What a difference a few days makes. Last week the market was collapsing. This week we recovered a big chunk of those losses and things feel significantly better. The only question is if this rebound is the real deal, or just a false bottom on our way lower.

The buying kicked off Tuesday morning when Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS) reported solid earnings. That was enough to move the conversation away from rising Treasury yields and put traders back in a buying mood. Last week’s selloff lowered expectations and now “not bad” is good enough to send prices higher.

There were a lot of “what ifs” last week asking if rising interest rates and trade war tariffs were going to strangle the economy and crush corporate profits. But if companies continue to hit their numbers the way GS and MS did, expect these “what ifs” to quickly fade from memory. Reality is rarely as bad as feared and it won’t take much to put traders back into a buying mood.

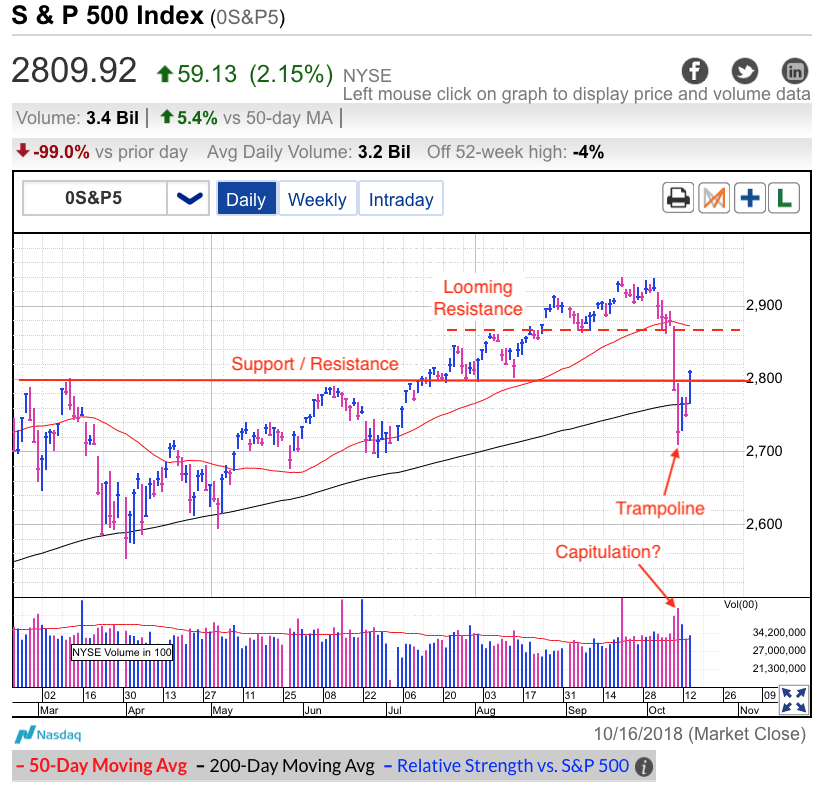

And this week’s dramatic reversal shouldn’t surprise anyone. Markets that fall down the elevator shaft typically land on a trampoline. Last week I wrote the following after stocks tumbled 3.3%:

“I fear the slow, insidious grind lower. Those are the losses that accumulate when no one is paying attention. What I don’t fear are the big, headline-grabbing down-days. The one that gets everyone’s attention and makes headlines around the world. That’s because those big, flashy days don’t have any substance. As the saying goes, the flame that burns twice as bright only lasts half as long.”

While it is most certainly premature to claim last week’s selloff is over, the situation is far less scary than it was a few days ago. And that matters a lot when talking about emotion-fueled selloffs. Last week people reflexively sold first, asked questions later. But this week’s bounce gives traders more time to be thoughtful and make rational decisions. Without the pressure of falling prices, most owners will stop overreacting to the fear-mongering headlines.

Risk is a function of height and believe it or not, last week’s dip was actually one of the safest times to buy in months. Prices plunged and impulsive sellers bailed out, but those discounts and turnover in ownership made stocks far more attractive. It certainly didn’t feel that way, but buying dips is never easy. By rule, every dip feels real. If it didn’t, no one would sell and we wouldn’t dip.

We are not out of the woods, but we are close.If the S&P 500 holds near 2,800 support through Wednesday’s close, we can say last week’s emotion-filled selloff is over. Even a dip to the 200dma wouldn’t be bad as long as it found support and didn’t trigger a waterfall selloff.

Market collapses are breathtakingly quick and holding last week’s lows for four days means cooler heads are prevailing and the impulsive selling is over. Without a doubt, the market could experience another leg lower, but it would take a fresh round of headlines to trigger that next wave of selling.

And while I continue to believe in this market over the medium- and long-term, we should expect volatility to persist over the near-term. If we survive the next few days, then this bounce will continue all the way up to the old highs near 2,870. That is where the waterfall selloff started, and the market will likely hit its head back toward 2,800 support. But rather than fear the next dip, that back-and-forth is the healthy way the market recovers from a big scare.

As usual, long-term investors should stick with their positions. More nimble traders can profit from these back-and-forth gyrations.

A person that cannot stomach another dip should sell the strength as we approach the old highs and buy the next dip. And if everything goes according to plan, the market will put this bout of indigestion behind it, and we are still on track for a nice rally into year-end. Every dip over the last nine years has been buyable and chances are this one is no different.