, but still up over 16% for the year. Investors have enjoyed excellent returns for the year, and market has rewarded long hands well.

But things may be taking a turn in the wrong direction. The loose monetary policy that has dominated central banks since the 2008 crisis seems to be coming to a close, and the market is beginning to see funds moving out. In fact, according to CNBC, recent weeks have seen the largest exodus of funds from stocks since 2004.

The report indicates that more than $30 billion has left the market in the last ten weeks, and that this market shift is going to continue. The exodus from stocks seems to be driven by the belief that the market has seen it’s high in the short term and will begin to contract, as investors take profits out of the market in coming weeks.

Time for Bitcoin?

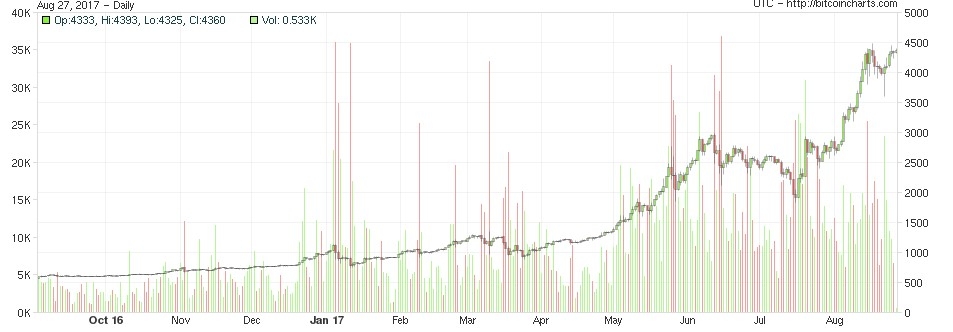

Bitcoin has also had a remarkable 2017. Driven by other forces such as currency crises overseas and market concerns, the cryptocurrency has reached record highs this fall, touching $4500 per coin in recent days.

The jump has coincided with the general weakening of the American dollar and the growing mainstream awareness of Bitcoin and the blockchain technology that supports it.

And while the market is clearly at a major high, so very conservative analysts are calling for even greater gains for the cryptocurrency. Even Fundstrat founder Tommy Lee, a notorious bear, has said that Bitcoin will cross $6,000 by year’s end, driven by mainstream acceptance and investor desire for safe havens besides gold.

So is the time right to invest in Bitcoin?

There are some inherent dangers with the cryptocurrency that might make investors worried. First, there are security issues. While blockchain technology is designed to be secure, Bitcoin is stored on digital wallets with private keys. It’s possible to have that private key compromised and your investment could be at risk for theft.

One company CORION, has created encryption for investor’s private keys, making them impossible to compromise, however, and so the security risk should be low. CEO of the Corion Platform, Miklos Denkler, said, “We believe that every e-wallet provider should shoulder the burden of proving that all necessary measures have been taken to protect their users against security vulnerabilities such as this – which is why the CORION Team guarantees that sensitive data is accessible only by the user.”

Security for stock trading houses is not completely fool proof either. However, the risk factor on Bitcoin may feel greater than traditional methodologies. Dinkier also commented, “CORION technology allows users to be verified in an isolated environment, so their information remains hidden from all prying eyes and recording devices. This innovation allows us to deliver a higher level of sensitive data management – making the cryptocurrency world a much safer place for our users.”

With compromised security being such a risk, utilizing a company like CORION protects Bitcoin, and makes investment safe and secure. In many ways, with the blockchain technology and CORION’s services, Bitcoin investing is more digitally secure than traditional stock trading.

Another risk is volatility. The cryptocurrency has been wildly volatile with 10% daily swings or more a frequent occurrence. Investors should be highly cautious about putting their funds into something so volatile, and positions should be small to mid-sized. Bitcoin is untested at these levels, and with the volatility, there could be major retraction from highs.

However, even with these risks, Bitcoin is still a great way to hedge against stock market retreats. Not only do analysts agree, but a large number of new hedge funds are also getting into cryptocurrencies, providing new ways for investors to participate. The best minds on Wall Street are beginning to move into the space, and savvy investors should follow, albeit cautiously.

Gold, or Digital Gold?

Bobby Lee, the crypto investor and advisor, has recently called Bitcoin ‘digital gold’. The implication is that, like gold, Bitcoin is a safe haven investment that will protect against currency and market collapses by remaining stable.

This is both true and false. The cryptocurrency has shown incredible resilience, even in the face of recent ‘forks’ (splits in the chain that produce new coins - this one called Bitcoin Cash). It seems that, though there are short term volatility issues, the long term position is stable and protected.

At the same time, while it is clear that the long term trend for Bitcoin is stable, short term volatility can be huge, and investors who are unable to embrace that level of risk should steer clear. Security risks can be curbed by technology, but the risks of market change cannot be controlled, and should be accounted for in investment strategy.

All told, it seems clear that investors should move include Bitcoin as a smaller position in their portfolio, both as a hedge against stock market contraction, and as a potential for substantial gains.