Chinese equities are developing a rebound on Friday, supported by the hopes for progress in China and the US trade negotiations. The telephone conversation between the leaders of two major world economies has shown that there is still an opportunity to settle trade disputes. Asian indices have added more than 4% since the beginning of the week, which is the strongest rally in almost two and a half years.

But it is hardly worth the hope for easy progress, as earlier this year there have been many negotiations at different levels, and the situation has only grown worse. The growth of markets in this context is rather a weakness of the Asian market in recent years than a cause for optimism. Despite the rebound, the blue-chip index of the Shanghai Stock Exchange China A50 remains within the range of the last 4 months.

S&P 500 Futures are adding 0.8% this morning and more than 4% from the beginning of the week. The fourth day of growth returned the index to the reach of 200-day average, reflecting the restoration of faith in the prospects of the American economy, despite a number of weak reports from IT companies.

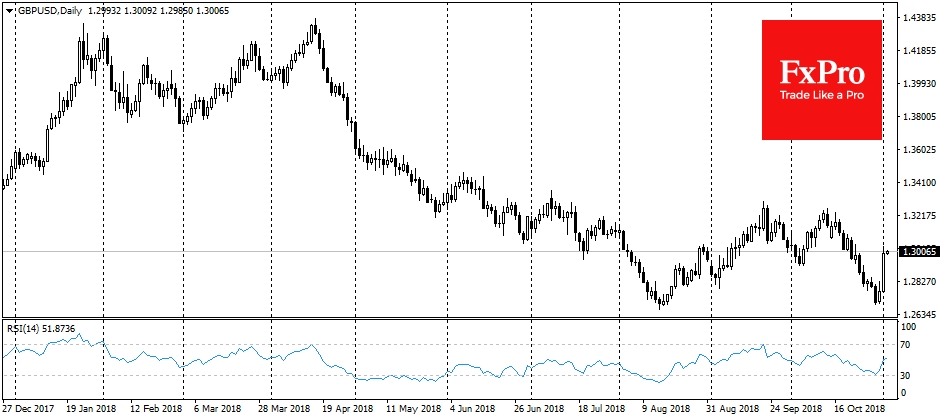

In the foreign exchange market, the British pound was the focus of attention on Thursday. The increase of Pound within a day exceeded 1.7%, which is the sharpest growth of more than a year. As a result, the GBP/USD couple returned to the key level 1.30. Sterling’s support was provided by the news around Brexit, and by the hints of the Bank of England that if Britain's withdrawal from the EU runs smoothly, it will accelerate the rate hike.

Today, the focus of the markets will be the labour market indicators in the U.S., where a strong employment report is expected. The month before, the markets were surprised and discouraged by the growth of new jobs only for 134K, which caused doubts about the sustainability of the economic growth. Additionally, the Fed's hawkish tone exacerbated the situation. However, over the past month we have seen many other positive signals that have dispelled fears that FOMC excessively aggressively raises the rates.

The yield of strong data on the employment growth can reduce the demand for the dollar as a defensive asset, depriving it of a part of the October growth. In this case, the shares can get additional impetus for the development of the rebound.

At the same time, the signs of the accelerating wage growth can support the growth of the U.S. currency on speculation that the Fed will be forced to conduct more aggressive increases than plans to keep inflation under control. In this scenario, the stock markets may return to caution, dashing the recent rebound.

Alexander Kuptsikevich, the FxPro analyst